Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

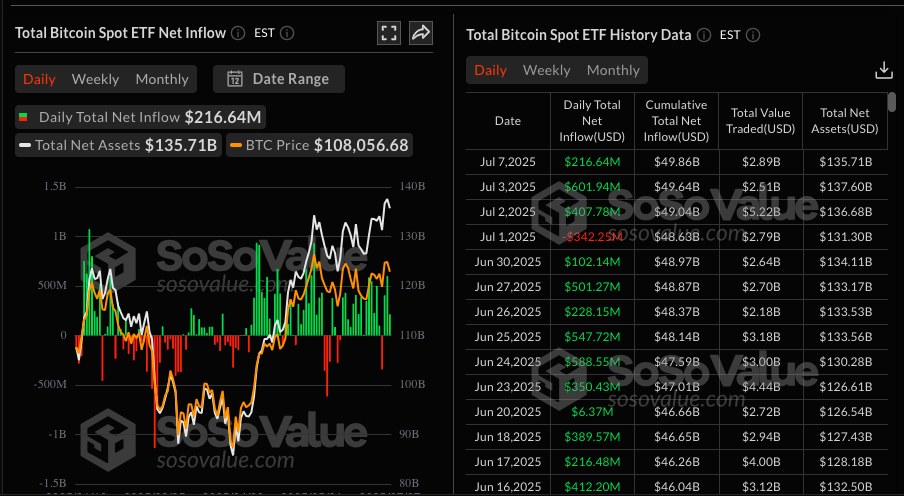

During the last three business days, US Spot Bitcoin ETFS have noticed more than $ 800 million in a pure tide, with daily diameters reaching approximately 1,980 BTC (equivalent $ 216.64 million), thus increasing the total cumulative influx of net network to $ 49.86 billion.

Data from Socal Indicates that Bitcoin ETF-HELD now commands beyond market value $ 135.71 billion. This represents an allocation of BTC records through regulated investment vehicles.

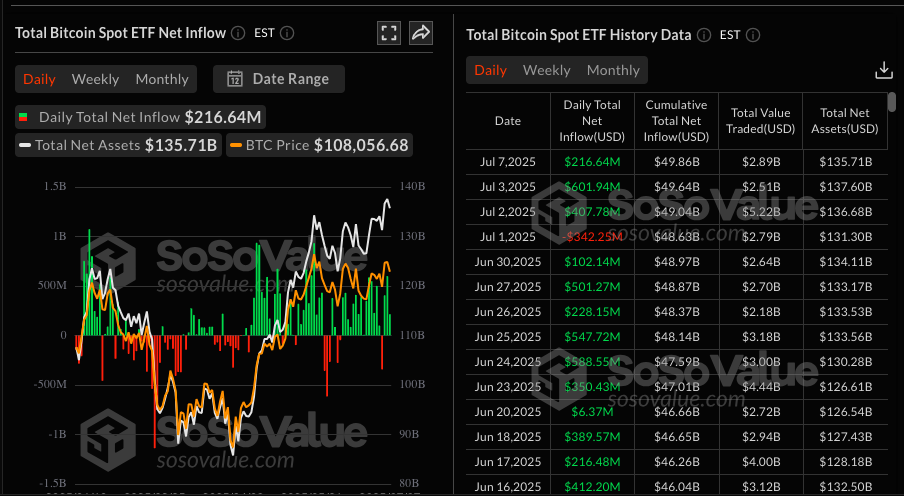

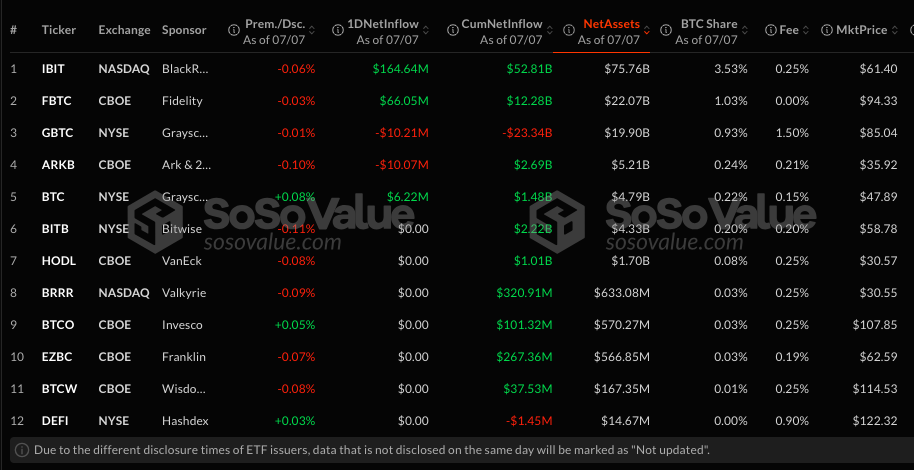

Most of these tides came from the largest asset manager in the world through IBT ETF.

The fund has now accumulated more than $ 52 billion cumulative net tide, which represents $ 216 million from the recent $ $ 164.6 million over the three -day period.

Fidelity’s FBTC and Greyscale’s GBTC During this period, they also contributed significantly and attracted $ 66.05 million and $ 6.2 million.

Blackrock currently holds 700 307 BTC in its Ishares Bitcoin Trust (IBT) ETF, according to Thomas Fahrer, co -founder of Apollo.

IBIT now represents more than 55% of the total BTC held across all American Bitcoin shoes ETF, according to Bitbo data. Since its launch in January 2024, the fund has created a total yield of 82.67%.

Recent success comes in the middle of the news that Blackrock now generates more revenue from your iBit fund than from its flagship Ishares Core S&P 500 ETF.

In addition to institutional purchases of ETF, publicly traded companies have become important buyers of bitcoins.

According to BitcointreasuriesThese companies received approximately 65,000 BTC in June, which is more than $ 7 billion worth Fiat.

The corporate Ministry of Finance, a pioneer of Microstratega, has evolved into a wider corporate strategy.

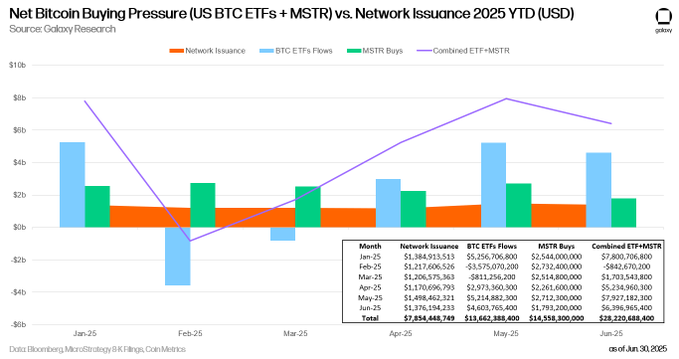

Galaxy Research Data shows that American bitcoin ETFCombined with Microstrategy, the largest corporate bitcoin holder, bought more bitcoins than miners produced almost every month of 2025.

Together, Microstrategs and the US Bitcoin ETF received $ 28.22 bitcoins in 2025, while the net new Bitcoins issue was $ 7.85 billion over the same time framework.

Despite robust flows, short -term catalysts could create pressure for BTC. In particular, President Trump 9 July Postponing the Deadline of Trade is a significant risk factor.

If the EU, Japan or China failed to complete trade agreements, up to 50%could be carried out, potentially rule concerns about inflation and reduce expectations of peeing federal reserve.

The report from June US jobs also exceeded expectations, with paying increases by 147,000 compared to an estimate of a consensus of 110,000.

These stronger employment data than expected have reduced the expectations of rates, which has caused many investors to the pre -terminals of their portfolios and retreat from higher risk assets such as bitcoins.

BTC 8 July gained 0.13%, cost $ 108,876, reversing a decrease of 1.52% of the previous day.

The next level of resistance is at a high level of $ 111,917, with potential goals to $ 115,000 if the dynamics continues.

The key support lies at $ 105,000, with the risk of the disadvantage extends towards $ 100,000 if macroeconomic pressures outweigh the momentum of the ETF flows.

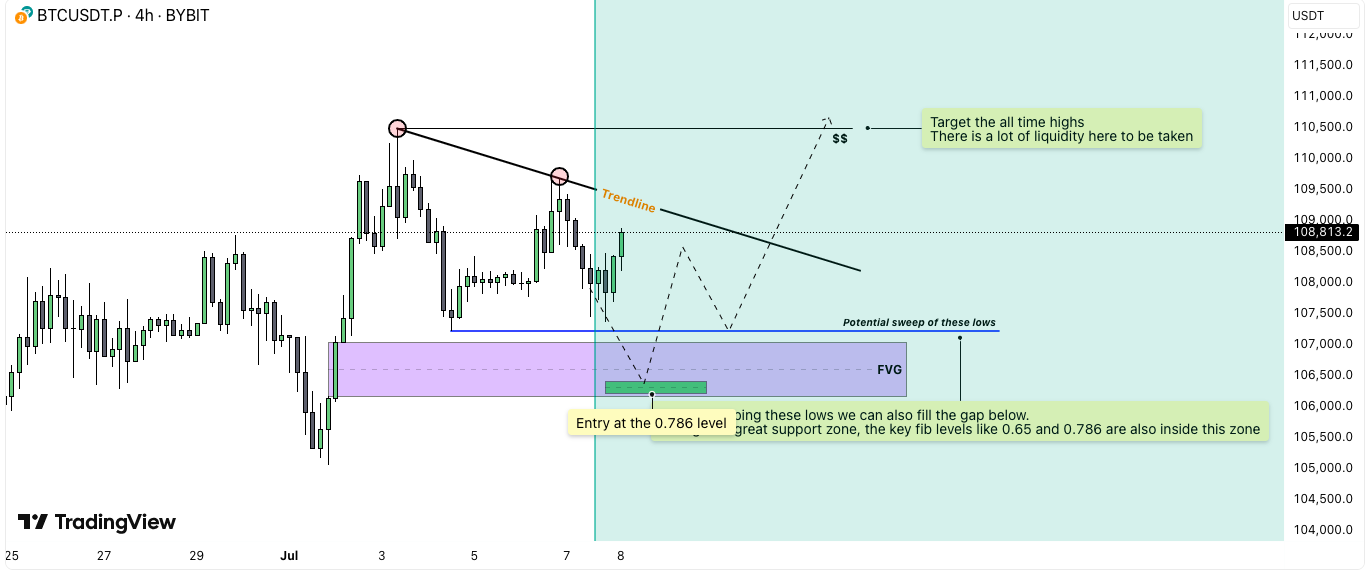

Technical analysis BTC/USDT The 4 -hour graph on the Bybity suggests that the bull formation developing around the potential zone of liquidity and the gap in real value (FVG).

The price that is currently traded for $ 108,813 suggests rejection of the descending trend line, although technical indicators indicate a possible decline below the recent mines to the FVG zone, between $ 105 and $ 106,500.

This area is in accordance with the levels of 0.65 and 0.786 fibonacci and creates a high probability zone for potential re -entry.

The scenario assumes liquidity below the local mini, triggers interest on the purchase side and fills the imbalance in front of a strong bull.

If this sweeping and bouncing takes place, projections indicate an aggressive step towards the highest maximum, potentially around $ 110,000-112,000, where substantial liquidity was identified.

The technical setting prefers a short -term decline in key support levels, followed by a collection towards a higher maximum, depending on the successful response from the 0.786 fibonacci zone.

Contribution Flood $ 200 million to Bitcoin ETF for 3 days – a new bull market? He appeared for the first time Cryptonews.