Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The rich father of the poor dad’s author Robert Kiyosaki released his worst warning of the upcoming “Global cash collapse“He urges followers to accumulate Bitcoingold and silver as protection against ‘The largest debt bubble in history.”

In paper X, the best -selling Financial Education said that the upcoming collapse will create winners and losers on a large scale, with the “largest loser” are “savers of false fiat money and especially bonds”, while those who have hard assets appear richer.

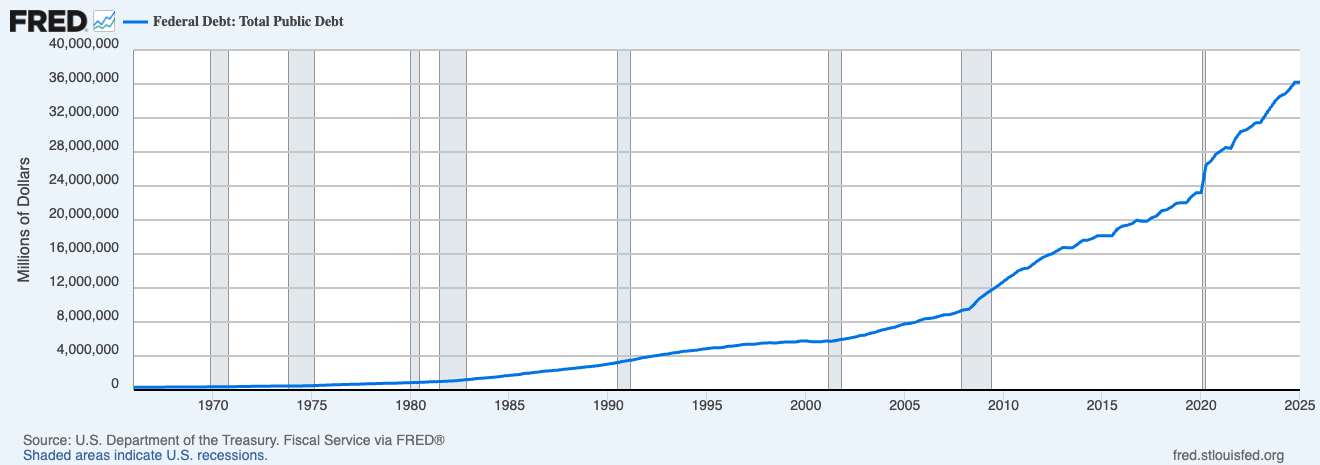

Alarm Kiyosaki comes when US state debt exploded to $ 37 trillion, which created what economists describe as an unsustainable fiscal trajectory that threatens global economic dominance of America.

Leading economists, including Ray Dalio, Ken Rogoff and Niall Ferguson, have All the serious concerns expressed about the upcoming debt crisis. Ferguson’s research shows that America is now spending more on debt service ($ 1.1 trillion) than to defense ($ 883.7 billion), a historical formula that preceded the decline in every main global force.

This fiscal deterioration occurs because the debt ratio to GDP has reached 123%, which is the level of economists warning, “” “debt induced by an economic heart attack“Unless corrective measures are quickly implemented.

The mathematics of the American debt crisis depicts a persistent picture that verifies Kiyosaki’s apocalyptic warning about cash collapse. National debt has tripled today from $ 10 trillion in 2000 to more than $ 37 trillion, not showing any signs of sustainable resolution.

The most alarming development is exponential growth trajectory, which first shifted the cost of debt services over defense spending in modern history and triggered what Niall Ferguson’s economist calls “Ferguson’s law”. This principle states this Any great power spends more on debt service than defense of risks loss of their global dominance.

This fiscal deterioration has accelerated dramatically during the recent administration, with a debt growing by 39% only in the previous Trump period.

The structural impossibility of growth from this debt load occurs when the mathematics of composed interest compared to realistic projections of GDP growth occurs.

The optimistic theory of Finance Minister Scott Bessnt that “we can grow from debt” requires permanent economic expansion that has not been observed from boom after World War II, yet the World Bank projects American growth in 2024 from 2.8% to only 1.4% in 2025.

Meanwhile, it is assumed that the debt ratio to GDP will reach 140% by 2029 and create what economists describe as’death spiral“If a growing debt service issues productive government expenditure on infrastructure, education and defense.

The consequences exceed far beyond abstract fiscal metrics on real world impact on American standard of living and global competitiveness.

Since the beginning of the printing of Covid -related money, the dollar has lost more than 20% of its purchasing power, with food prices rising by 23% and transport costs increased by 34%. This represents permanent structural inflation that disrupts savings and wages.

Interest payments now consume 13% of the federal budget. It is assumed that by 2033 they will reach $ 1 trillion a year, forcing inevitable cuts on social security programs, Medicare and Medicaid, which together represent an annual spending of nearly $ 3.2 trillion.

This fiscal compression occurs when America faces the assembly of geopolitical challenges that require increased defense spending and create impossible between military readiness and Fiscal sustainability.

Kiyosaki’s recommendation is more than speculative investment counseling; It is rooted in a fundamental understanding of how monetary crisis evolves and why rare assets historically overcomes the currency rejection during the period of rejection.

The mathematically enforced Bitcoin supply limit of 21 million coins contrasts significantly with the unlimited printing of money, which characterizes modern Fiat systems, and has reduced the inflation rate over time.

Offers what COINBASE CEO of Brian Armstrong describes as a “check and balance” of the expenditure of government deficit This could eventually build bitcoins as a world reserve currency if the fiscal irresponsibility continues uncontrollable.

The historical precedent for this monetary transition is convincing, with each main currency collapse preceded by unsustainable debt accumulation and attempts to inflate duties through the printing of money.

The Venezuelan debt ratio to GDP exploded from a manageable 30% in 1998 to more than 300% by 2020, resulting in hyperinflation, which caused worthless currency worthless and forcing millions to run out of the country.

While the status of American reserves temporarily protects it from such a dramatic collapse, basic dynamics remain identical. The currency faces Growth in exponential debt, declining trustand Increasing the acceptance of alternative trades of value.

The role of bitcoins as monetary securing becomes particularly relevant in the consideration of limited alternatives that are available to ordinary citizens looking for protection against currency degradation.

Traditional hedges, such as gold and real estate, face regulatory restrictions, storage challenges and potential confiscation risks, while decentralized nature and global accessibility of bitcoins and global accessibility for governments virtually impossible to limit or seizure.

The performance of cryptocurrency in recent inflation periods shows this protective function, with bitcoins reaching historical maximum, as investors are looking for refuge from deficit expenditures and cash expansion.

The institutional wave of adoption further verifies had the thesis of bitcoins Microstrategy accumulates more than 592,000 BTC As a treasury and many public societies after similar strategies.

Actually A recent analysis of Vancký suggests that a strategic bitcoin reserve could balance 18% of US debt by 2049 If the cryptocurrency continues to appreciate historical rates.

This would provide a mathematical path to nations to escape debt pastes by premature acceptance of bitcoins.

Contribution “Rich Dad Poor Dad” Author Robert Kiyosaki predicts the collapse of “the largest debt bubbles” He appeared for the first time Cryptonews.