Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The crypto market is down today. Ten out of the 100 best coins have seen an increase in the last 24 hours. In addition, the market capitalization of cryptocurrency in the last day has decreased by 2.8%, now to $ 3.23 trillion, compared to Friday $ 3.37 trillion. The total volume of trading crypto is $ 161 billion, back to typical levels.

Tl; Dr:

All 10 best coins on the market ceiling are down today.

Bitcoin (BTC) It fell by 0.7%, now traded for $ 101,924 and was approaching a psychologically relevant sign of $ 100,000. This is also the smallest decline in this category.

Also, Ethereum (ETH) dropped by 1%, changed his hands to $ 2,251. This is the second smallest decline in the category.

XRP (XRP) He saw the highest decline in this category by 2.6% of the price of $ 2.02.

In addition, ten out of the 100 best coins have noticed that their prices increased in the same period. The best artist is Story (IP)With a single two -digit increase of 11.6% to $ 3.06.

At the same time, FileCoin (In) fell most, followed Tonore (tone). Are a drop of $ 3.9% and 3.8% to $ 2.12 and $ 2.75.

Speaking of XRP, Bloomberg analysts recently placed a chance Approval of ETF XRP to 95%.

Meanwhile launched recent geopolitical shocks instant market reaction. Investors began to move into traditional safe assets such as gold and the US dollar.

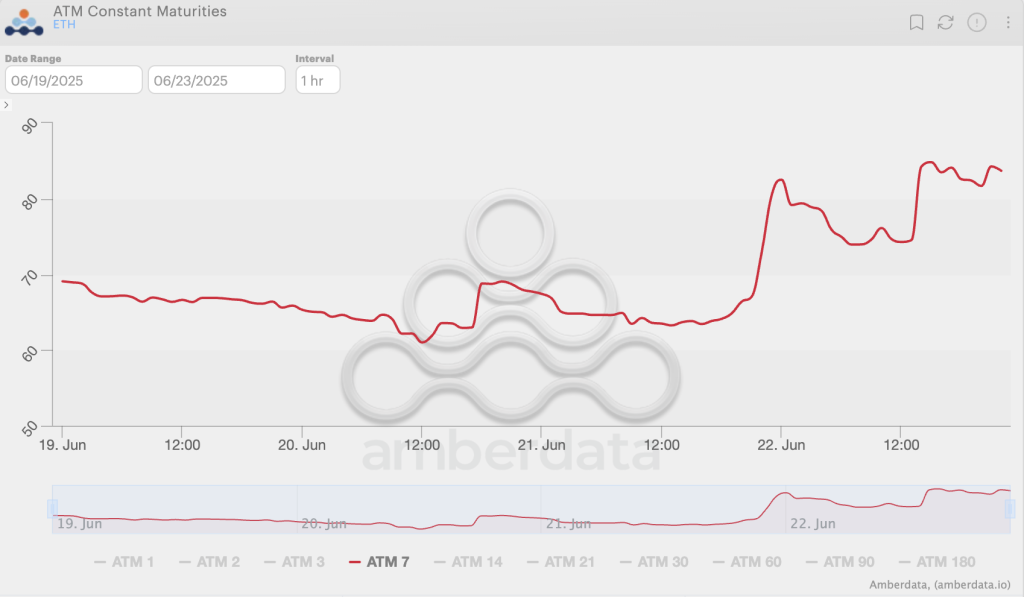

Dr. Sean Dawson, Head of Research Decentralized Platform onchain Options Ai-Machaved ,, Derive.XYZHe noted that the increase in short -term expected volatility (IV) confirms that the market will solidify for greater instability. Volatility markets tell us that it’s not over.

“In the middle of the growing geopolitical pressure, we see classical risky behavior with falling prices, volatility and downloading upwards,” says Dawson.

In one place, BTC withdrew from $ 104,300 per $ 300. At the same time, there was an increase in short -term implicated volatility by 10% to 45%. It happened when traders began to appreciate the new risk.

In addition, ETH dropped almost 14% of $ 2,550 to $ 2,200, along with a 15-point jump in 7-day IV to 83%. This reflects the increased security and uncertainty of the disadvantage, says Dawson.

“The double -digit loss and volatility of Ethereum to 83% show how fast the risk may disintegrate when the lever effect is high,” he adds.

Without a clear de-escallation launch, the company expects more cautious positioning and attenuated dynamics in the next month, the head of the research remarks.

Dawson notes that the BTC option market is currently “spreading back to optimism”. The probability that BTC will end up to $ 2025 over $ 200,000 dropped to 3.5%. The chance that it will be $ 150,000 in the same period dropped to 11%.

“The bulls lose their beliefs as a geopolitical risk, and the macro winds the optimism of half and the ETF flows overshadow.”

At the same time, the likelihood of BTC closing below $ 80,000 does not change to 20%.

All these percentages “show that the market leaning tilts defensive. Merchants are not right now.”

At the time of writing, BTC is traded for $ 101,924. At one point on the last day of the coin, it has seen a sharp drop from Intraday 102 739 and under a psychologically critical mark of $ 100,000 to $ 98,467. Since then it has recovered a little.

Over the past 7 days, we have seen a decrease of 4.5% compared to intraweek maximum $ 108,771.

At the same time, Ethereum is currently trading for $ 2,251. The price recorded a maximum of $ 2,280 daily, dropping to $ 2,134, before it increased slightly to the current price. Last week, ETH dropped by 13.7% of the weekly maximum $ 2,671.

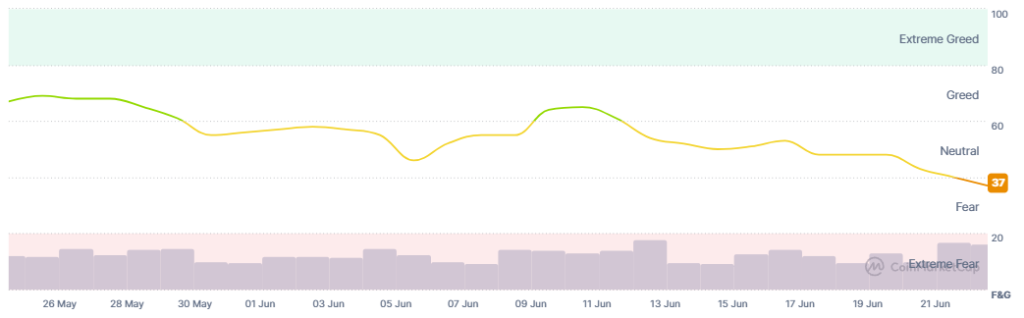

In addition, the crypto market sentiment entered the territory of fear. The fear and greed index fell from 48 on Friday and 40 on Sundays to Current 37. Now fear increases prices that potentially push them below. But it can also represent a chance to buy immersion.

Meanwhile, June 20, USA BTC BTC Spot Exchange Traded Funds (ETF) Until today 6.37 $ A million in tide. While Black -shin saw the tide of $ 46.91 million, Fidelity He recorded a drain of $ 40.55 million.

On the same day we have seen the US ETF outflows $ 11,34 millionbroken another strip. Blackrock leads this amount with a loss of $ 19.71 million while Bark and Vanek He took $ 6.6 million and $ 1.77 million.

Investment firm on Tokyo list Metaplanet bought another 1111 BTC For $ 118.2 million, in the middle of price immersion. The company now holds $ 11,111 in its balance sheet worth more than $ 1.07 billion.

On the other hand, Cathie Wood Ark Invest explained $ 146.2 million value Circle (CRCL) Shares on Friday.

The Krypto market has seen a significant decline per day, while the stock markets recorded a mixed picture on the last day of trading. The S&P 500 dropped by 0.22%, Nasdaq-100 reduced by 0.43%and Dow Jones industrial average increased by 0.083%. Investors were on the outskirts of Israel and Iran and the potential role of the US. On Saturday, the US attacks were surprised by Iran, and this must be reflected on the stock market.

Given the current geopolitical and economic development, prices can further decrease. Bitcoin may drop below $ 100,000 and ETH below $ 2,100.

Contribution Why is Krypto down today? – June 23, 2025 He appeared for the first time Cryptonews.