Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Key with you:

Stablecoins are one of the fastest growing crypto segments. Some analysts say they are already a rare story of success that corresponds to traditional and decentralized finances.

But could stablecoins replace giants like Visa and MasterCard? This question became the urgent 19th June, when the shares of both companies reduced after the reports that Amazon, Walmart and other major US corporations were investigating the Stablecoin -based payment systems.

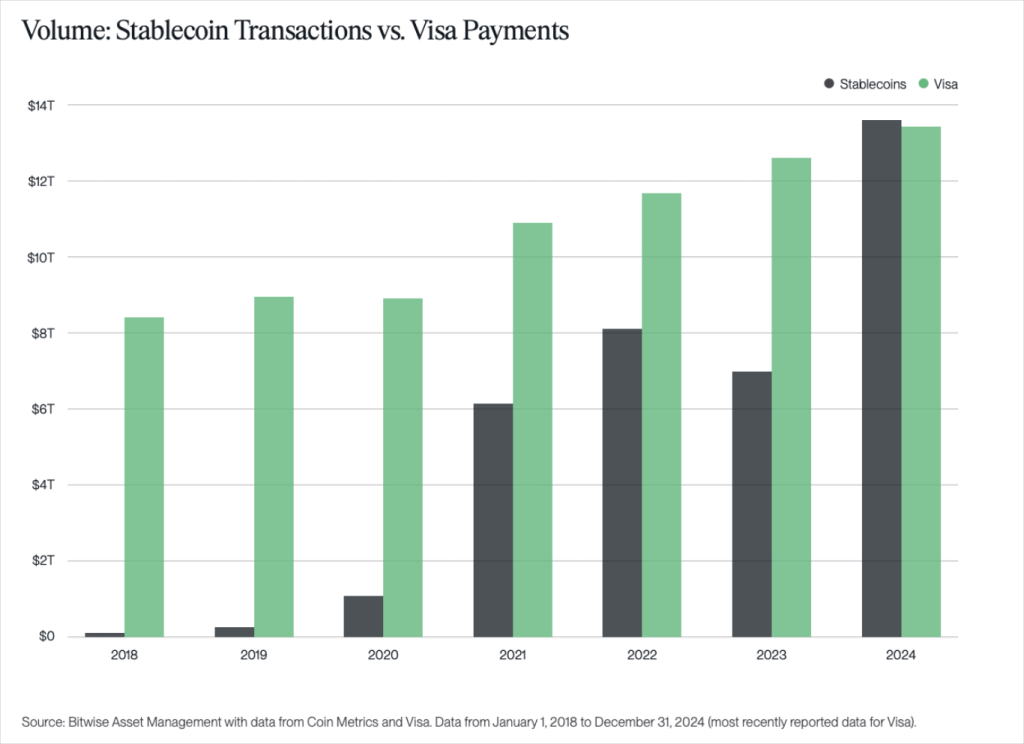

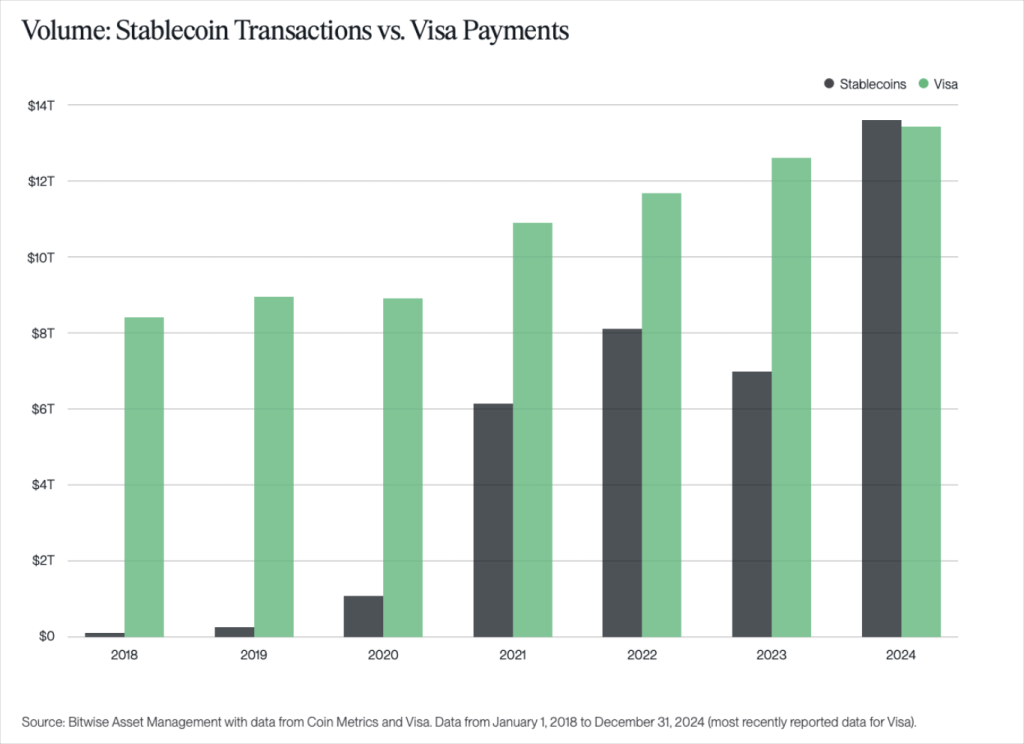

Should Visa and Mastercard be afraid? In 2024, Stablecoins briefly exceeded the transaction volume. It was a close lead, but symbolic.

Frank Combhay, COO next generationsaid Cryptonews One of the main advantages of stablecoins is their availability across different types of users:

Stablecoins ecosystem have a strong chance to compete if providers can make them attractive enough to lead to adoption. The key principle is the availability of multiple platforms that ensure availability through various trigger partners, including global crypto exchange.

He added that the market is becoming more attractive not only for users, but also for corporations that want to accept stablecoin ecosystems. One of the largest catalysts was regulatory clarity:

We are in the middle of a fast crossing. While all transformations require time, progress was remarkable. The only main obstacle was regulatory uncertainty. However, this changed last year with the introduction of Mica, which gave green light for accelerated growth.

Combay also said that full -fledged stablecoin payments can reduce transaction costs and fees by up to 90 to 92%, or even more.

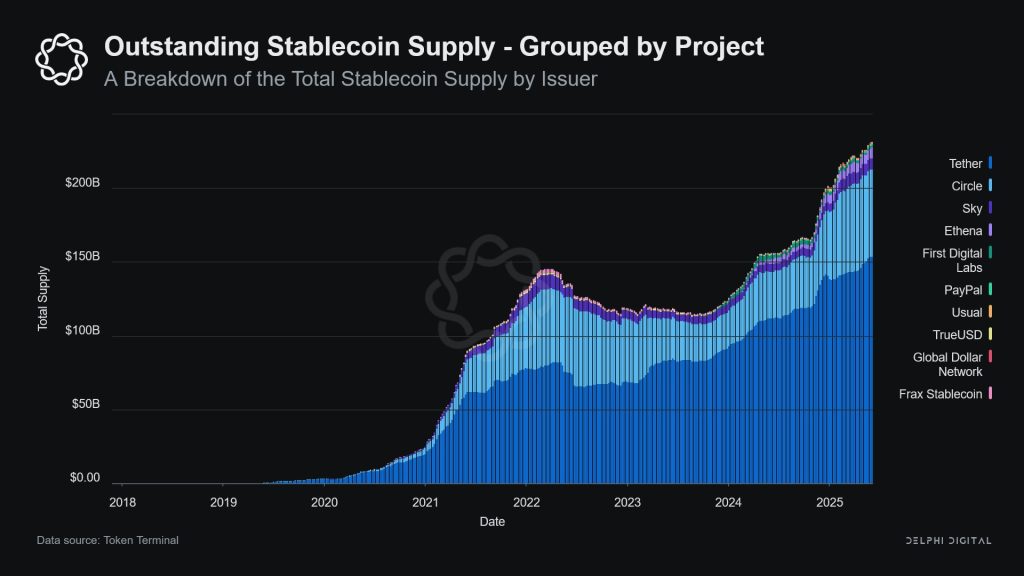

According to Delphi DigitalMore than $ 120 billion in US treasury bonds now support Stablecoins. Institutional adoption increases. Tether (USDT) and Circle (USDC) still dominate the market, but new players are entering new ideas. For example, Ethena (ENA) Stablecoin carved a niche with a revenue program.

One of the main developments is proposed Genius Actor Leading and creating national innovations for American stablecoins. The Senate approved the bill on June 17th and is now heading to the House of Representatives.

If proven, genius could become one of the the most important laws regulating stablecoinsturn the US into a global ecosystem center. Scott Bessnt, Secretary of the Treasury and Proponents of the Act, claimed that this could help reduce state debt.

However, there is a debate about whether this might have the opposite effect. Stablecoins could increase demand for state cash registers, which means more debt issuance. The law would require issuers to support their chips with American bonds, just like in Tether and the circle.

Once the genius is fully implemented, the stablecins bound USD could strengthen. Imiters may have to adjust their framework or release tokens specific to us to comply. Rumors suggest that Donald Trump wants to see the law completed by August.

Although Genius does not directly affect state debt, he would still open the door for more market participants and new types of Stablecoin partnership.

The Stablecoin market not only grows among cryptorite users. It also attracts attention from American treasures, technical giants and traditional banks. Does this mean that Stablecoins will replace the banking system?

Not necessarily, according to Frank Combay:

While Stablecoins remains the choice, we expect banks eagerly accepting them to remain competitive. Those who prefer cards can continue to use them and at the same time benefit from faster transactions and lower fees. Importantly, stablecoins do not pose any threat to CBDC, because the digital currencies of the central bank serve as alternatives for physical cash supported monarchs. Rather than framing this shift as “disruption” or “coexistence”, we prefer the term “smooth integration”.

This opportunity is not limited to the tokens of the supported USD.

The momentum grows Stablecoins denominated euroespecially after introduction Markets in the regulation of crypto-aspat (mica). Combay sees it as another great opportunity:

With the 230B+ $ market ceiling, we see that global players show new stablecoins at an unprecedented pace. And that’s just the beginning. While stablecoins linked to USD have already demonstrated their potential, EUR-PEGGED stablecins are still in the initial adoption phases, which is the greatest opportunity to grow, with more than 99% of unused market potential.

Stablecoins are gradually becoming a real alternative in the payment space. With lower fees, faster transactions and growing regulatory clarity, they are no longer just a cryptomic niche.

As Frank Combay said:

Acceptance of digital assets, including stablecoins, grows exponentially. It is an irreversible shift in modern finances.

The shift will not take place overnight and traditional players like banks and networks do not go anywhere. Stablecoins, however, take both cryptorotive projects and older institutions. The idea of ”smooth integration” can be exactly how it happens.

Contribution “Nothing holds Stablecoins back”: Time for the trench visa? He appeared for the first time Cryptonews.