Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Key with you:

According to industrial analysts at the end of May, the Donald Trump Tax Act, which, according to industrial analysts, could lead to a significant increase in energy costs for bitcoin miners who rely on solar energy and other renewable resources.

Bill, dubbed The Republican President “Big, Beautiful Account” would eliminate incentives on renewable energy sources in Biden with tax credit cuts 30% on solar energy by 2028. The legislation is currently reviewed by the Senate before the law can be passed.

“Trump’s account could result in an increase in electricity costs by 10-15%, especially in areas where miners rely primarily on sun energy,” said Michael Jerlis, CEO of Bitcoin Mining Pool EMCD, Cryptonews.

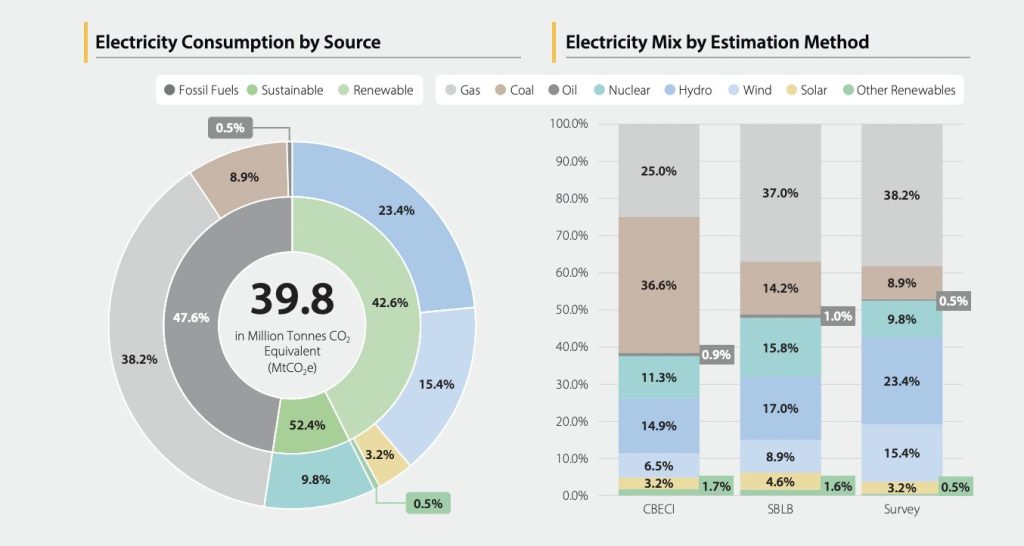

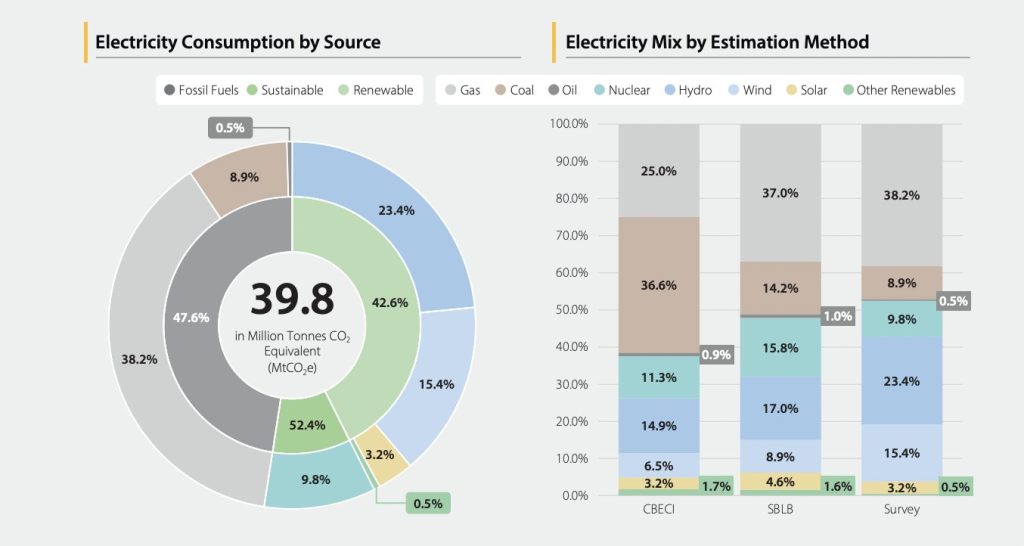

Almost 43% of a bitcoin network is now powered by renewable energy sources, with solar energy representing only 3.2% of the total, according to The latest data from the Cambridge Center for Alternative Finance.

The hydroelective energy is the largest share with 23.4%, followed by wind energy to 15.4%and other renewable sources to 0.5%. It is not clear what share 137 bitcoin miners In 21 US states he relies on solar energy.

“The industry can be significantly influenced by any changes in the regulations that affect them. [energy] Sources, ”said Jerlis, adding:

“The impact of the law on mining will largely be determined by local laws, configurations of energy mixes and specific tax burden miners in each region.”

Solar projects, often built in distant areas, rely on Bitcoin miners as “anchor tenants” to justify the development. Experts say that without subsidies, new solar farms could stop, which caused the approach of miners to low -cost performance.

But it may not always be. According to Mason Jappy, CEO of Bitcoin Miner based in the USA BlockwareThe assumption that miners depend on solar energy is misleading.

“Miners do not necessarily rely on solar energy,” he said in answering questions from Cryptonews. “In fact, it is really the opposite. Sun energy producers are very dependent on the upper bitcoin.”

This is because large solar farms are often found in distant areas where retail energy is low and transmission to cities, for larger consumers, is expensive.

However, BTC miners are “able to provide solar energy manufacturers” Backstop “demand, because they can work anywhere where there is a cheap energy source, Jappa said.

In this light, the cuts of Trump’s Clean Energy say the loan tax does not report a disaster for miners who depend on the electricity generated from the Sun. On the contrary, economic motivation for cooperation could actually increase. Jappa explains:

“Investors who want to build new solar farms have less uncertainty because they know that bitcoin miners are almost always helpful and able to buy their energy. Finally, it will increase the production of solar energy even in the absence of government subsidies.”

Environmental analyst Daniel Batten agreed to Jappa and said that bitcoins do not need subsidies to be renewable sources such as solar economically viable.

“Bitcoin mining is politically agnostic,” Batten said. “May work in an environment with or without subsidies.”

Talk to CryptonewsBatten quoted academic research by Hakimi et al, which shows that solar projects in scale will achieve a faster return on investment or return of investment in less than half the time using bitcoins mining.

The roof solar installations also reach 57% better investment return and overcome the batteries by four, if combined with mining. Batten sees any tax cuts from Trump’s law as encouraging more market innovation.

“So if solar operators (like some already have), start looking at a coordinated solution for the introduction of solar/bitcoins, it is a more economically sustainable alternative than depending on subsidies that may or may not exist on factors outside direct control.”

On campaign, trail, Donald Trump He promised to eliminate clean energy tax loans approved by former President Joe Biden under the Inflation Decrease Act of 2022. Tax loans were a key pillar of Biden administration.

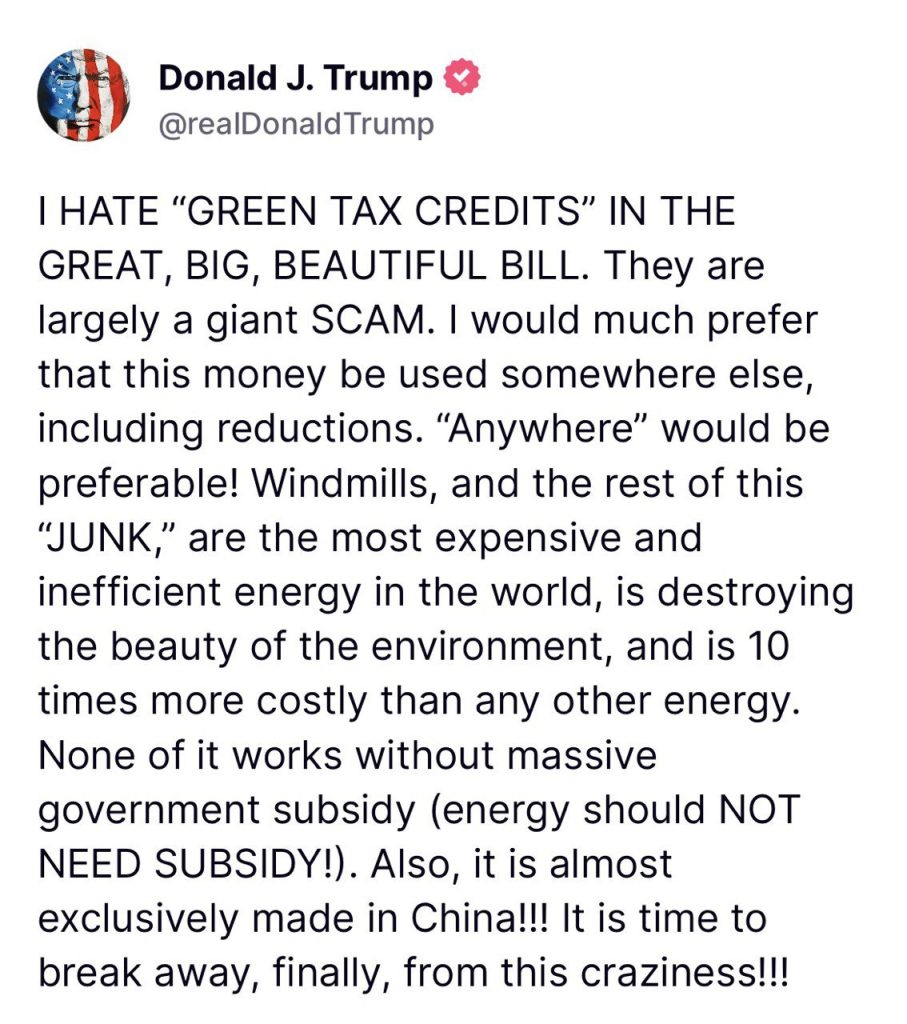

Trump claimed that energy subsidies are expensive and harmful for business. In a post On his social network, Trump continued his attacks on green tax loans at the weekend and called them “giant fraud”.

“I would prefer this money to be used somewhere else, including a reduction,” he said. “Windmills and the rest of this junk are the most expensive and inefficient energy in the world, destroying the beauty of the environment (sic).”

However, Trump’s “big, beautiful account” revives the old provisions that could help Bitcoin’s miners “exterminate” their tax accounts – 100% bonus depreciation.

As Cryptonews formerly reported“The clauses allow companies to immediately deduct full capital expenses, such as new mining equipment from taxable income. According to the law, bitcoin miners may write down 100% hardware costs.

For example, the miner spends $ 30,000 on the purchase of three Asic miners for $ 10,000. Under 100% bonus depreciation, mining hardware of $ 30,000 becomes $ 30,000 in advance.

If the miner earns only $ 5,000 this year, he can report a $ 25,000 paper loss. Mining companies or individuals can use the loss of faux “to balance income from your work, business or investment”.

“Depending on your tax group could save you $ 7,000 to $ 10,000 in taxes,” tax expert Arniel Sia published at x at the end of May.

The current rules of the Internal Revenue Service (IRS) require companies to depreciate large equipment for many years. The number of taxes extends during the life of the asset, usually five years for the miners of ASIC.

Jappa Blockware believes that 100% bonus depreciation is the game converter.

“This will allow miners to write off the full cost of their mining hardware (ASIC) in a single tax year – leading to large tax savings and higher net income for bitcoin miners,” he said, “he said,” Cryptonews.

Jerlis, CEO for EMCD Bitcoins, said the hardware is most of the capital mining expenditure estimated somewhere between 60%-70%. Tax relief from bonus depreciation could balance the increase in prices related to solar rates, especially in miners using mixed energy sources, he said.

In addition to Solar, Trump’s pressure on “domestic energy independence” could with plans to modify environmental regulations and at the same time support things such as natural gas and nuclear expansion, reduce costs throughout the industry.

As the CEO of Jappa notes, bitcoin miners are “customizable and non -discriminatory”, prefer the cheapest source, whether subsidized solar or deregulated gas. They could benefit from Trump’s pivot, he says.

“Politics that support natural gas production, reduce regulatory barriers for new energy projects, etc., would lead to lower energy prices for Americans and higher profitability for Bitcoin mining.”

According to the latest Cambridge Center for Alternative Finance studiesMore miners switch to cheaper power outside the net. It is said that 52.4% sustainable force used in BTC mining includes 9.8% nuclear and 42.6% renewable sources such as water, solar and wind.

For the first time, natural gas replaced coal as the only largest source of energy in bitcoins – a process that includes a solution to complex mathematical puzzles to verify transactions and add to blockchain.

The report published in April says natural gas, a cleaner combustion fuel, now represents 38.2% of electricity used for BTC’s center of gravity, 25% three years ago. The use of coal during the same period dropped to 8.9% of 36.6%.

Meanwhile, bitcoin -related emissions have remained stable in the last three years and have stable to 39.8MTCO2E (megatons of carbon dioxide equivalent), due to improved machine efficiency and renewable energy transition.

Contribution Trump’s tax account could push the bitcoin miners relying on the solar energy He appeared for the first time Cryptonews.