Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

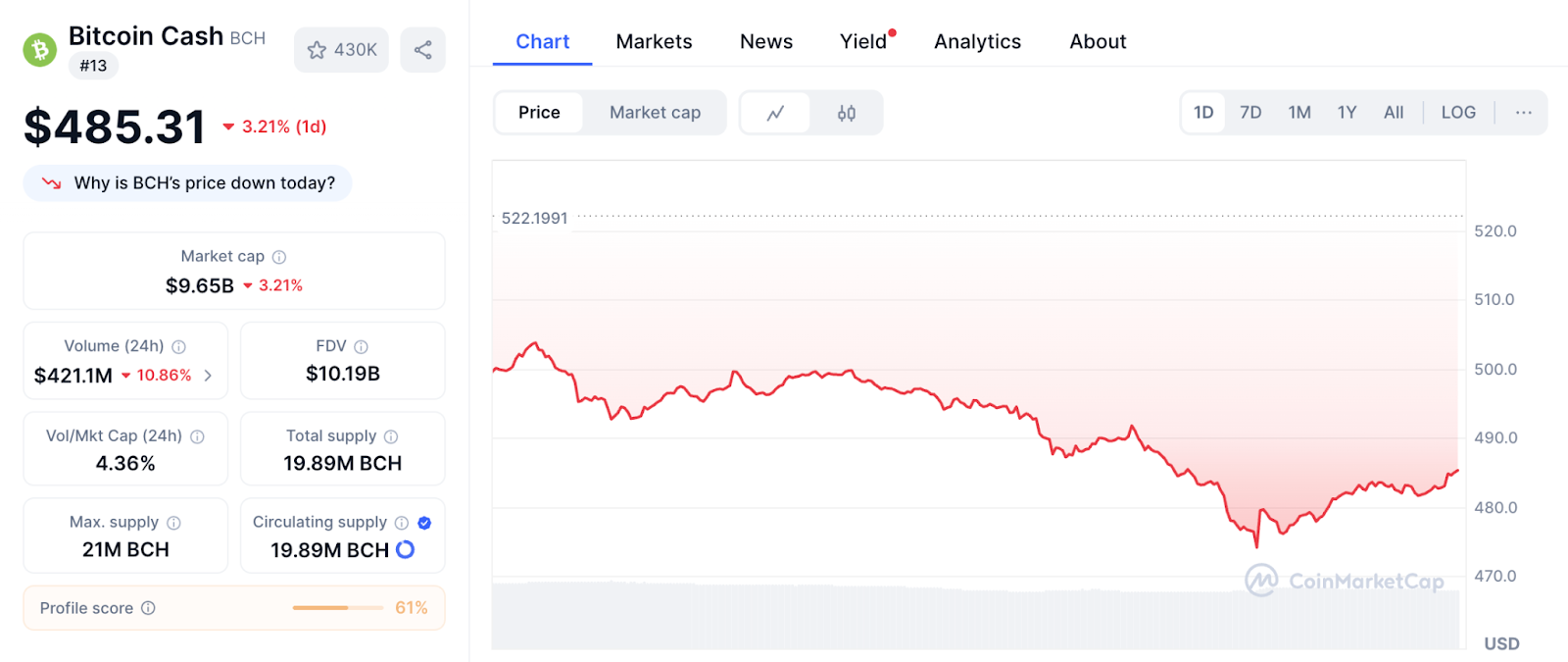

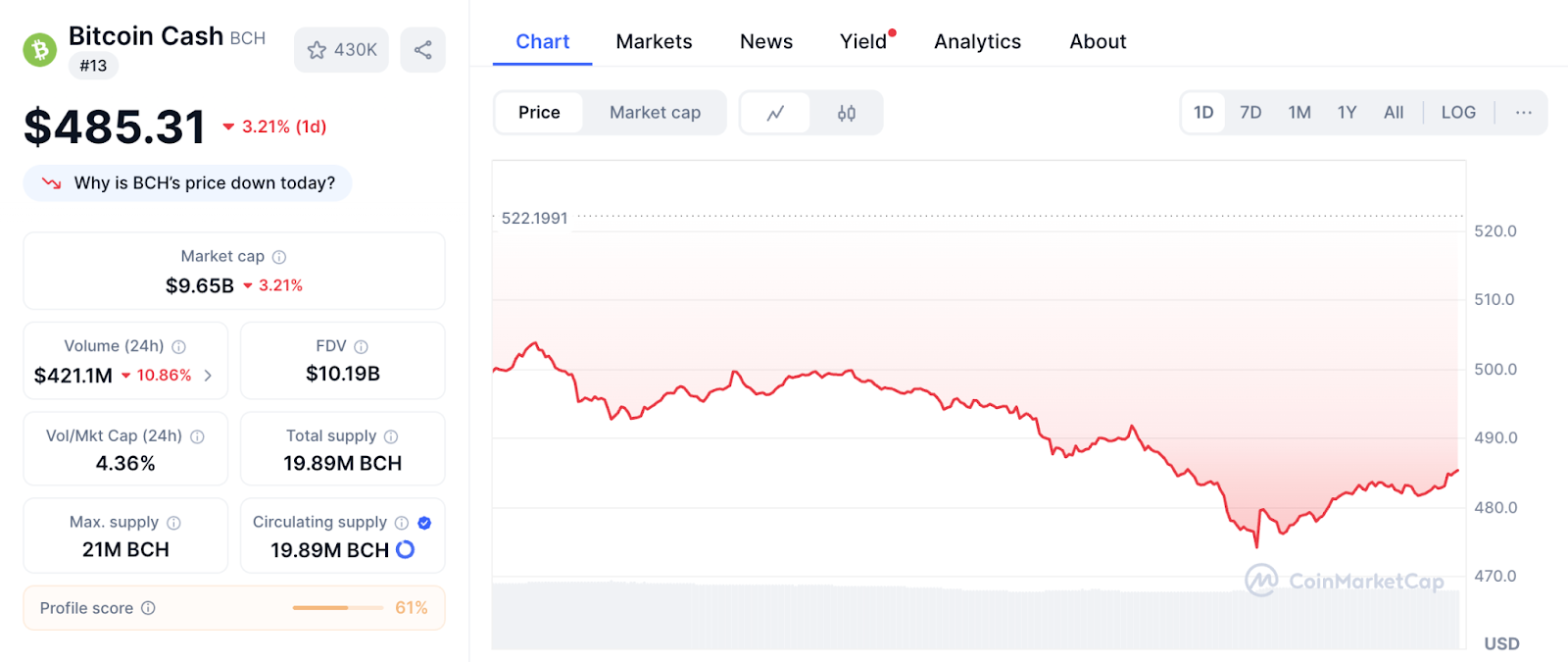

Bitcoin Cash (BCH) This week it fell by 7.8%when $ BCH collapsed over $ 485, as well as futures open interest with 24%, revealing a dangerous gap between speculative betting and a six -year minimum network.

It seems that 20% of the altcoin rally in June is now built on Quicksand. While derivative traders have accumulated, daily active crate addresses at the 2018 level. With the flashing bear divergence RSI, BCH must hold 400 $ to avoid all recent profits.

Launched in August 2017 as bitcoin forks, Bitcoin Cash ($ bch) It has been designed to facilitate faster and cheaper transactions by increasing block size limit from 1 MB to 8 MB.

The network, secured by the consensus for evidence of work, currently has approximately $ 19.8 million in circulation, with a maximum delivery limited to $ 21 million.

A major upgrade 15 May 2025 introduced targeted virtual machine limits, high -precision arithmetic and adaptive algorithm of block size to improve scalability and reliability.

Although these improvements aim to support more complex applications on the chain, adoption remains low-day active addresses recently hit six-year minimum, indicating that recent prices can be driven more speculation than usefulness.

Despite the thickened activity on the chain, institutional engagement has increased.

The open interest on futures $ BCH increased by more than 24%in June, while the volume of trading more than doubled after $ BCH 27th June exceeded $ 500. This briefly shifted its market capitalization over $ 10 billion, which evaluated it 12., although it has slipped to the 13th time since then.

Analysts point to the scalability and stability of $ BCH over $ 400, because key bull factors, but warn that Bearish RSI Divergence could reduce other profits.

The Bitcoin Cash Cash ecosystem shows potential but fights for traction. Despite low fees and $ BCH and high permeability – additions that attract specialized developers – chain 7.9 $ Million Total Value Locked (TVL) and a modest 13 841 $ daily volume Dex to reveal modest real use in the real world.

This disconnection is growing Starker when exploring a recent price action. While $ BCH ran 20%in June, the on-sear activity hit a six-year minimum, confirming that the rally was powered by speculation of derivatives rather than organic growth.

BCH must convert their technical strengths (such as the modernization of May scalability) to adoption of traders and incentives for developers for sustainable adoption. An increase of 24% in the open interest of futures suggests that there is a market confidence; Now the network must deliver the corresponding tool in the string.

To maintain a long -term growth of $ BCH, it must strengthen the adoption of the merchant and developers’ incentives. While recent upgrades and growing interest in futures provide a foundation, wider acceptance will depend on whether the network can convert technical improvements into real use.

The BCH/USDT graph reflects a clear transition through the multiple market phases, starting at the end of June and continuing to the beginning of July.

The price initially showed a strong uptrend characterized by steep escape and large green candles with substantial volume support. This fast rally was powered by BCH from approximately $ 475 to less than $ 510.

This bull momentum stopped when the price entered the side of the consolidation to the side and created a formula bound to a range between approximately $ 500 and $ 510. During this period, the volume decreased and MacD flattened, indicating the indecision and weakening purchase pressure.

When the consolidation broke into the disadvantage, BCH entered a stable descent and created a sequence of lower maximum and lower minimum. The price consistently decreased with minor relief reflections and eventually broke under the support region of $ 480. The continuation was accompanied by an increase in red volume strips, indicating a growing sales pressure.

Most recently, the graph shows signs of bull -reflection, with a sharp turn from Zone 472-474. This was confirmed by the bull of MacD crossover under zero line, suggesting that bear dynamics slowed down and the buyers enter. The volume also rose slightly and strengthened the short -term bull conversion.

However, in order to be sustainable, BCH must get BCH back $ 488-490 and maintain dynamics above the MacD base line. If this is refused, risk prices repeat $ 474 support.

Contribution Futures Bitcoins jump 24%because active addresses have achieved a six-year-old low-risiko forward? He appeared for the first time Cryptonews.