Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Processed AI CHATGPT 42 Live indicators revealing bear dynamics when dogecoin threw himself 5.58% on $ 0.16241 In the midst of political tension between Elon Musk and Donald Trump, which affects DOGE speculation.

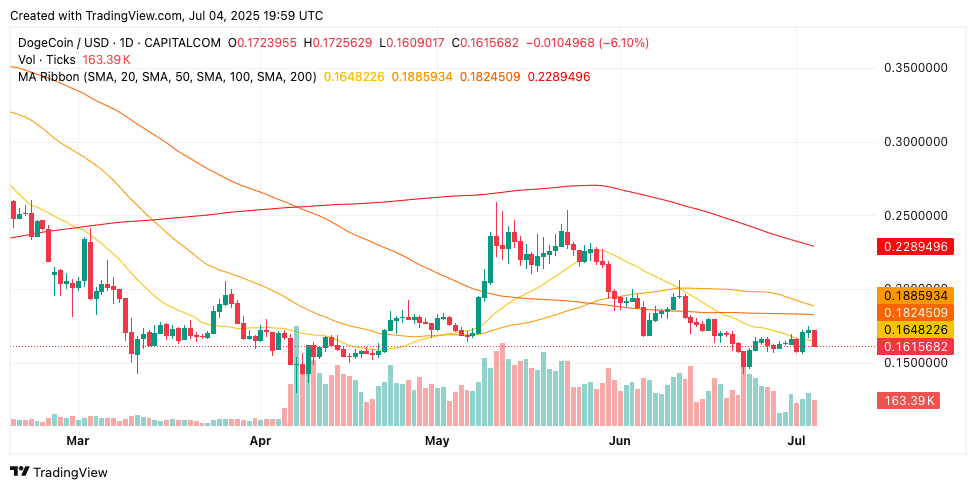

DOGE is trading under all the main EMA with a massive increase in volume of 636.62 m as it tests key support on 0.155 – 0.160 $ zone.

Strong sales pressure occurs when the price drops below 20 -day Ema (0.16855 $), 50 -day Ema (0.17932 $), 100 -day Ema (0.19104 $) a 200 -day Ema (0.20457 $), in the middle of an increased political drama, the introduction of volatility.

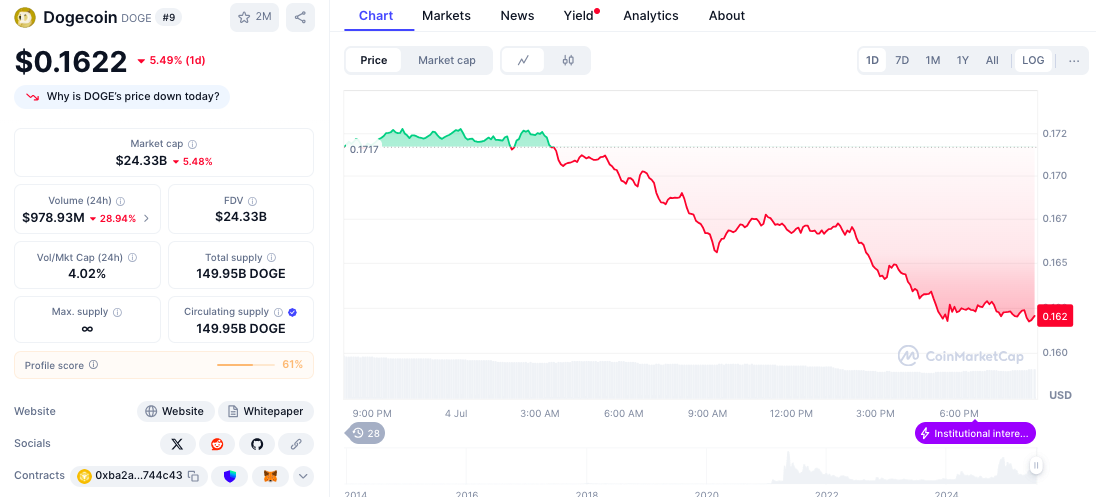

The market hat stands on $ 24.33 billionexplosive 42.16% Volume to increase up to $ 908.02 millionVerification of institutional relocation during a period of uncertainty.

The following analysis synthesizes the Chatgpt 42 Real -time technical indicators, political development, sentiment metrics and technical formulas to assess DOGE 90 -day Trajectory in the middle of the escalation of political tension and formations of patterns.

Dogecoin’s current price $ 0.16241 reflects a major 5.58% Daily drop from its opening price $ 0.17201, introducing a business range between 0.17296 $ (high) and 0.16128 $ (low).

This 0.01168 $ Intraday distribution indicates high volatility during a period of political uncertainty.

Rsi and 43.57 The territory is sold without reaching extreme levels, indicating balanced momentum despite intensive sales pressure. This location suggests that DOGE remains susceptible to further drop without immediate reversal signals from technical indicators.

MACD indicators show conflict values with MACD line to 0.00176Trading slightly above zero, indicating basic bull momentum. Negative histogram on -0,00733 It denotes strong bearish divergence of momentum requiring careful monitoring for disintegration.

The political dispute between Elon Musk and Donald Trump introduced Dogo volatility, with speculation surrounding the Duge agency and creating uncertainty among investors.

This political drama is a departure from the traditional assemblies of controlled MEMe, which represents a systematic risk to the DOGE price action.

Elon Musk OA speculation New American party It has increased attention for potential scenarios of the meme coin boom, although the current political tension overshadowed these bull stories.

The timing of political development coincides with the technical patterns of decomposition and amplifies the pressure down.

Technical analysts identify a large ascending formula of the triangle in weekly charts, which represents a classic bull structure despite the current price weakness.

The formula shows that DOGE holds the support of the trend 0.17 $Although recent disorders question this bull work.

Ascending formation of a triangle suggests accumulation at higher minimum while facing consistent resistance around 0.25 – 0.29 $ levels.

This formula usually solves with ascending escapes, although current political tensions complicate the traditional prerequisites of technical analysis.

More reflections from key support zones indicate the institutional interest in the accumulation of DOGE during the period of weakness, although recent disintegrations under the support of the triangle raise questions about the validity of the pattern.

For the next few weeks, it will be key to determining whether the bulls can get back the support of the triangle or bears to move lower prices.

DOGE’S 2025 Power shows extreme volatility after January strong closure to 0.33 $representing the local high maximum per year.

Subsequent correction for February $ 0.20 and stabilization around 0.17 $ In March and April, they created current ranges of trading.

May’s modest recovery at 0.19 $, followed by a June decline on 0.16 $, It demonstrates DOGE’s inability to maintain momentum without the main catalysts. The current price event is a continuation of the correction cycle, which began after the January top performance.

The 51% The decline from the January maximum to the current levels reflects Doge’s nature and sensitivity to sentiment shifts.

This historical context provides a view of current weaknesses and at the same time emphasizes Doge’s potential for dramatic reversal during the period of positive catalysts.

Immediate support appears on today’s low surroundings 0.16128 $strengthened by a zone of key support on 0.1500 $ -0,16,000 $.

This confluence is the most important technical level for determining the short -term direction and potential of DOGE for deeper correction.

The main support zones range from 0.14,000 $ on $ 0.15,000, representing the historical level of accumulation, followed by a strong support from 0.12 000 $ to $ 0.13,000, corresponding to previous minimals of the cycle. These levels provide multiple security networks during extended correction scenarios.

Resistance begins immediately at 20 -day Ema, placed on 0.16855 $representing the first obstacle for possible recovery attempts.

The key cluster of resistance lies between 50 -day Ema (0.17932 $) a 100 -day Ema (0.19104 $), creating a demanding directorial offer.

Doge keeps and $ 24.33 billion market capitalization with exceptional 24 hours Volume of trading $ 908.02 millionrepresentative 42.16% increase. The volume cap ratio to the market 3.74% It proposes intensive sales pressure during a period of political uncertainty.

High -volume increase 636.62 m DOGE confirms institutional relocation during experiments at a breakdown, verifies technical analysis rather than designing accumulation.

This volume formula supports the bearish interpretation of the current price action.

Current prices represent a 78% discount on historically achieved maximum 2021Although comparison with recent maximum shows a 51% Decline from January 2025 peaks.

This location provides long -term arguments and recognizes significant technical damage.

LunarCrush data reveals durable community connection 83% Positive sentiment despite the recent price weakness.

Social dominance 2.95% with 2.71 million Overall orders show the ability to keep attention during the correction periods.

Recent social topics focused on the ascending formations of the triangle, accumulation opportunities and long -term bull scenarios focused on $ 1 level.

Community discussions emphasize technical patterns and at the same time recognize short -term political headwinds that affect price action.

Disconnect between social sentiment (83% Positive) and technical indicators (Bearish) represent a typical behavior of community Doge during correction periods. This durable sentiment provides basic support for possible recovery scenarios.

Musk-Trump’s political tension resolution, combined with escape from the ascending triangle, could lead to healing 0.25 – 0.29 $representing 54-79% upside down.

This scenario requires political clarity and successful defense 0.155 – 0.160 $ Zone support with volume confirmation.

Technical objectives include $ 0.20, 0.25 $and 0.29 $ Based on measurement of triangle patterns and historical resistance levels. MEME coins could be strongly reappeared if political uncertainties resolved favorably for speculation related to DOGE.

The ongoing political uncertainty and technical collapse could cause Doge to get to 0.12 – 0.14 $representing and 14-26% disadvantage.

This scenario assumes continuing political tensions and cannot maintain a key level of support during the summer business periods.

Support for 0.155 – 0.160 $ would probably fail during prolonged correction, with the normalization of volume 400-500 million DOGE daily. This event to the side of Downward provides better accumulation options for long -term holders looking for lower entry points.

Heavy political escalation or wider weakness of the market could cause repair to 0.10 – 0.12 $representing and 26–38% disadvantage.

This scenario would require strong negative catalysts beyond the current political tension.

Strong community sentiment and MEME coins resistance reduce extreme scenarios disadvantages, with great support on 0.12 – 0.13 $ Providing key long -term trend support for future recovery cycles.

The current location of DOGE reflects the convergence of political uncertainty, technical collapse and community resistance.

The 42-Signal The analysis shows that the cryptocurrency is located at the key intersection between the continuation of the pattern and the main correction.

Current consolidation around 0.16 $ with critical support on 0.155 $–0.160 $ It creates a decision -making point for Dog’s trajectory. Combination of political drama, technical weaknesses and positions of community optimism for volatile price action, as catalysts develop throughout Q3 2025.

Contribution Key analyzes of DOGE CHATGPTU 42-SIGNAL DOGE. He appeared for the first time Cryptonews.