Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The second largest financial institution of Spain, BBVA, introduced for retail customers trading with Bitcoins and Ethereum trading in retail, which meant significant expansion Regulated Digital Asset Services Throughout Europe.

BBVA fully integrated these cryptocurrency services into its proprietary mobile platform and operated separately without relying on external service providers or third -party custody.

The bank’s approach allows customers to make autonomously transactions and at the same time claim that it does not offer investment consulting services.

According to Official edition The launch of the cryptocurrency service of 4 July results from the regulatory approval of the Spanish National Securities Commission (CNMV) in March 2025.

This The License Framework entitles BBVA to provide cryptocurrency services To all customers who meet the requirements of the legal age.

“Our goal is to simplify investment in cryptocurrency for retail customers in Spain through accessible and user -friendly digital platform available on their mobile devices“Gonzalo Rodríguez, head of BBVA retail banking for Spain, said.

The service architecture ensures compliance with European Union Markets in Crypts (Slp) Regulation that sets comprehensive standards for cryptocurrency -related services across EU Member States.

The Spanish cryptocurrency initiative BBVA builds on the success of its Swiss operations. In June 2021 BBVA Switzerland promoted the offer of bank cryptocurrency by introducing bitcoins and business services for private banking clients

Since then, the Swiss division has diversified its cryptocurrency portfolio to include Ethereum, Solana, XRP and Avax, and successfully attract both institutional investors and an individual with a high value.

Recent news Since June 18, BBVA recommends 3% to 7% in cryptocurrencies for its rich clients.

Philippe Meyer, head of digital and blockchain solutions in BBVA Switzerland, indicated that the bank currently advises clients to focus on investment of bitcoins and ethereumWith plans to introduce other cryptocurrencies at the end of this year.

“3% Portfolio allocation on cryptocurrency represents an exposure to a manageable risk“Meyer explained.”In a balanced portfolio structure, the introduction of 3% cryptocurrency allocation can increase the overall performance.“

In addition to Bitcoins and Ethereum BBVA, the USDC Stablecoin Services incorporated its offers. In September 2024, the bank expanded its cryptocurrency custody and business skills Include a USD coin for institutional and private banking in Switzerland.

This expansion allows clients to trade, hold or convert USDC to euros, dollars or other currencies with an almost unprecedented design.

The bank noted that investment fund administrators and large corporations often use stablecoins, such as USDC, to accelerate transactions across different cryptocurrency stock exchanges.

In addition, stablecoins serve as a hedge against cryptocurrency volatility by allowing investors to maintain the value of assets during market fluctuations.

Over approximately 95% of EU banks avoid cryptocurrency services Given the cautious regulatory attitude of the European Securities Office and markets (ESMA), the Spanish cryptocurrency market has shown significant growth.

Survey of the European Central Bank 2024, published in January 2025, revealed that nearly 9% of Spanish citizens now have digital assetsrepresenting more than twice the figure of 2022.

The degree of acceptance of the cryptocurrency of Spain is now equal to the extent of France and Croatia in the euro area, although it remains below 15% of Slovenia’s adoption and 14% of Greece ownership.

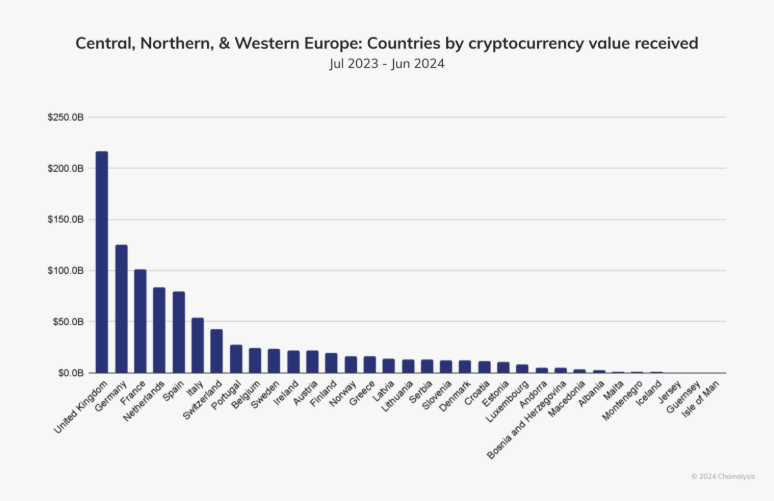

Between 2023 and 2024, Spain received a cryptocurrency worth over $ 80 billion, which makes it made 5. The largest European countries with the highest crypt value received.

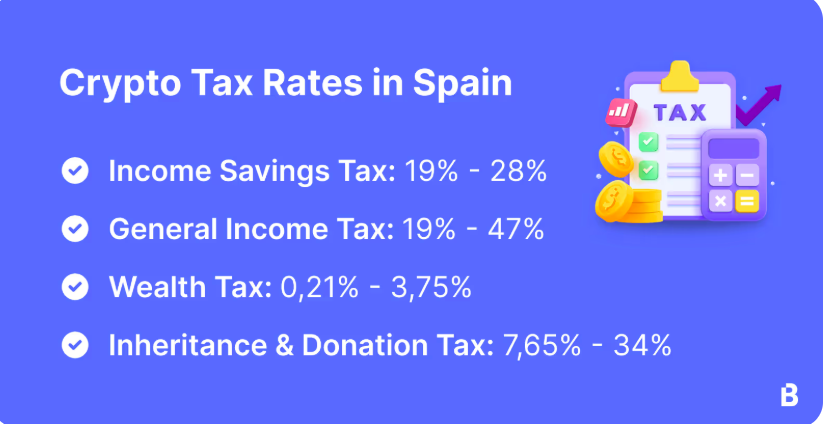

Despite growing adoption, Spain has tight tax regulations for crypto.

The Spanish taxation of cryptocurrency is governed by specific instructions set by the Spanish State Agency for the Tax Administration (AEAT). Spanish residents are obliged to declare profits from cryptocurrency transactions and income generated by possession of digital assets or related activities.

Spanish taxpayers are obliged to report profits of cryptocurrencies exceeding EUR 6,000 within the income tax (capital income tax), with rates from 19% to 28% depending on total profits.

Contribution BBVA Spanish Bank Giant expands the crypto offers with bitcoin and Ethereum Services He appeared for the first time Cryptonews.