Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Solan

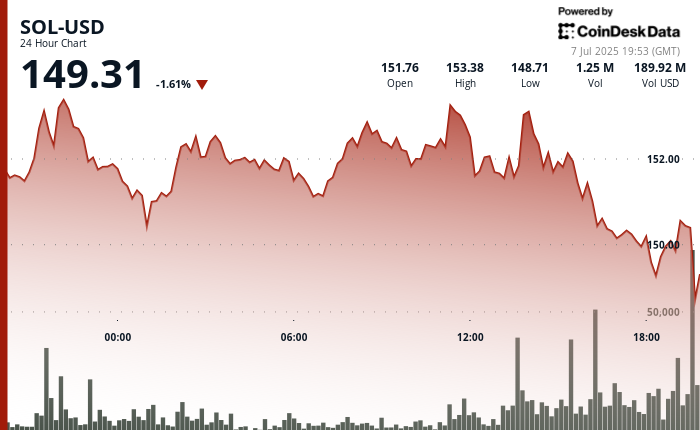

Over the past 24 hours, it fell by $ 1.45%, according to Coindesk Research technical analysis, $ 151.41 fell to $ 149.21. As for a wider crypto market as measuring the Coindesk 20 Index (CD20)It is a decrease of 0.56% in the last 24 hours.

The token was traded in a wide range of $ 4.58 and the summit of $ 153.67 before a sharp sale managed prices at a key psychological level of $ 150. Increased volume near the session low proposed the buyer’s interest in the £ 149 support zone, which at the end of the period helped SOL to restore $ 149.31.

Despite the recent short -term weakness, the new chain data emphasizes the growing strength of Solana network.

According to Data from Analytical platform ArtemisSolana corresponded to the combined monthly active addresses of all other Blockchains L1 and L2 in June 2025. This growth of users comes together with the revenue from a network of record records, while Solana generated more than $ 271 million in Q1 2025, according to. Data from blocking work. It was the third consecutive quarter of the blockchain, which led all chains in the network income that consists of transaction fees and tips outside the protocol.

Together, these metrics underline the position of Solana as one of the most active blockchains in the industry, both in terms of real users and economic permeability. The main increase in network revenue also strengthens the sustainability of Solana and ecosystem activity, even in the middle of volatile market conditions. Since developers and users continue to accept high -speed solana infrastructure, these trends can support the long -term value due to the almost term resistance.

Emphasizing technical analysis

Renunciation of responsibility: Parts of this article were created with the help of AI tools and reviewed our editorial team to ensure accuracy and observance our standards. See more information Complete policy of AI of Coindeska.