Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Bitcoin is traded just above $ 114,000 and prevents its ascending trend line and a 50 -day SMA, a key zone of confluence that traders often follow the bull sequel. This technical repeated test comes when institutional momentum is heated: Satsuma technology has just received $ 218 million in financing a denomination BTC, increasing the wider wave of long -term capital to bitcoins.

Since higher minimums and main players, such as pension funds and SBI Holdings, have been created since April, the crypto is expanding, the setting to escape towards $ 123,000 harder to ignore.

London Technology SATSUMA based on SA headline $ 217.6 million convertible credit noteThe first of its kind in the UK to be fully prepaid to bitcoins.

This round of financing, supported by Pantera Capital, Kraken, Blockchain.com and British Asset Managers who supervised more than 300 billion GBP, exceeded its goal by 63%.

Despite positive dynamics, satsuma shares slipped by 14%, movement analysts attributed to profit and short -term volatility. Henry Elder, CEO, confirmed that capital will support its plan for decentralized AI infrastructure via Bittensor with Bitcoin’s cash register strategy.

Currently, it holds 1 126 BTC at an average entry of $ 115,149, the attitude of Satsuma is almost broken, reflecting firm beliefs in the long -term Bitcoin trajectory in the middle of a wider market turbulence. The increase is in line with the increasing macro trend: $ 7.8 billion was published last week in the acquisitions of crypto assets, with $ 2.7 billion to Bitcoins.

Bitcoin shows remarkable technical power. The price action of approximately $ 114,980 is consolidated just above two key supports:

This confluence zone, where the resistance has turned into support, is often a bull signal continuation.

RSI is going to cross over 50, which could be the beginning of bull momentum. The graph shows a wide ascending triangle with a higher minimum and accumulation below $ 123,206. The break of this level could release the buyer at $ 131,337 and $ 138,680.

If there is a trend line, it is a staircase rally. However, if it falls under $ 111,995, it could move the sentiment and open the door to a decline to $ 105,225 or $ 99,500. Confirmation of the volume and the bull -absorbing candle over $ 115,000 would be the perfect entry for swing traders.

Setting the BTC store (short -term):

If this triangle confirms, the bulls could regain control, especially if they are paired with a renewed institutional influx and ETF stability.

In the US, the Michigan State Pension System has just tripled its Bitcoin Exposition ETF and added 200,000 shares of the ARK 21SHARES BTC ETF to its portfolio, now worth $ 11.4 million. This comes despite more than $ 1.4 billion in USA lanes in the US ETF last week, which signals long -term beliefs.

Michigan also holds $ 13.6 million Trust Ethereum in Gray GradeIt has not changed since 2024. Although crypto remains small harvested portfolios of $ 19.3 billion, analysts claim that Sharpe for bitcoins is becoming increasingly attractive for pension strategies that seek asymmetrical yields with manageable risk.

In the Pacific, the Japanese SBI Holdings awaits the first bitcoin-XRP ETF in the country. If the green it would be listed on the Tokyo Stock Exchange – unlocking an institutional approach on a firmly regulated market. The second ETF, mixing gold and crypto, is also in the pipeline.

This development could dramatically increase the Asian influx, especially if the Japanese Agency for Financial Services reclassifies the crypto according to FIEA status – a shift that could redefine an institutional approach throughout the region.

What will be for BTC?

Given that BTC support holds nearly $ 115,000 and institutional stories that strengthen throughout the US, the UK and Japan, the foundation is ready for a bull sequel. If the ascending triangle takes place, Bitcoin could break a resistance of $ 123,000 and in the near future to reappear $ 131,000 or $ 138,000 and possibly set the soil to run Q4 towards $ 250,000 or higher.

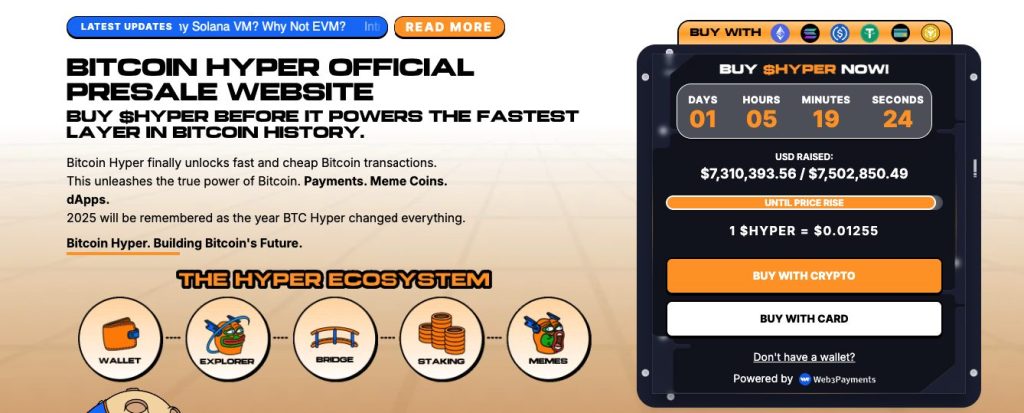

Bitcoin Hyper ($ Hyper)The first BTC-national layer 2 driven by the Solana virtual machine (SVM) has received more than $ 7.3 million in its public pre-platform, with $ 7,393 from $ 7,502,850. The token is awarded at $ 0.01255, and the next price level will be announced soon.

Bitcoin Hyper, designed to combine the security of bitcoins with the velocity of the Solana, allows fast, cheap intelligent contracts, DAPPS and MEME coins, all with a trouble -free BTC bridging. The project is audited by Consult and created for scalability, trust and simplicity.

The Golden Cross Meme appeal and Real Utility caused Bitcoin Hyper a 2 -layer 2 applicant in 2025.

Click here to participate in advance sales

Contribution Prediction Bitcoin Price: $ 218 million Satsuma Increase and SMA Retest Tip 123k Breakout He appeared for the first time Cryptonews.