Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

SOLAXY ($ SOLX) It has just broken a $ 35.5 million milestone and has added nearly $ 1 million to a new capital from a total total of $ 34.6 million.

This momentum comes when Solana ($ sol) rises around $ 180, with $ 200 firmly in sight. The timing could not have been better. As the first Layer-2 Solana, SOLAXY quickly becomes playing for investors who look behind the base layer and towards the infrastructure that was powered by another leg up.

It is not just a market hype that supports this step. Vaneck recently launched his tokenized US Financial Fund (VBILL) on Solana – the main vote on trust in traditional finance. It is another sign that institutions are beginning to handle sola not only as a fast chain, but as a serious financial infrastructure.

Smarter money understands that the long -term trajectory of Solana depends on the solution of scalability, and there enters Solaxs. It is a motor designed to pick up what the base layer cannot handle.

Right now, $Solx It is the price for $ 0.001724 – but before the next price increase, only 24 hours will remain.

Global Asset Manager Vaneck officially launched Vbill, his first tokenized American treasury fund, in cooperation with Securitize.

The Fund provides real -time access to the chain to the assets supported by the cash register and now lives across Solana, Ethereum, BNB chain and avalanche, with worm hole allows interoperability across chains.

VBILL is a fully regulated product powered by Full-Stack Services Securitize-Founder and Fund manager after the dealer intermediary. It is designed to offer real -time capital efficiency and deeper liquidity for institutional players who go to the chain.

And Solana was not only included – that was at the start. This is being built there directly with Ethereum in one of the largest institutional introduction.

But Vanek’s pressure doesn’t stop there. Together with 21shares, Bitwise and capital capital, the company filed in the federal register. Bloomberg Intelligence currently agrees with approval courses to 90%, which signals how close this additional wave of unlocking is.

It is a kind of institutional shift that Solana could push Solan to repeat its $ 295.40 at a high level from January 19.

Source: TradingView

And while the subtitles focus on Solan’s layer-1, the real story is what is going on Solax It explodes and the numbers prove it.

SOLAXY’S PREVIEWS It is in Overdrive and adds millions of new capital, because more investors recognize this as the key to unlocking the next phase of Solana. Its goal is clear: to solve the problems of overloading, instability and scalability that held Solan back before overcoming the dominance of Ethereum in the intelligent contract area.

After starting, SOLAXY is expected to significantly increase the permeability of Solana, which will be more able to handle high games from games, meme coins and defi without sacrificing speed.

And that’s not just a theory. SOLAXY already adds. The team introduced faster restarting nodes for smoother synchronization, stabilized the test environment and optimized handling with straight for better transaction performance. BUGS UI have also been repaired, so the platform allowed reacting and ready for production.

Another phase is close. The native SOLAXY bridge is about to live on the test -net-niches the first real look at how this layer-2 in practice expands the net.

Live testnet and Block Explorer They are already accessible through SOLAXY website.

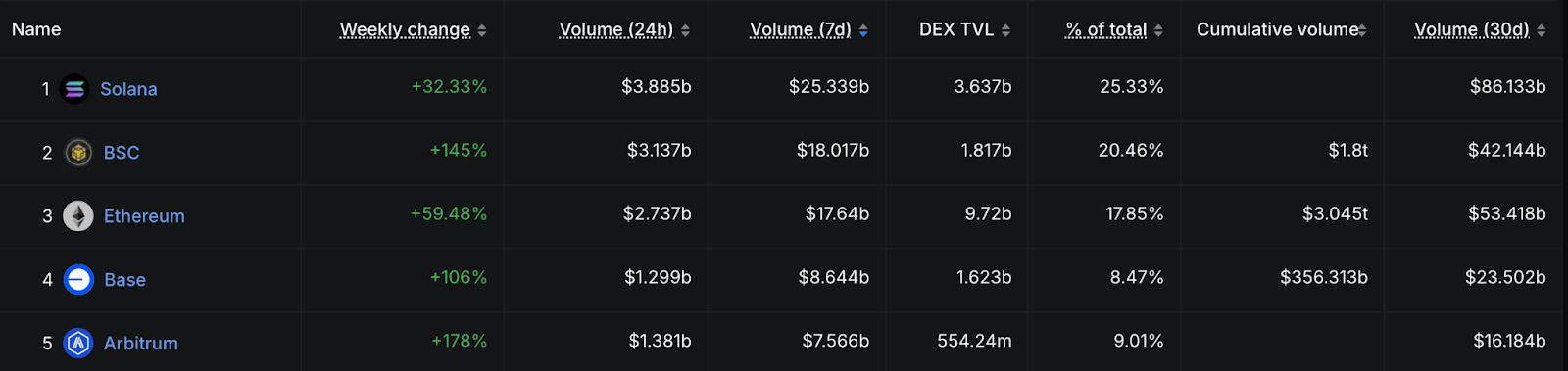

Solana has shown that she can scalance. It is this month that leads all DEX chains, records over $ 3.88 billion in a weekly volume and more than $ 86.13 billion in the last 30 days, exceeding $ 53.4 billion in the same period.

However, the raw speed itself is not enough in the race. Ethereum still holds the edge, mainly because of its excellent network stability.

Meanwhile, Solana is still ripening. Its longest outage-20-hour stop in 2021-by in traditional financing.

Visa and MasterCard process thousands of transactions per second without hiccups, and this is a standard that must meet a serious financial network. If Solana is to lead not only in defi but in the competition and reliability of Tradf in the real world, he needs a second engine.

Solax It is the second motor-struggling as a coprocessor, absorbing overflow, maintaining a chain during top speed, and providing protocols that do not interfere with overvoltage.

The higher the volume on the sole, the greater the demand for SOLAXY infrastructure – and in the extension of its native token, $ Solx.

$ SOLX is a scalability of an asset. Its demand will be dealt with directly with the growth of Solana, especially in high -performance cases of use, such as dex trading, agriculture and launching MEME.

If SOLAXY fulfills its promise, it will come on:

$ SOLX is not just a token; It is a mechanism for more resistant and capable sole.

And catch your share while there is still time, visit SOLAXY website and attach a supported wallet.

The newly acquired SOLX tokens can be immediately set into a dynamic 113% APY, which adapts to the pool activity and overall participation.

For optimal performance, Best wallet It is a recommended possibility of self-destivities-the full visibility of preliminary allocations of $ SOLX and smooth support of multichiain across Solana and Ethereum.

You want to update, join the SOLAXY community Telegram and X.

Contribution Solana breaks $ 180 because the first layer-2 SOLAXY exceeds $ 35.5 million in pre-sale-only 24 hours He appeared for the first time Cryptonews.