Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

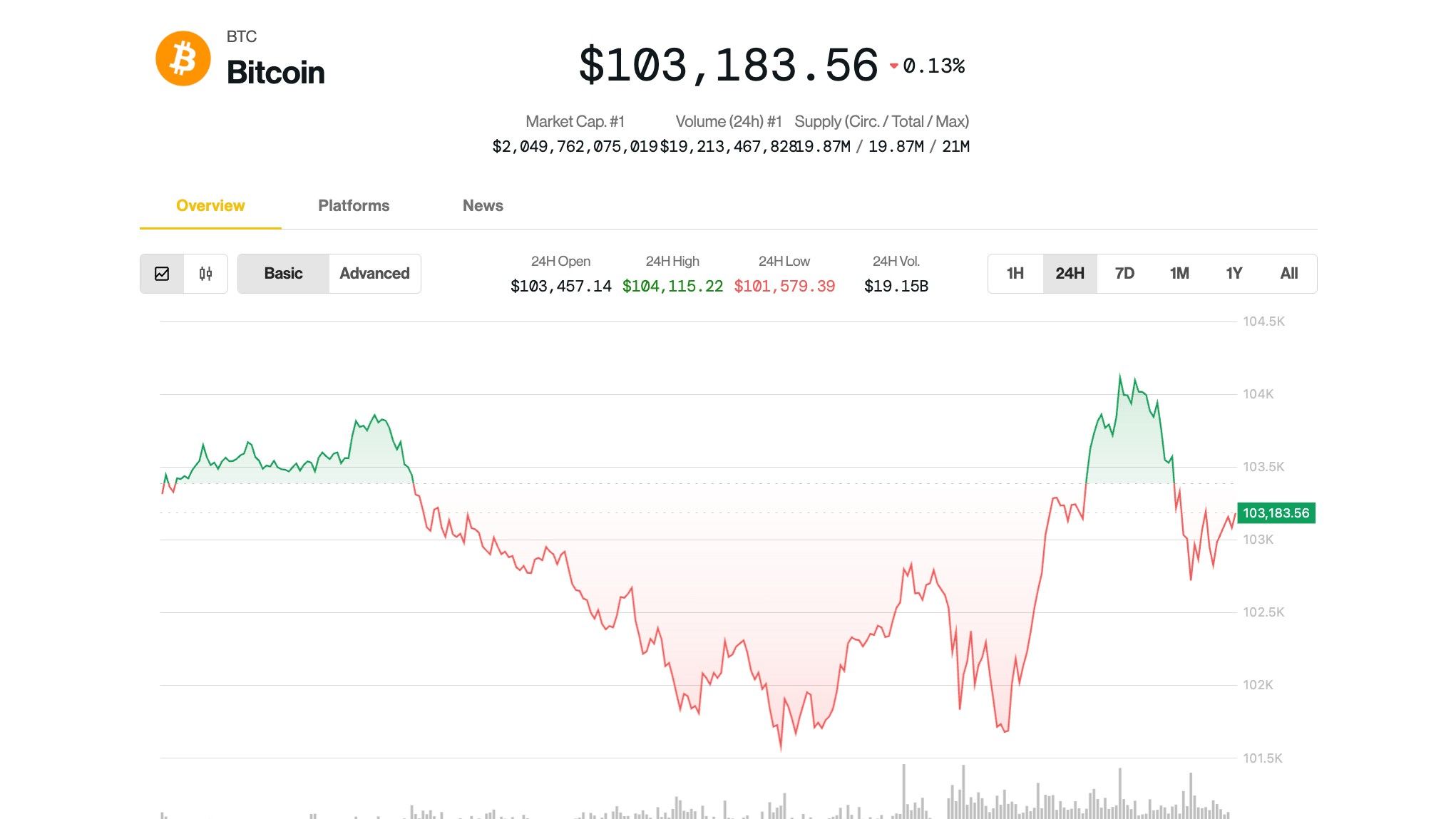

Crypto rally took a long delayed pause on Thursday because traders took some profits after weeks of relentless procedure that picked up bitcoin BTC$103 726.04 Almost recorded prices.

Consolidation occurred in the middle of the killing of economic data from the US. April retail sales missed expectations, producers’ prices increased less than forecasts, the demands without work remained on the good way, while the NY Empire State production index and Philadelphia Fed has shown softening business activities – brands that did little rattle traditional markets. S&P 500 added 0.4%while Nasdaq ended the apartment.

Bitcoin pulled back to $ 101,000 in the US meeting before the last 24 hours over $ 103,000, slightly down.

Altcoins were doing worse with the Broad-Market Coindesk 20, which dropped by 3%over the same period. Native tokens aptos Apt$5.36Avalanche Avax$23.54 and the USAP Uni$6.24 fell by 6%-7%.

Crypto investors should not sweat today’s pullback, said Coindeska analysts.

“The current Pullback seems to be a correction in a wider medium -term UPTRED,” said Ruslan Lienkha, chief of youhodler market.

Ascending momentum in the stock markets was alleviated after the delay of tariffs in China and short -term traders began to lock profits, he said. “This displacement in sentiment has spilled into risky assets, including BTC.”

“Anything below 5% [price move] It is often considered to be just a noise on the market, ”said Kirill Kretov, an expert in coinpanel trading.

It seems that a wider price action retreats from short -term movements, without clear signs of immediate peak.

Vole Lunde, Senior Analyst K33 Research, said BTC had just left one of his longest periods of neutral financing, defense signal signal

“This resembles patterns of risk aversion since October 2023 and 2024 and is far from the price near the previous peaks of the local market,” wrote Lunde, who was optimistic that the lack of foam with BTC over $ 100,000 is preparing a way for potential fresh record maximum.

According to Sten Research, crypt tails stem from the secret expansion of a private loan – especially in the US and Europe. In previous bull runs, the crypto succeeded in expanding basic money: massive injections of central banks that supported inflation of assets across the album. This time, however, the balance sheets of Fed and the European central banks continue to reduce quantitative tightening.

“Many of them have pointed to Chinese liquidity injections as the primary driver of the Assembly,” Samuel Shiff wrote on Thursday. “But the brand is missing. The actual support comes from the growth of the Western Bank loan – a quieter, less visible engine behind this stroke.”

He said that the outlook indicators project global financial conditions that improve into the summer months, driven primarily by the weakening of the US dollar. This historically led to higher BTC prices.

“We probably have space until June and by the beginning of July before the picture begins to change,” Shiffman said. “But as soon as we approach the back of July, the settings become more complicated. Our leading indicators suggest that the peak of financial release may not have last August.”