Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

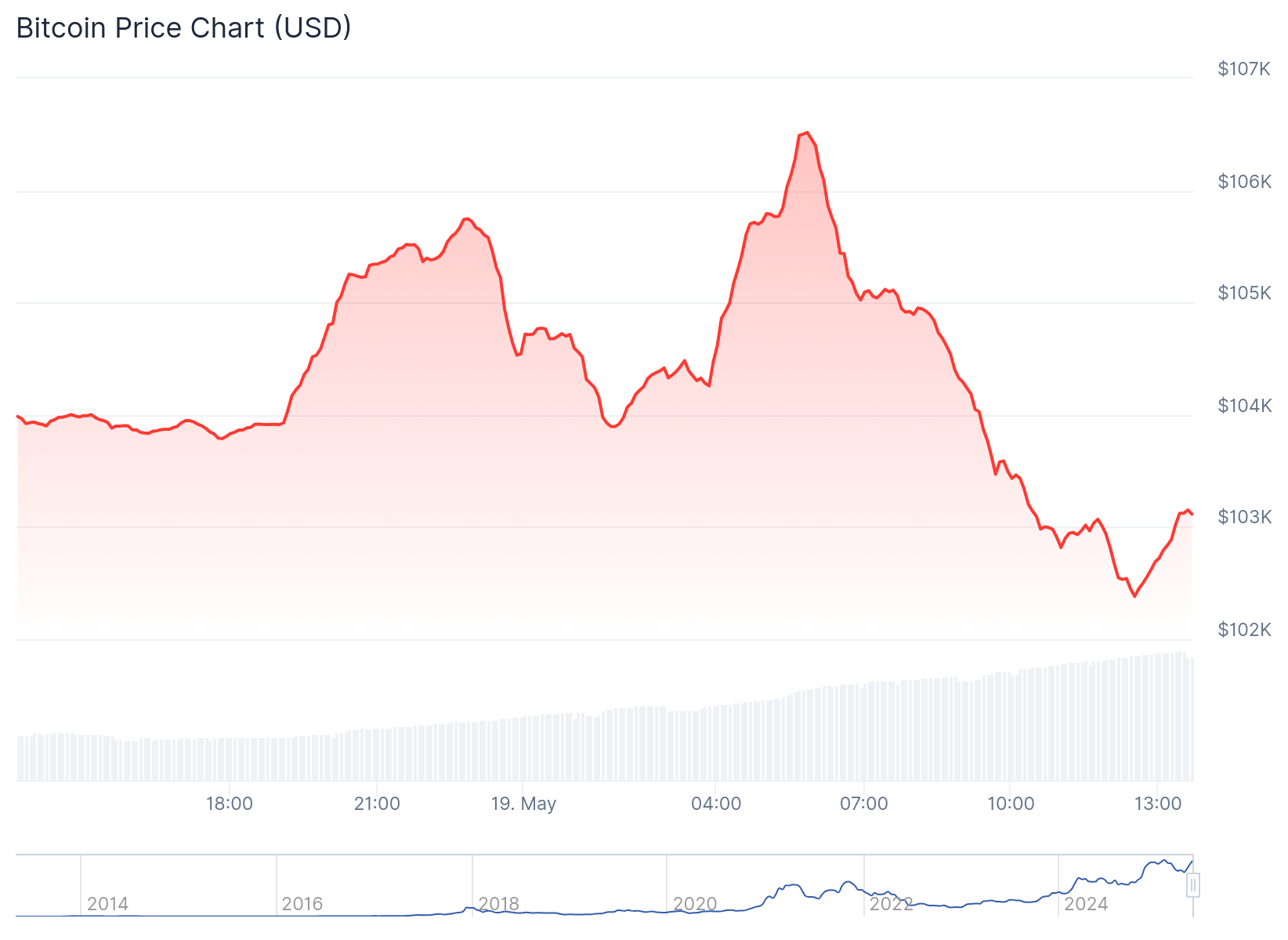

Over 600 million dollars have been liquidated since the late Sunday because Bitcoins (BTC) organized a sharp rally around $ 106,000 per Wee, just to turn the course and throw back to nearly $ 103,000, caught bulls and bears.

This step began around 21:00 UTC on Sunday, when Bitcoins increased by more than $ 2,500 in less than an hour – a formula that can be attributed to thin weekend liquidity and potential algorithmic purchase caused by technical levels.

Such a price event was a short press of textbooks followed by aggressive profit or stop-run. A short press occurs when traders put on the price (short sellers) forced to buy an asset as rising to cover their losses, pushing the price even higher and often very quickly.

A sudden thrust erased More than $ 460 million in long positions And $ 220 million in shorts, across futures by tracking large companies such as Ether (ETH), Solana (Sol) and Dogecoin (Duge).

The liquidation wave was remarkable for occurring during the traditionally silent weekend hours, an unusual event that means forced sales or buyers the main player.

Prices of SOL, DOGE and XRP in the last 24 hours have fallen by more than 4%, The data showWith a wide -based coindesk (CD20) by more than 2%.

Volatility follows a week of macro uncertainty, with Moody decreased on Friday’s credit rating and after mixed economic data feared inflation fears. Downgrade also led to us 30 -year revenues of the Treasury, which violates a 5% stamp.

While Crypto generally benefits from renewed institutional influx and imitation of ETF momentum, traders remain cautious at current price levels, As mentioned.

Bitcoin is a flat, but recent inability to maintain over $ 106,000, a psychological and technical level-can signal almost a term resistance, said Coindesk Alex Kurusikevich FXPro.

Meanwhile, some traders expect higher volatility on days that come in a warning sign for those who want to use their bets.

“Investors are shifting capital to bitcoins because concerns are growing over the US -waiting account, which could add trillions in debt and push for a higher treasury bonus,” said Haiyang RU, HASHKEY BUSINESS GROUP CEO, in a telegram report.

“But while Bitcoins float just below the new maximum, we expect greater market volatility because traders are preparing for new business agreements and the final version of fiscal policy,” Ru added.