Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The crypto market turned red at the weekend. Hardly any coin in the TOP 100 category are higher today. The cryptocurrency market capitalization has decreased by 3.3%over the last 24 hours, now to $ 3.36 trillion. The total volume of crypto trading is $ 141 billion at the time of writing.

TLDR:

Neither coin among the top 10 coins on the market ceiling has increased today. Ethereum (ETH) noticed the highest loss. It’s 4.8% for a price of $ 2,386.

The smallest decline is recorded Bitcoin (BTC)After dropping by 0.9%, now traded to $ 103,011. It is a significant move from short daily maximum $ 106,518. In particular, it was also his high in the last week.

Only four out of the 100 best coins recorded their prices in the same time frame. Virtual protocol (virtual) He is the best artist of the day, with an increase of 4.5%, now changing his hands to $ 1.82.

On the other hand, Bittensor (Tao) In this category it fell most: 7.1% to $ 399. Follows Ethena (this) ‘with 6.1% to 0.3569 $.

Meanwhile, virtuals is a protocol for tokenized AI agents Coinbase’s Ethereum Layer-2 Basethat announced yesterday “comes more traffic [Base’s] way.”

It also announced that Arbus tokenfrom the AI Market Intelligence layer ArbusHe began to live on virtuals.

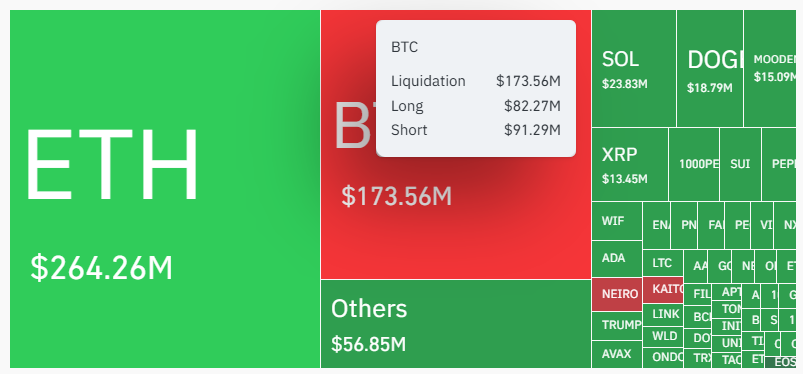

Overall, the daily pull. 669.12 million USD in the last 24 hours.

John Glover, Chief Investment Director on Crypto Lending Platform Ice and the former Barclays The CEO, he says he expects to see a short -lasting bitcoin correction before another leg higher at $ 136,000.

“The BTC Action is a nice line,” Glover says. He expects a short -term correction to the middle number of $ 80,000 to complete the wave (II) of the wave 5.

Once this wave is finished, another impulsive step would be higher to focus on $ 120,000, with a final goal of $ 136,000 later in the year, or at the beginning of next year to “finish the 5 (orange line) of bull run”.

For Glover, “Keep in mind that the wave (i) can be completely peeled off with a wave (II), so repetition of low wave IVs is not possible by the end of this year/start next year/start.”

Meanwhile Adam Back, CEO of Blockchain Tech Company Blockingrecently claimed that BTC is significantly underestimated and could hit $ 1 million per coin During the current market cycle.

He said that a four -year BTC prices cycle is going over time and that we are at the beginning of this cycle. “I think this cycle could be quite high.” […] $ 500,000 to $ 1 million because much is happening. ”

The catalysts include the US approval of Bitcoins (ETF) and the crypto-friendly political approach in this country, Back said.

Bitcoin published its previous weekly high maximum in December 2024, when the price exceeded $ 104,400. The coin is currently around $ 103,000, which signals a short -term weakness. However, a decline below a psychological level of $ 100,000 and a technical level of $ 98,000 could lead to another disadvantage.

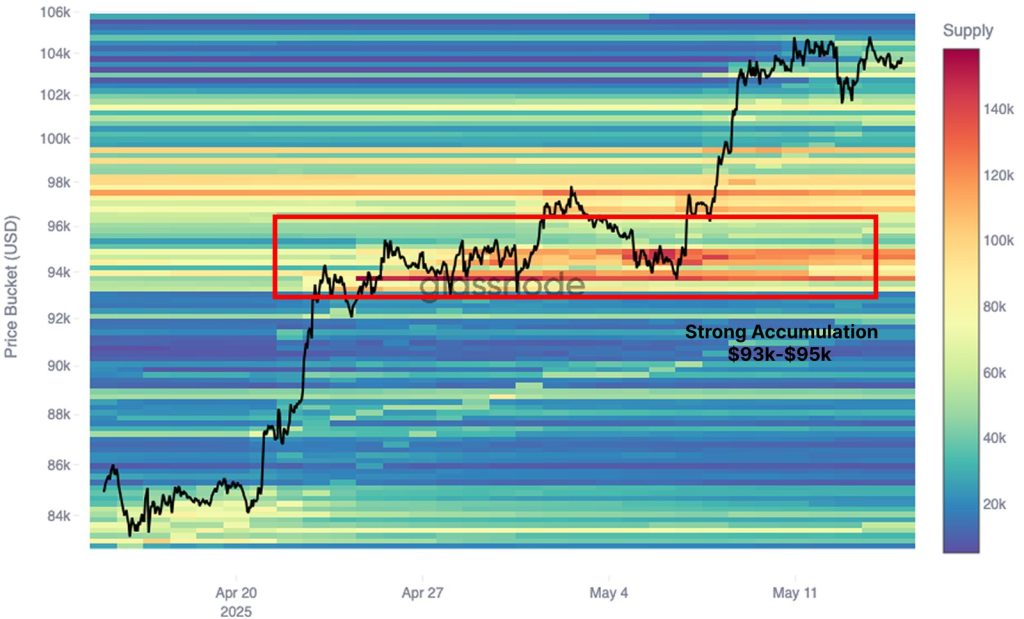

According to to the latest Glass node The report, the key accumulation zone was between $ 93,000 and $ 95,000. This zone is likely to act as a strong level of support in the case of a short -term market like this. It will be “a zone of demand where investors are likely to see value again.”

Moreover, the index of fear and greed has been 71 for several days. Although this may indicate an increase in optimism and purchasing activities, the disadvantage is that it can also indicate excessive self -confidence and overvaluation.

This means that the price is still supported Consistent influx of ETF ETF And the main macro factors. Inflation, tariffs and other economic factors change investors’ interest in safe assets, including digital assets.

In a week of 16th May, Bitcoin ETF recorded on the US list on the US list in the total amount of $ 608.4 million, with Blackrock’s Ishares Bitcoin Trust (Ibit) Package management.

Moreover Metaplage bought another 1 004 BTC Monday. This is the largest Asian Bitcoin holder in Asia and the purchase is part of its strategy of bitcoin accumulation. This acquisition increased its total shares to 7,800 BTC.

The purchase comes after the company showed record revenues for the first quarter of 2025.

Today, the wider crypto market has seen remarkable volatility and downward pressure due to a high lever effect and disposal. On the other hand, US stock markets have published profits due to the increase in investor and optimism macro. For example S&P 500 is 0.7%today, Nasdaq-100 increased by 0.43%and Dow Jones industrial average increases by 0.78%.

With regard to the permanent sale, it may be unsustainable with regard to consistent institutional interest. Immersion is probably a pullback induced by liquidation through long and short positions. However, negative messages or control shifts in combination with volatility can cause further correction.

Contribution Why is Krypto below – May 19, 2025? He appeared for the first time Cryptonews.