Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Cryptocurrencies received on Monday after a rocky start of a commercial session that reflected a wider recovery in risky assets because merchants spent Moody Downgrade of US government bonds.

Bitcoin

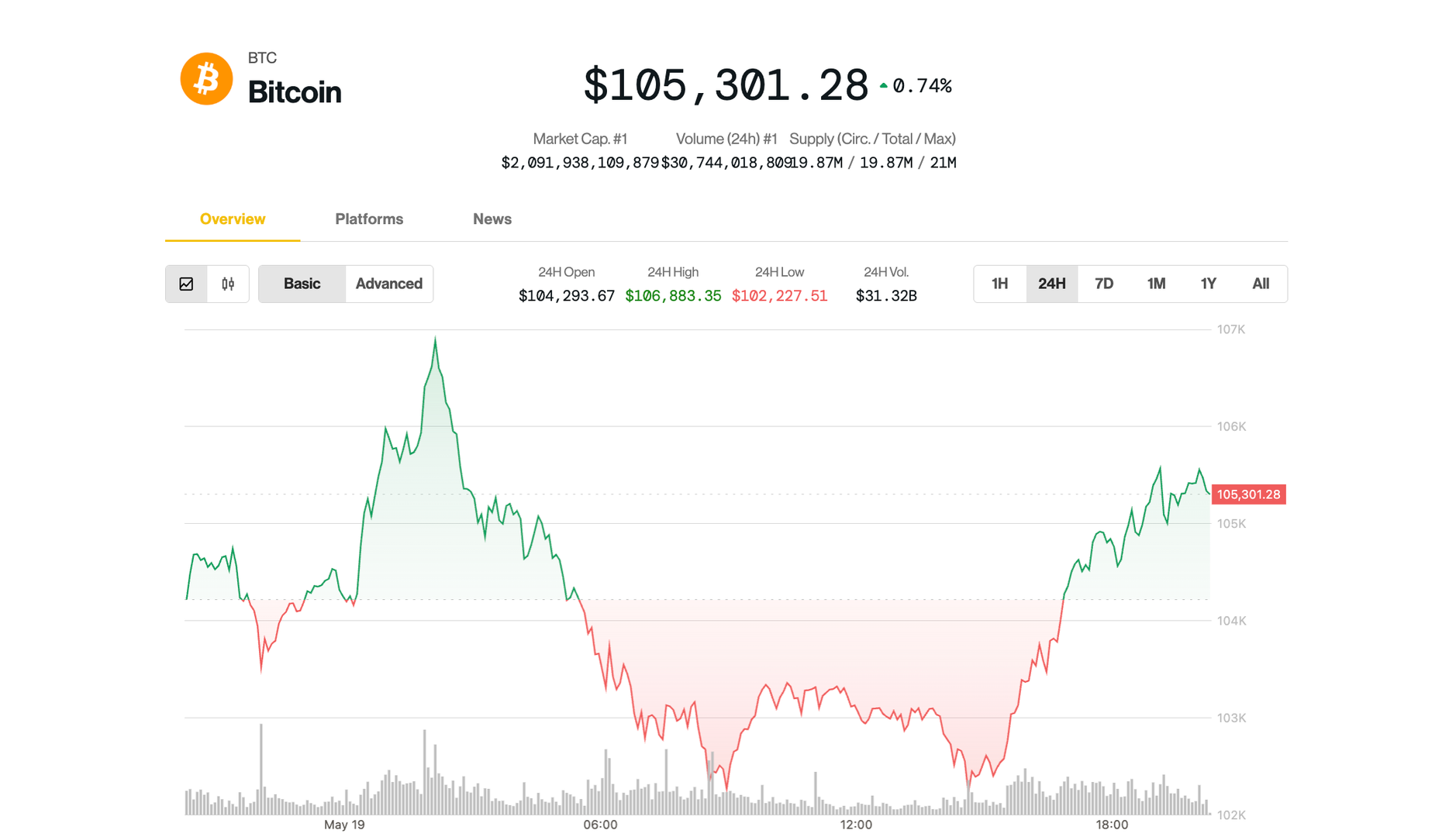

noticed a strong bounce Slip At only $ 102,000 at the beginning of the US session, after its record weekly closure for $ 106,600 overnight. The largest marketplace cryptocurrency in the afternoon trading came back to $ 105,000, which is 0.4% in 24 hours. Ether increased by 1.2%, regenerating a level of $ 2,500.

Defi lending platform AAVE

He surpassed most altcoins with large capital, while most members of the Coindesk 20 index on the market still remained in red, although they advanced from their daily minimum. Solana, Avalanche and Polkadot dropped by 2%-3%.

The jump also spread to American stocks, with the S&P 500 and Nasdaq erased their morning decline.

Soon the Pullback in Krypto and the shares came after Moody’s late Friday reduced the American credit rating from its state AAA. The bond markets that were rattling have shifted revenues from the 30 -year cash register above 5% and a 10 -year note to more than 4.5%.

However, some analysts have downplayed the long -term impact of downgrade on asset prices.

“What is he doing [the downgrade] does it mean for the markets? Long-term-right, ”said Ram Ahluwalia, CEO of Lumid Wealth’s wealth management. He added that there could be some sales pressure focused on US cash registers in the short term because some of them are only commissioned in AAA securities.

“Moody’s is the last of the three main rating agencies to reduce US debt. That was the opposite of a surprise – it came for a long time,” said Callie Cox, the main market strategist in Ritholtz Wealth Management, in X Post. “Therefore, investors seem to not care about stocks.”

While the BTC moves just below its January record prices, the digital asset ETF emission 21shares see more up this year.

“Bitcoin is on the verge of escape,” wrote research strategist Matt Mena Va Monday’s message. He argued that the current BTC gatherings were not managed by not retail mania, but by the confluence of the structural forces, including institutional inflows, historical offers and improving macro conditions that indicate a more resistant and mature path to fresh high maxima.

Spot Bitcoin ETF has permanently absorbed more BTC than mining daily, tightening supply, while main institutions, corporations such as strategy and newcomer Twenty One Capital accumulate, and even states are exploring strategic reserves.

These combined factors could increase BTC to $ 138,500 this year, predicted Mena and converted to about 35% of the rally for the largest crypto.