Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Bitcoin [BTC] 26th June climbed 1.33% in 24 hours to trade for $ 107,842, shaking short -term panic. Deeper metrics, however, painted a more cautious picture.

25 Delta BTC-Míra Sentiment Sentiment-Makes its 1-week reading of a decline from more than 10% to just 2.96%. This reflects reduced panic among traders. Yet not everything is calm.

The three -month and 6 -month chamfer remained negative at -2.6% and -4.3%. This means that medium -term uncertainty has not disappeared.

Remarkably, the volumes of options still prefer the pros and point to a defensive placement among larger players.

Although, although the immediate fear has retreated, the basic sentiment revealed that investors still have to gain full bull trust.

Source: X/Glassnode

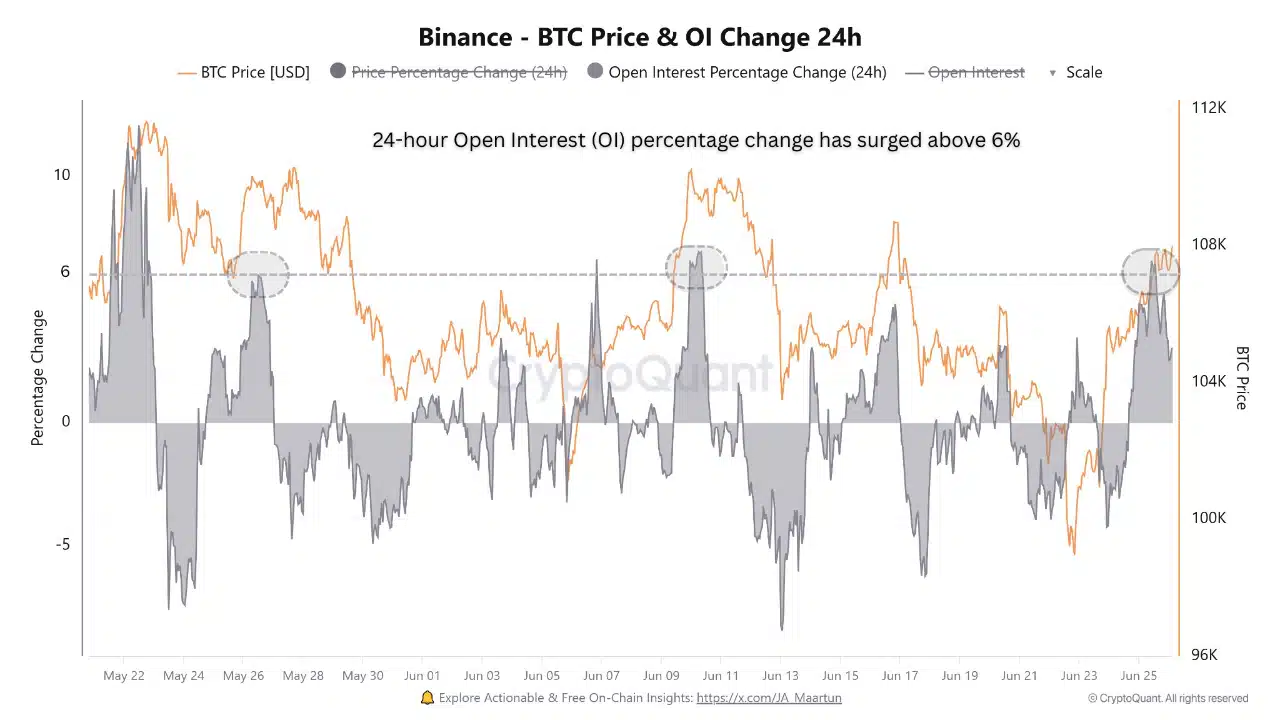

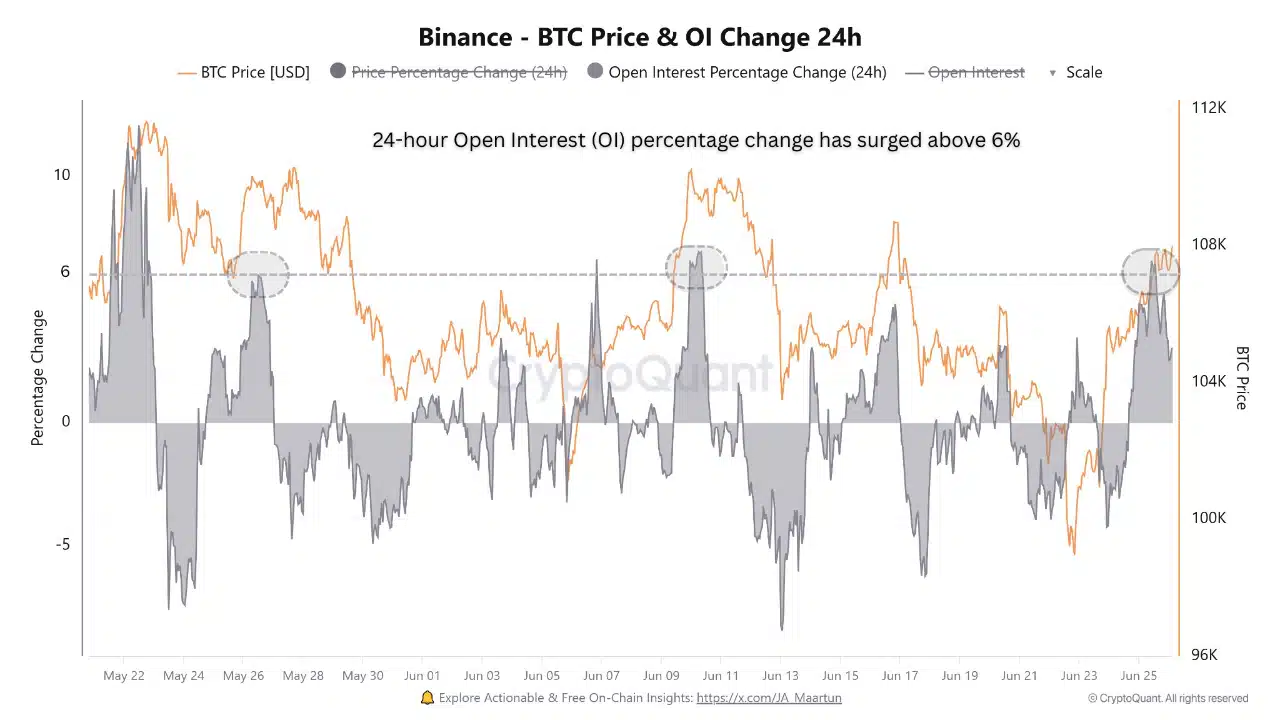

The open interest on binance in two months increased over 6% for the third time and called a remarkable increase in speculative placement. Each of the last tips in May and June was preceded by sales and temporary slowdowns.

This, of course, suggests an increase in speculative stores and overheated short -term environment, although the price of BTC looks stable. In short, the lever effect is back on the rise.

Source: Cryptoquant

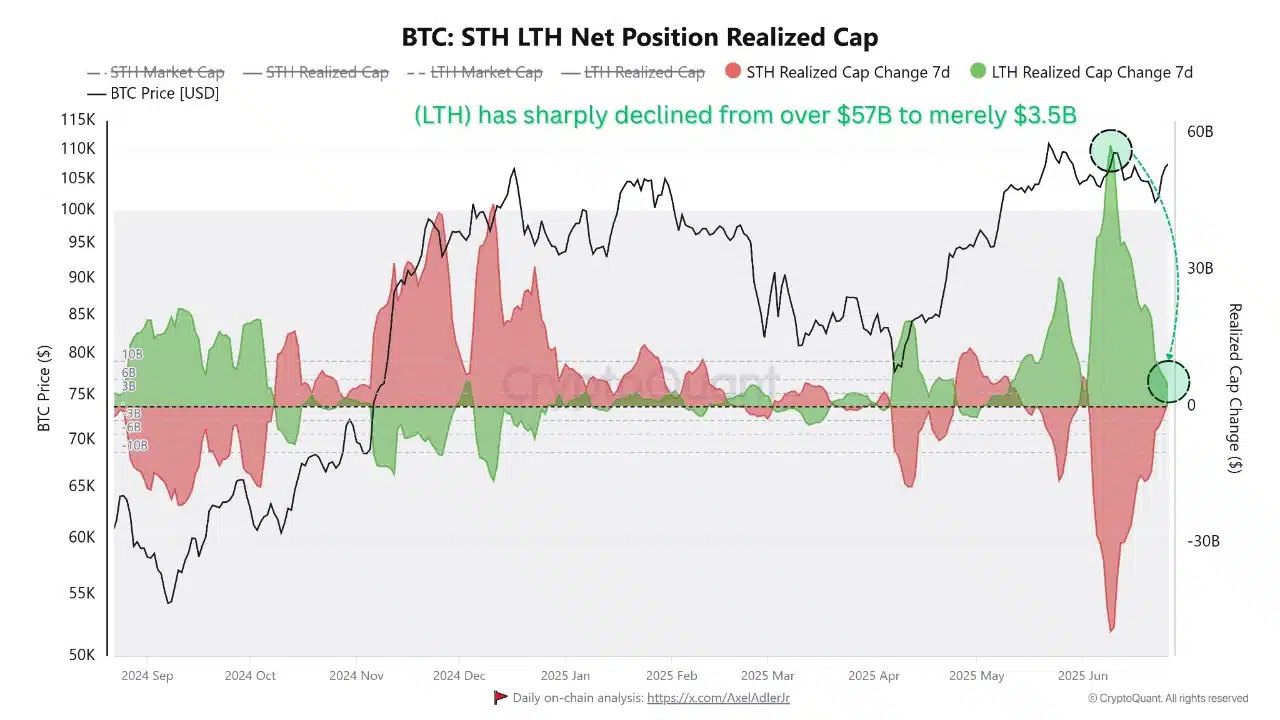

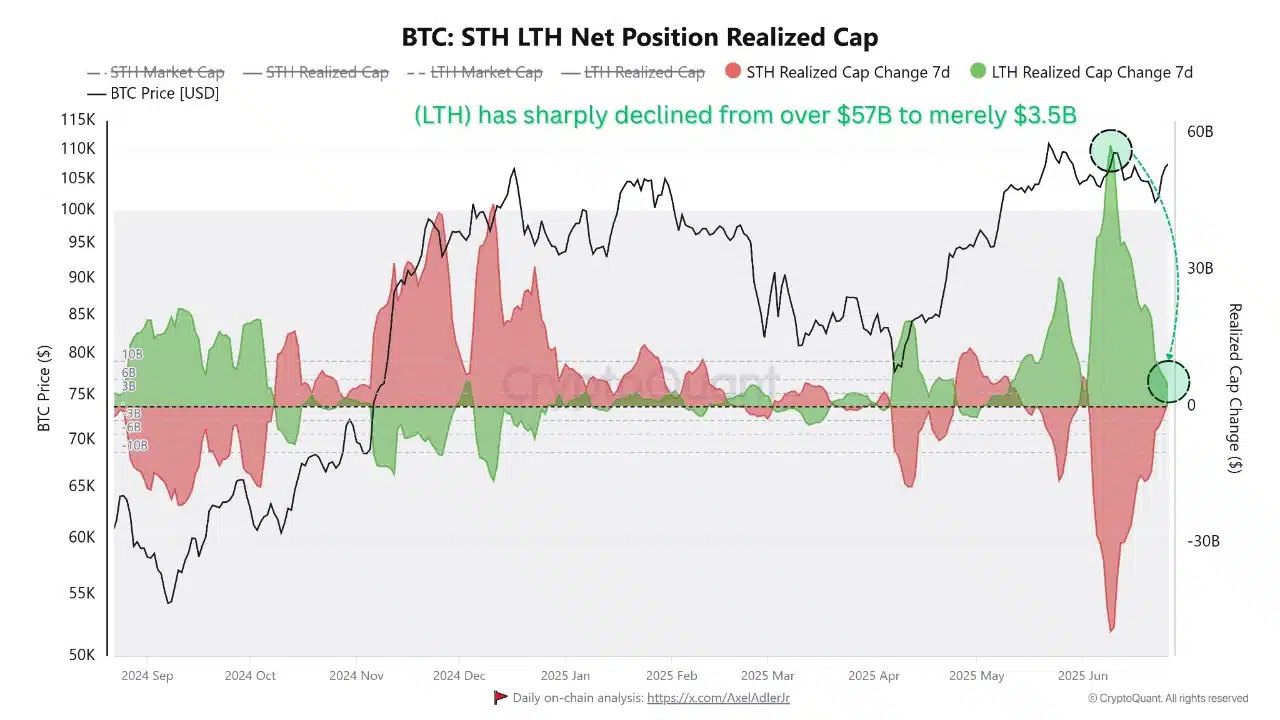

The long -term clean position of the holder has realized the cap from more than $ 57 billion to only $ 3.5 billion, which revealed a lot of profitable obtaining.

This decline has shown that LTH, usually the most market cohort of the market, began to trim the exhibition after significant profits.

Of course, this does not panic. It is more likely that the derizations have been calculated, without the main bear catalyst in sight.

However, such a steep drop still signals recalibrated expectations, perhaps associated with macro uncertainty or fatigue in half.

Source: Cryptoquant

According to Cryptoquant’s bubble graph, the volumes of trading with national exchanges have narrowed. Despite the fact that the BTC floated near ATH, there were no signs of madness.

Most volume bubbles remain neutral to blue and strengthen a healthy environment where prices do not burn with fear or greed.

This stability gives a bitcoin space for consolidation rather than a whip. Instead of overheating, the market could breathe in front of another foot up.

Source: Cryptoquant

The ratio of bitcoins to the flow increased to 387, not to mention the highest in recent months. This metric monitors how many years it would take BTC to benefit from current rates.

Although it is not historically the highest, sharp increase reflects the growing demand versus decreasing supply, which potentially creates pressure up.

However, the timing of such effects often delays. Therefore, even if this Spike strengthens the basic value of BTC, it has not yet guaranteed short -term upside -down without supportive price action.

Source: Single

Although fear has fallen and the market avoids overheating, LTS caution and growing speculation introduce complexity.

The BTC must carefully navigate in this rope – to balance a healthy consolidation with an increasing lever effect – to create the basis for its further major movement.