Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Over the past eight years, Bitcoin [BTC] He recorded a huge shift in his price behavior as the market matures.

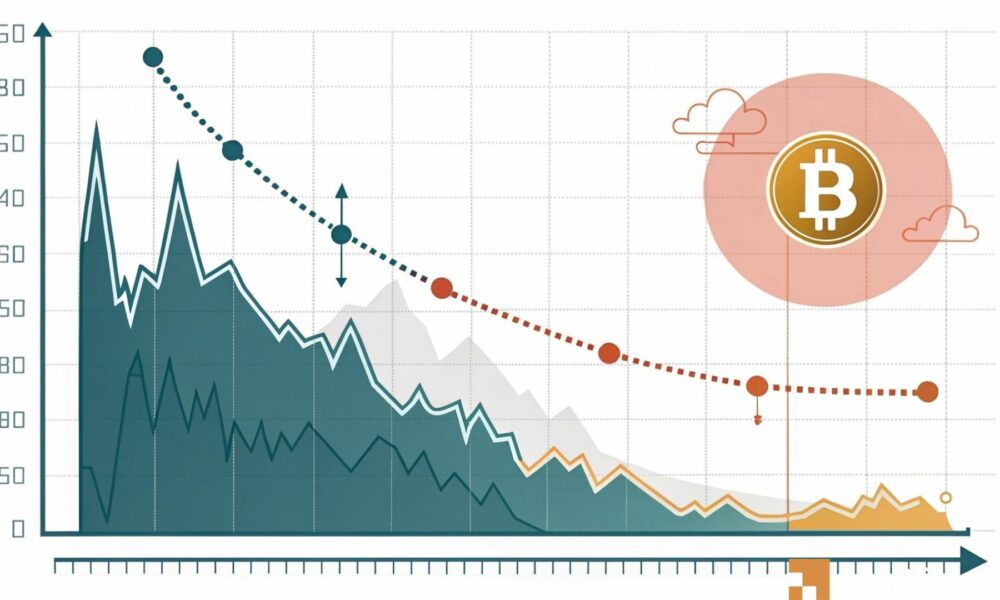

With each cycle, the peak of the BTC created on a lower multiple of its two -year -old simple gliding diameter (2Y SMA), reflecting the reduction of volatility and a more stable market structure.

Looking at the previous cycles, the early Bull Runs of Bitcoins were explosive, while the peaks occurred at 15x 2y SMA by Alphractal.

These explosive rises signaled wild speculative growth, largely driven by a thin market and early adoptive.

Since 2017, however, the market began to change when bitcoins have reached the global market with widespread consciousness. The growth of crypto, albeit stunning, was very subdued.

During this time, about 10x 2y SMA was reached the peak, indicating high volatility in rising maturity.

In 2021, institutional money flooded. Yet the top of the cycle dropped again, first hit 5 times and then turned around 2,65 × 2y SMA.

This meant a structural shift: Bitcoin was no longer just a trade – it became a macro asset.

In the last cycle, Bitcoin failed to overcome 2.65 times a multiple, show narrowing of profits and indicate a more mature asset.

Currently, the level 2y SMA × 2,65 reflects lower volatility, deeper liquidity and mature user base. This level now finds around $ 159,000. If BTC does the main rise, $ 159,000 will act as another key resistance.

As mentioned above, although bitcoins are currently experiencing a decreasing cycle of peaks, there is still more space for growth.

Looking at the Bitcoin Mvrv, it currently rotates around 2.4 and indicates that the market is still under the territory of Euphoria.

Historically, the bitcoin peaks appeared around 3.5 to 4.0. At current levels, there is even more space for growth in front of the top of the cycle.

Nupl (pure unrealized profit/loss) remains in the zone of faith/rejection – not yet in greed or euphoria.

With significant maturity in market behavior, BTC holders are currently unlikely to promote extreme profits because they expect higher prices of the current cycle.

Therefore, although future cycles can no longer experience an increase of 15 times, there is even more space for growth, where bitcoins are more stable, less volatile and reliable as investment.

BTC has more and more space for growth in the prevailing market. If the momentum of the cycle is valid and BTC exceeds $ 110,000, we could see an increase of $ 159,000.

However, it is unlikely in the short term, but since the market does not reach the peak yet, this level can be a place where the markets for the current cycle are cooling.