Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

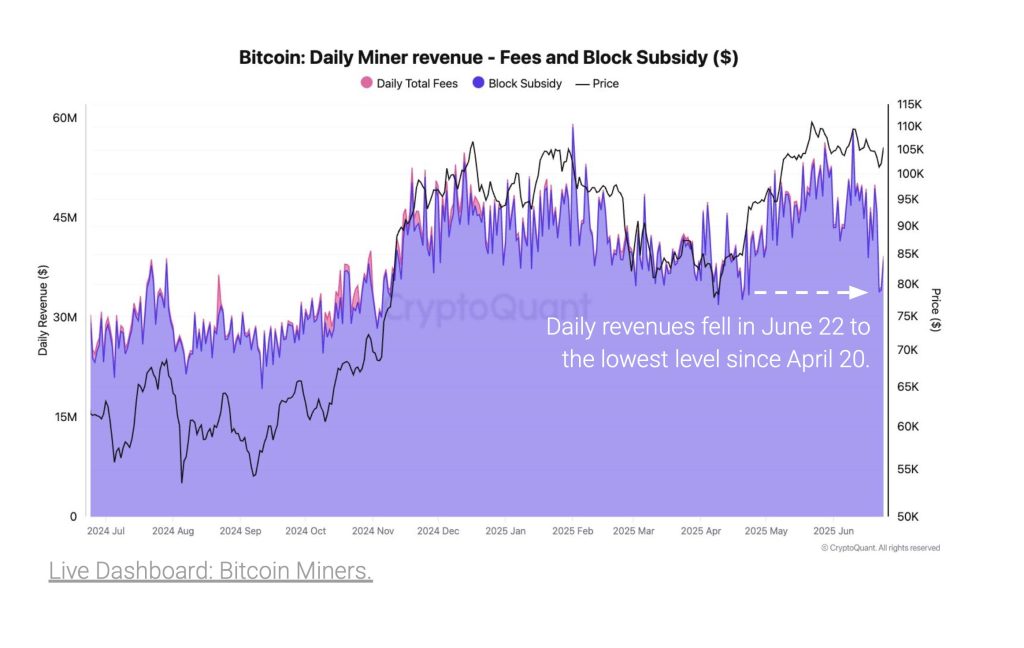

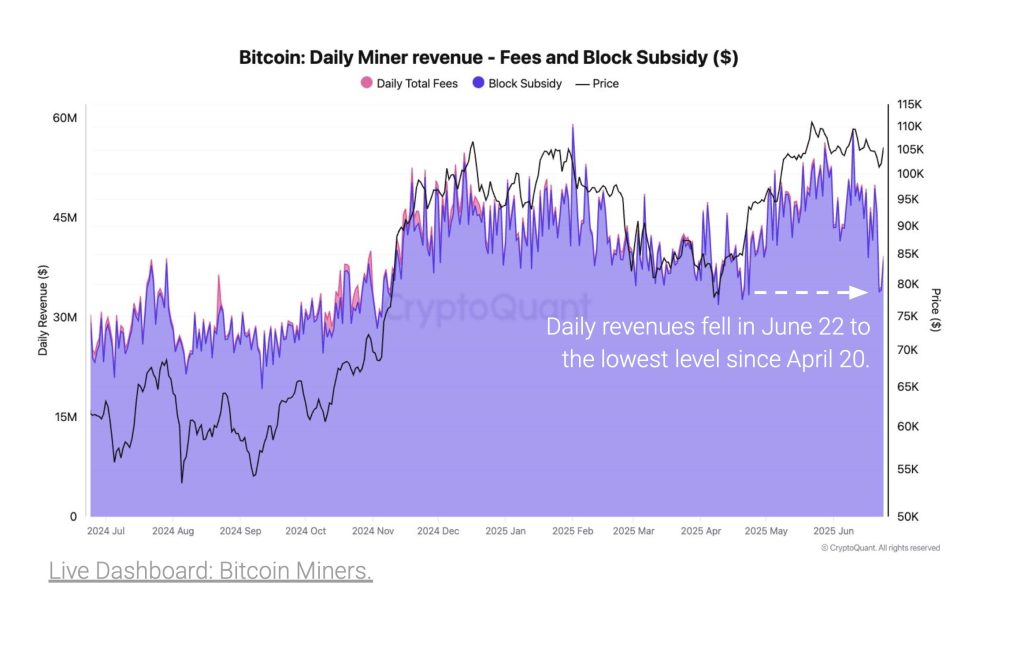

Bitcoin According to analysts on the chain and the market revenue, the revenue of the miner in two months in two months in two months dropped Cryptoquant.

On June 22, daily earnings dropped to $ 34 million, a level that has not been observed from April 20, 2025. The decline is credited mainly by reduced transaction fees and a decline in the Bitcoin market price.

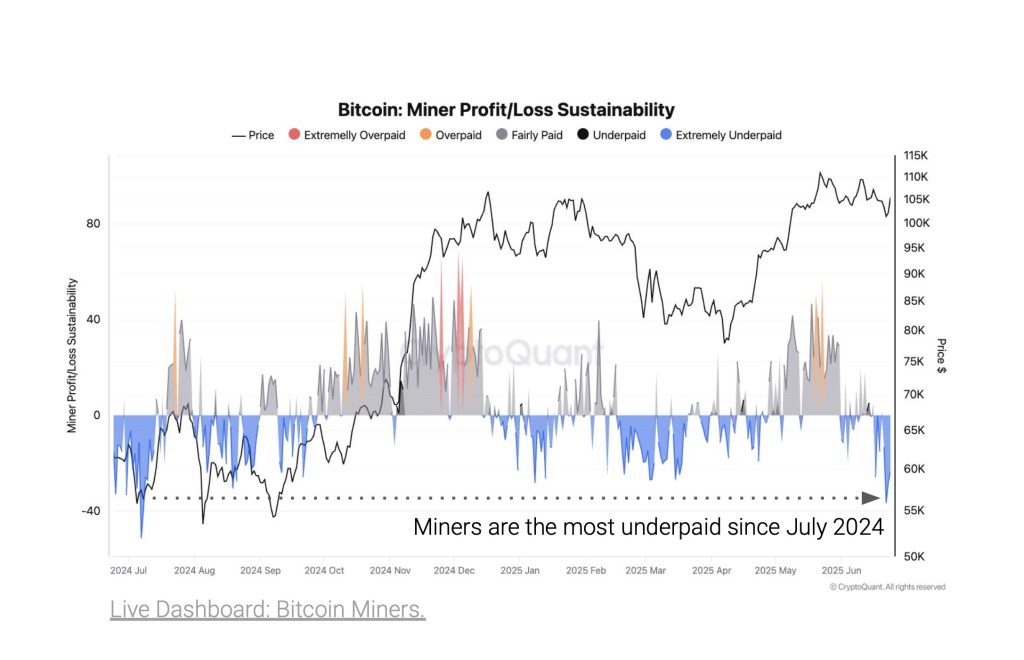

The combination of these factors leads to an environment in which miners experience some of the lowest levels of compensation recorded in the past year. As mentioned in the weekly analysis of Cryptoquant, miners are currently “most insufficiently paid that were last year”.

Despite a decline in income, miners did not respond with increased sales. Cryptoquant states that the outflows of bitcoins from wallets were constantly decreasing and in February fell from the peak of 23,000 BTC per day to approximately 6,000 BTC.

This represents a significant reduction in sales activity, especially due to the recent price volatility. Especially Hashate networks experienced 3.5% of drawing since June 16, which meant the biggest decline in almost a year.

However, this decrease in computing power did not qualify for increased disposal miners. In addition, so-called “satosh-” miners “have only sold only 150 BTCs in 2025 compared to almost 10,000 BTC in 2024.

Cryptoquant analysts also note that instead of sales, miners increase their reserves. Addresses that take place between 100 and 1,000 BTCs have grown combined shares from 61,000 BTC 31. March to 65,000 BTC at the end of June. This is the highest level of reserve accumulation by this group of miners since November 2024.

The stable accumulation trend suggests that most miners must not face immediate financial stress, even in the middle of declining income. Their continuing reserve growth suggests long -term outlook and confidence in future price recovery rather than surrender under current market conditions.

Overall, while the income from Bitcoin’s miners dropped to two months low, there is no evidence of extended sales pressure in response. The Cryptoquant finds the mining sector, which, although insufficiently paid according to recent standards, remains resistant and strategically focused on long -term accumulation.

Contribution Bitcoins revenue hit a two -month low, sales activity remains muted: cryptoquant He appeared for the first time Cryptonews.