Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

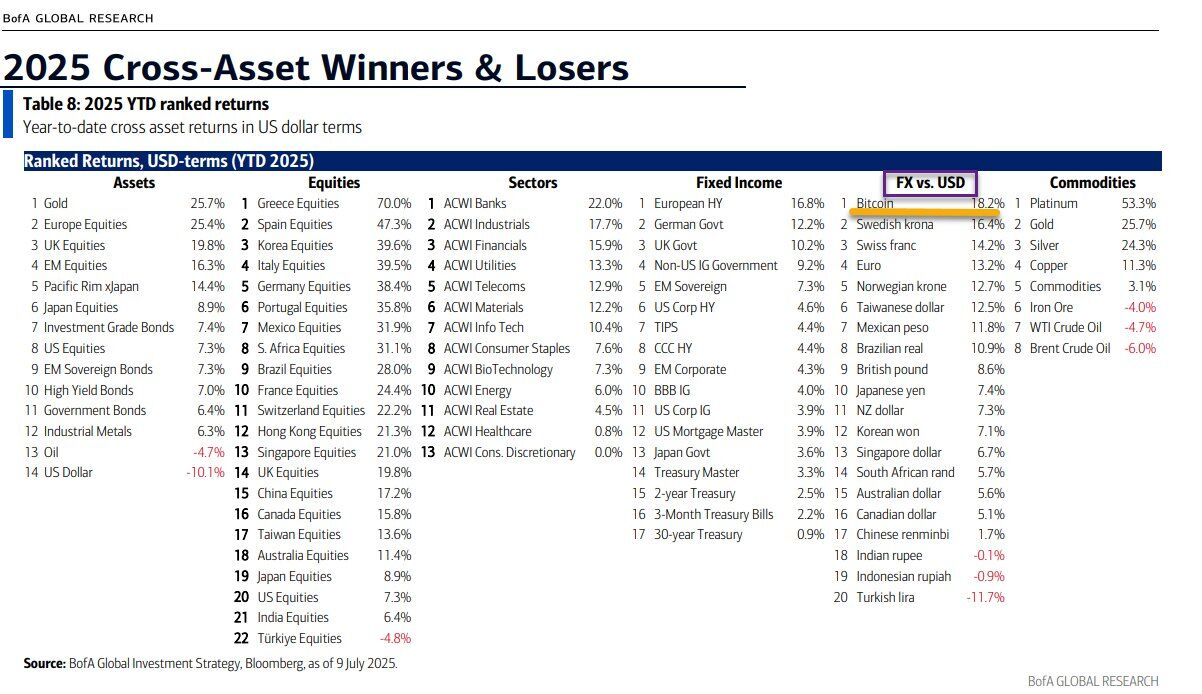

Bank of America officially crowned Bitcoin As the most powerful currency from 2025, the designation of a historical milestone in the path of cryptocurrency to the main financial acceptance, because Wall Street can no longer ignore it.

Report “Banking Giant Giant Giant” $ 1.6 trillion, winners and defeated winners “, released 9 July revealed 18.2% year -on -year profit and definitely overcame traditional currencies in safe, including the Swedish Krona, Swiss Frank and Euro.

Meanwhile, the US dollar fell by 10.1% since January and demanded the last place between 14 assets of assets.

This institutional approval will arrive as Bitcoin climbed to several historical maximums and rose sharply around $ 118,856 In the middle of massive shopping pressure from Spot ETF and corporate treasures.

Bitcoin ETF -based ETF has seen a daily tide over $ 1 billion Two consecutive days, the first since their launch of January 2024.

IBT Blackrock himself attracted $ 953 million on Friday, which helped to push the total assets of ETF over $ 140 billion.

The increase was coincided with President Trump’s Social Media statement that crypto goes “over the roof” Starting massive institutional relocation.

Due to these institutional validations and growing demand, Bitcoin stood up for the continuing parabolic growth towards $ 150,000 and further.

The technical structure of bitcoins reveals convincing evidence of massive institutional accumulation through multiple cups and handle patterns in different time frames.

The weekly chart shows that Bitcoins are completing what could be the largest cup and handle in its history, with the current pattern being made in the range of $ 60,000-110,000.

Previous cup formations in the range of $ 25,000-30,000 and $ 50,000-70,000 led to an explosive escape to $ 70,000 and $ 100,000.

The Golden Versus Bitcoins comparative chart reveals similarities in samples of institutional accumulation.

The Gold extended side is traded around $ 2,100 created a cup -shaped storage zones before it falls apart into a rally reaching $ 354, which is 60% increase.

Bitcoin currently reflects this exact formula, after testing and repeated resistance around $ 106,500 before breaking over $ 118,000.

The methodological nature of this accumulation indirectly suggests that institutional players are gradually building positions without disrupting market movement.

Data Exchange Reserve also provides a major confirmation of the price of drive shocks.

Bitcoins held on the stock exchanges dramatically dropped from 3.25 million to 2.55 million BTC and removed nearly 700,000 BTC from easily available trading reserves.

This represents 3.3% of Bitcoin circulation supplies that are withdrawing for long -term storage.

The trajectory suggests that reserves could be reduced to 2.0 to 2.2 million BTC and will reach the lowest level since the beginning of 2018.

RSI climbing at 73.56 indicates the conditions of reunion similar to at the end of May, when Bitcoin stopped almost $ 110,000.

However, institutional accumulation creates a different market dynamics than a retail assembly.

The persistent shopping pressure from ETF, corporate treasures and sovereign entities suggests that any pullbacks to $ 110,000-111,000 would be rapidly absorbed to create drained pads for movements towards $ 120,000-125,000.

The complete cycle of bitcoins shows a cryptocurrency in the wave of 5 larger supercycle -powered institutional and sovereign adoption rather than retail speculation.

Unlike the previous waves driven by half and retail FOMO, the current phase includes models of strategic allocations from at least 20 years of decreases.

This basic shift creates persistent demand formulas that could maintain higher prices for a longer period of time.

Annotation of a reference country’s reference country potentially using bitcoins to deal with state debt, indicating sovereign rich funds and central banks entering the market.

They represent the largest capital funds around the world and their participation would drew previous institutional adoption waves.

Polymarket courses now propose Almost 80% probability that bitcoins will reach $ 120,000 at the end of the month, with 92% probability of affecting this level before the end of the year.

In particular, President Trump’s proposal for a historical reduction in interest rates by 300 basic points creates ideal conditions for the continuing output of Bitcoins.

Massive cash expansion would cause a massive rejection of the dollar when driving institutional money to Nesideign asset.

Historical analysis projects dramatic inflation of asset price, while the weakness in the dollar is Bitcoin located as the primary recipient of the depreciation of the ongoing currency.

These political tails and accelerating institutional acceptance indicate that bitcoin could achieve 150 000 $–$ 200,000 How the traditional level of resistance becomes irrelevant in the pure price discovery mode.

As Bitcoin reaches new heights, restrictions about transactions and fees are increasingly obvious to investors who are trying to maximize the usefulness of their shares.

BTC hyper It appears as a convincing solution that offers a platform of 2 layer scaling built on a solan virtual machine, which makes Bitcoin transactions instant and cost -effective, and at the same time unlocking defiic opportunities for previously inaccessible BTC holders.

The $ Hyper Token has already received over $ 2.5 million and offered early investors with high APY and received rewards before the Mainnet Q3/Q4 2025.

Unlike traditional bitcoin investments that remain static, BTC hyper allows users to bridge their BTC Holdings and access to Defi platforms, NFT marketplaces and DAPPS.

The wrapped bitcoin function allows trouble -free movement between the Bitcoin Mainnet and the Hyper Network without the KyC requirements on the basic functions.

With the planned Mainnet deployment at the end of 2025, BTC Hyper will be perfect for a bitcoin institutional adoptive wave.

Soon adoptive can buy $ Hyper Tokens Using ETH, USDT or BNB through platforms such as the best wallet, with the main exchanges planned by running after the mainnet.

Contribution Bitcoin prize prediction: Bank of America names BTC the best currency – does institutional accumulation accelerate? He appeared for the first time Cryptonews.