Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Bitcoin floats nearly $ 102,230, but there is a powerful shift in ownership for price action. Corporations appeared as the most aggressive buyers in 2025, overtaking ETF, retail investors and miners.

According to the recent message According to River Financial, 157,000 BTC added to their balance sheet this year – which corresponds to $ 16 billion.

Michael Saylor’s strategy (formerly Microsthega) remains a dominant player who represents more than 75% of this year’s net accumulation. But appetite is not limited to technical visionaries. Companies across sectors-finance, counseling, health care and even non-profit organizations-buy.

Almost 36% of corporate bitcoins came from financial companies, followed by 17% of the technique and 16.5% of the consulting groups.

Since only 450 BTC is mined daily after positioning, this aggressive demand creates pressing the textbook.

Metaplanet is recent Purchase 1 241 BTC He moved his reserves around the National Hash of Salvador and emphasized how quickly the crowd of companies moves. In Q1, twelve publicly traded companies launched BTC purchases, including Rumble, which revealed its shares in March.

According to CEO Cryptoquant Ki Young Ju, the mass behavior of the strategy could shift the annual growth of bitcoins offer to negative territory -to create an effect of -2.3% “synthetic deflation”. Author Adam Livingston reflects that sentiment warns that a stronger float combined with a growing institutional interest can cause bumpers upstairs.

Some analysts with a smaller number of circulating coins and larger balance sheet bitcoins claim that a $ 120,000 climb could be powered by a limitation on the offer of the offer than traditional retail speculation.

Prediction of bitcoin price It remains mixed because while the macro trend supports long -term bulls, short -term graphs tell a different story. Bitcoin recently rejected the 50 -hour EMA at $ 103,017 and $ 23.6% of Fibonacci to $ 103,364.

Since then, the price has decreased back to the support zone of $ 101,924 (38.2% FIB), after a collapse from 7 May ascending trends.

Key bear signals:

A decisive step above $ 103,400 could invalidate the bear structure. Until then, traders should track disorders below $ 101,900, with targets of $ 100,760 and $ 99,596.

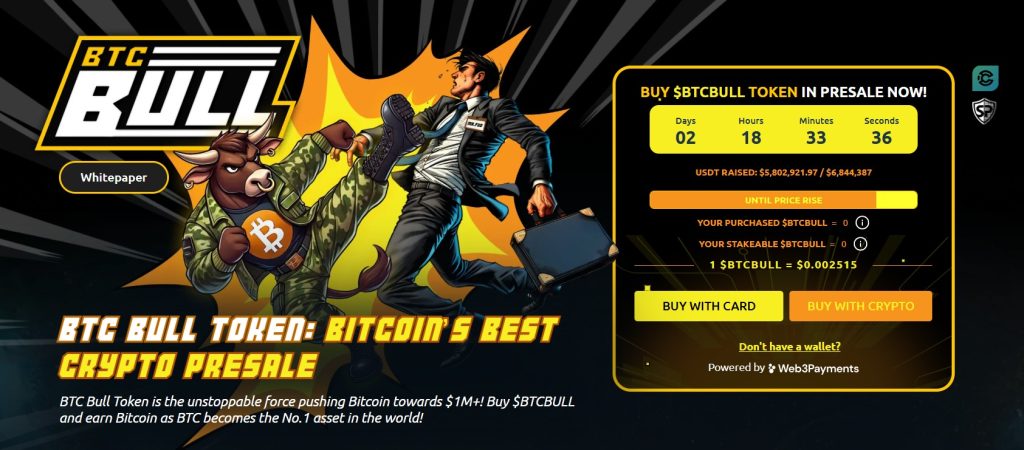

As Bitcoin stabilizes above $ 102,000, the focus of investors moves towards the yield altcoinam -o nothing more than BTC Bull Token ($ btcbull). Token has now increased $ 5.80 million from its 6.84 million USD, with the price increased when it entered its final section of the financing.

What distinguishes BTCBull is its flexible betting model, which offers an estimated 71% annual return without locking or sanctions for download.

This approach gives freedom to earn passive income while maintaining full liquidity – an attractive alternative to traditional defi protocols.

Key statistics:

Btcbull It combines a viral attraction of the meme tokens with the usefulness of defi in the real world, making it a choice for those who want to earn a crypt of 2025.

Since there are less than $ 1 million before the next price level, it is limited to entering current levels – it raises the urgency between retail investors looking for early access to passive income.

Contribution Prediction Bitcoin Price: May BTC reach $ 120,000 because corporate possession has reached $ 16 billion He appeared for the first time Cryptonews.