Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

This week, Bitcoins (BTC/USD) increased to $ 108,182, which briefly violated the key level of resistance, which now has the potential to cause a new wool of bull momentum.

Currently, BTC is traded around $ 107,300, cryptocurrency in just three days increases by almost 10%, which is powered by a combination of short disposal, technical escapes and release of geopolitical tension in the Middle East.

Traders widely expected to step around $ 108,000. The level represented a significant zone of liquidity and its violations forced aggressive short positions to rest.

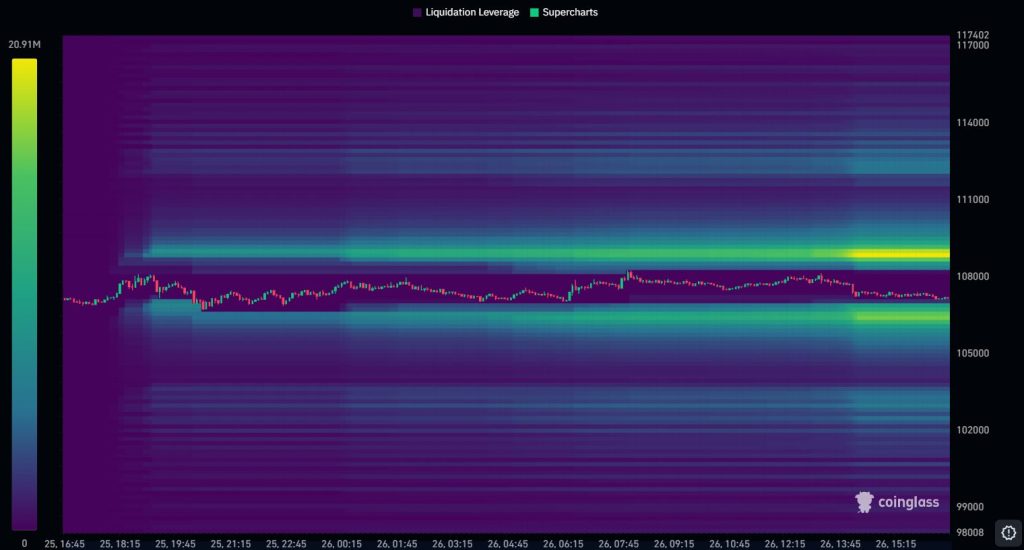

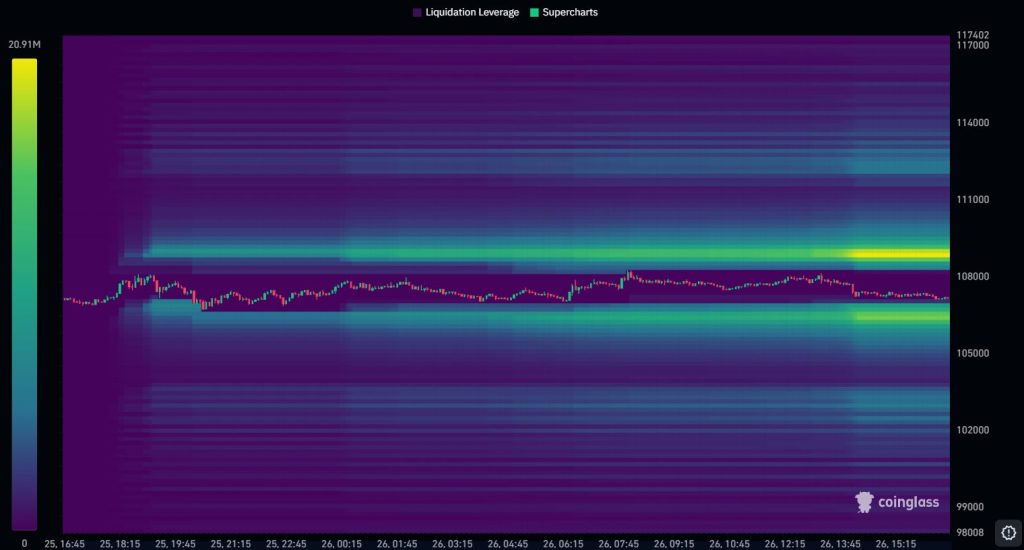

Data from Coinglass It confirms that this rally has absorbed a large part of a short interest with a high development based on recent prices and effectively cleaned the path for potential tearing towards a higher level of resistance.

Popular analysts, for example Matthew HylandDescribe the current environment as “bulls under control”, while others, like the Titan of Crypto, emphasize the recent escape to Ichimok cloud and signal additional potential upwards.

Technical models now indicate $ 110,448 and $ 111,944, because potential goals upside down if BTC can maintain its traction above $ 108,251.

From the perspective of mapping, Prediction of bitcoin price It seems that after the BTC it has recently created a three -bar bull pattern, similar to the modified setting of “three white soldiers”, indicating a strong buyer’s commitment.

However, the price event stops just below the long -term descending trend of the line, indicating that $ 108,251 remains a critical infection point.

If BTC closes above $ 108,251 with a high volume, we could move a quick move to $ 11,000. If not, we could see a short-term move to $ 105,000-103,900.

The tension in the Middle East has relaxed, but the geopolitical risk remains. The market sentiment has moved back to Eastern Europe as the tension between NATO and Russia increases. According to QCP Capital, risk bonuses for global assets develop from short -term secure to the long -term assumption.

S&P 500 and Nasdaq have experienced a slight reflection, temporary peace, but macroeconomic uncertainty remains the headwind. For BTC, any increase in global volatility, especially from traditional markets, could bring the flows safe to the crypto.

However, the BTC structure remains bull. With a chain indicating lower realized profits and technical indicators that indicate a continuation, the path to the new highest maximums remains open if $ 108,000 pays.

Conclusion: BTC is at the intersection. Near over $ 108,251, it could signal a quick move to $ 11,000 and then. If not, we could see a pullback for key support zones. Traders follow – this level will define the next step.

With Bitcoins trading nearly $ 105,000 with the focus of investors moves towards BTC Bull Token ($ btcbull)A growing altcoin, which is almost fully assigned during its pre -sale. To date, this project has increased $ 7,438,492.88 from its goal of $ 8,397,441, leaving below $ 1 million before it increases before the price of the token moves to the next level.

Currently, at the price of $ 0.00258, early buyers have a limited time to enter before the subsequent increase in the price is reflected.

BTCBULL combines its value directly to the price of bitcoins through two intelligent systems:

This download model appeals to veterans Defi and newcomers looking for hands-off income. When only the remaining hours remains and the hard cap almost reached, the momentum is built quickly. BtcbullA mix of bitcoin value, lack of mechanics and flexible betting promotes strong demand. Soon buyers have a limited time to entry before the next price level is activated.

Contribution Prediction of Bitcoin Price-If Bitcoin breaks this level, expect a quick move to the new historic maxima He appeared for the first time Cryptonews.