Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Bitcoin is traded just below $ 109,000 after $ 29.74% of the second quarter, its strongest Q2 since 2020.

American Senator Cynthia Lummis recently introduced A comprehensive account aimed at modernizing how crypto is taxed. Key functions include the exemption of transactions below $ 300 from capital revenue tax (limited to $ 5,000 per year) and delay in mining taxation or remuneration until they are sold.

The proposal also outlines tax relief for lending and charity gifts, and allows cryptomy traders to be involved in the market, with digital assets to compare with traditional securities.

The bill of $ 600 million from 2025 to 2034 is expected to become a law in the middle routine financing.

Institutional demand continues to support Bitcoin Bulls Dynamics. According to SOSVALUE, US Spot BTC ETF attracted 769.6 million dollars this week, which meant four direct weeks of clean positive flows. This consistency suggests that institutional investors build positions with a long -term view.

On the side of Microstrategy, it has expanded its shares by acquiring 4,980 BTC, thus increasing its overall stash to 597 325 BTC. The Japanese metaplanet added 1 005 BTC and the Blockchain Group bought 60 BTC – condemned the BTC’s beliefs in BTC as a treasury asset.

Geoffrey’s Standard Chartered Geoffrey has increased its prognosis at the end of the year to $ 200,000 to speed up the demand and improve macroeconomic conditions. His basic case for the end of 2025 remains $ 135,000, which strengthens the structurally bull outlook.

Key institutional activity:

Prediction of bitcoin price remains bull, like AsseT is above the key upward trend line drawn from a minimum of June 20 and continues to respect almost $ 108,000 support. Momentum, however, after refusal to $ 110,413.

MACD has changed to a 2 -hour chart, suggesting that short consolidation or pullback may follow. The key levels of the disadvantage include $ 108,000 and $ 107,325, while the resistance remains at $ 110,413 and $ 112,041.

Setting the technical store:

Until bitcoins fall below $ 108,000, the bull trend remains intact. Traders can seek reflection from support to re -entry into positions, especially because the subtitles of politicians and institutional activities maintain an increased sentiment.

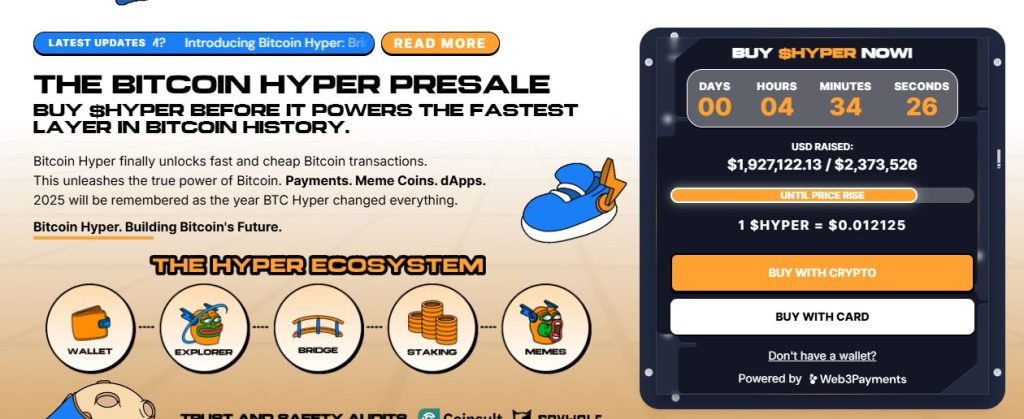

Bitcoin Hyper ($ Hyper)The first Bitcoin native 2 -powered by the Solana (SVM) virtual machine, exceeded $ 1.74 million in its public pre -platform, with $ 1,922,227 being raised from the target of $ 2,373,526. Token is the price of $0.012125with the next price expected in a few hours.

Bitcoin Hyper, designed to combine the security of bitcoins with the velocity of the Solana, allows fast, cheap intelligent contracts, DAPPS and MEME coins, all with a trouble -free BTC bridging. The project is audited by Consult and created for scalability, trust and simplicity.

The Golden Cross Meme attraction and real usefulness caused the Bitcoin hyper a candidate for layer 2.

Contribution Prediction of Bitcoin Price-Senator Lummis Pushes Tax Expenditure BTC: Is this the first step towards mass adoption? He appeared for the first time Cryptonews.