Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Bitcoin slipped to $ 108,035 after unexpected movement of more than 80,000 BTC, which has been inactive since 2011. Coins that were obtained initially when BTC traded under $ 1 were transferred 4 July in two major transactions, increasing concerns about potential statements at almost record prices.

That was shift Sleeping bitcoin in more than ten years.

While no direct transfer to centralized exchanges was found, a typical sales signal was issued; However, the extent of the draft caused the ripple on the market. The traders were afraid that such a massive hiding in circulation could cause correction.

In response, long positions were unfolded, shorts accumulated around the level of resistance of $ 110,000 and the price in a few hours slipped by almost 2%.

Despite the initial shock, the fact that the BTC has not been sent to stock exchanges suggests more reorganization of the inner wallet rather than a coordinated sale.

However, this event emphasized the sensitivity of sentiment, especially when bitcoins move near key zones of psychological and technical resistant zones.

While the short -term sentiment cooled, the longer -term bulls found encouragement in macro comments from the main economist of SUI Hong Hao. Hong, who spoke to Phoenix Finance, assumed that Bitcoin could hit fresh maximum by the end of 2025, powered by strong global liquidity and pigeon money policies.

Hong stressed that bitcoins remain highly responding to changes in liquidity as central banks, which are likely to release financial conditions by 2025, will benefit the risk of BTC. He also pointed to improved sentiment in US stocks, suggesting that he could return a wider risk of appetite.

For the time being, analysts say that this dual narrative-a time-long caution vs. Long-term optimism-likes to maintain BTC consolidation because markets spend the consequences of the sleeping activity of coins.

Technical, Bitcoin After not breaking over $ 110,413, support is held at $ 108,035. The price event in a two-hour chart shows consolidation above the key upward trend line and just below the 50-year EMA ($ 108,250). Bear divergence in the MacD histogram indicates the weakening momentum upwards.

If BTC does not fall below $ 107,325, the structure remains intact. Reflection from the current zone could re -enter business dynamics.

Setup Settings:

For a Prediction of bitcoin priceThe next 48 hours will be essential because the break under the trend support would cancel the uptrend. However, if the level of $ 108,000 pays, it remains a classic “Buy-the-Dip” scenario in structurally bull setting.

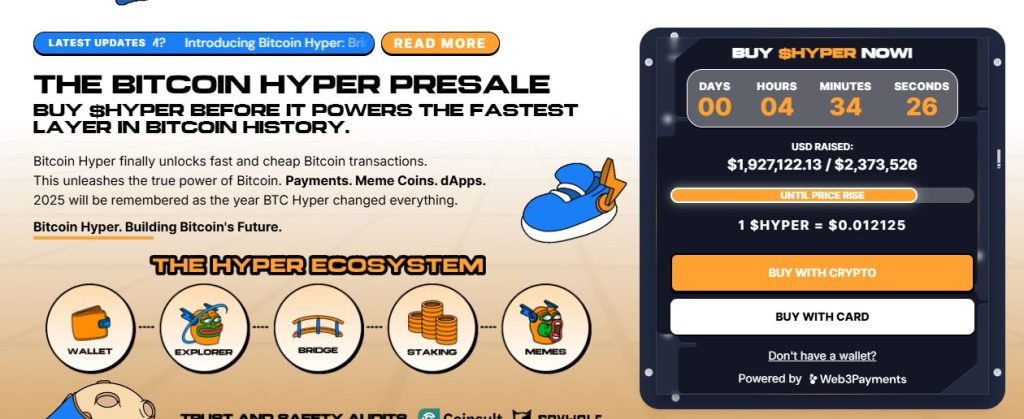

Bitcoin Hyper ($ Hyper)The first Bitcoin native 2 driven by the Solana virtual machine (SVM), exceeded $ 1.90 million in its public pre -platform, with $ 1,922,122 being increased from the target of $ 2,373,526. The token is a price of $ 0.012125, with additional levels expected within hours.

Bitcoin Hyper, designed to combine the security of bitcoins with the velocity of the Solana, allows fast, cheap intelligent contracts, DAPPS and MEME coins, all with a trouble -free BTC bridging. The project is audited by Consult and created for scalability, trust and simplicity.

The Golden Cross Meme attraction and real usefulness caused Bitcoin Hyper a candidate for layer 2.

Contribution Bitcoin prize prediction: Saying Satoshi after 80,000 BTC Move – Sentiment’s Sentiment? He appeared for the first time Cryptonews.