Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Bitcoins

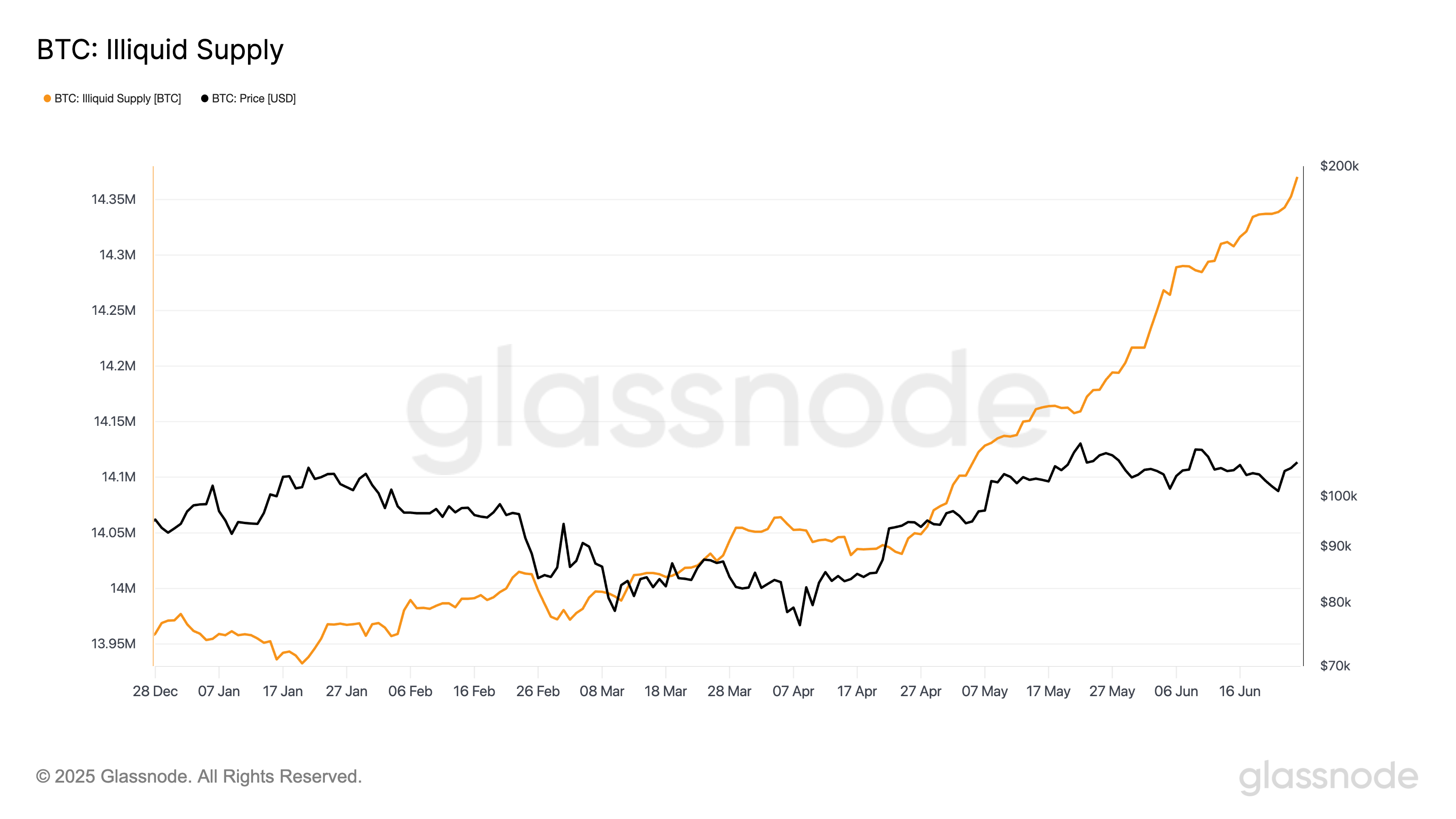

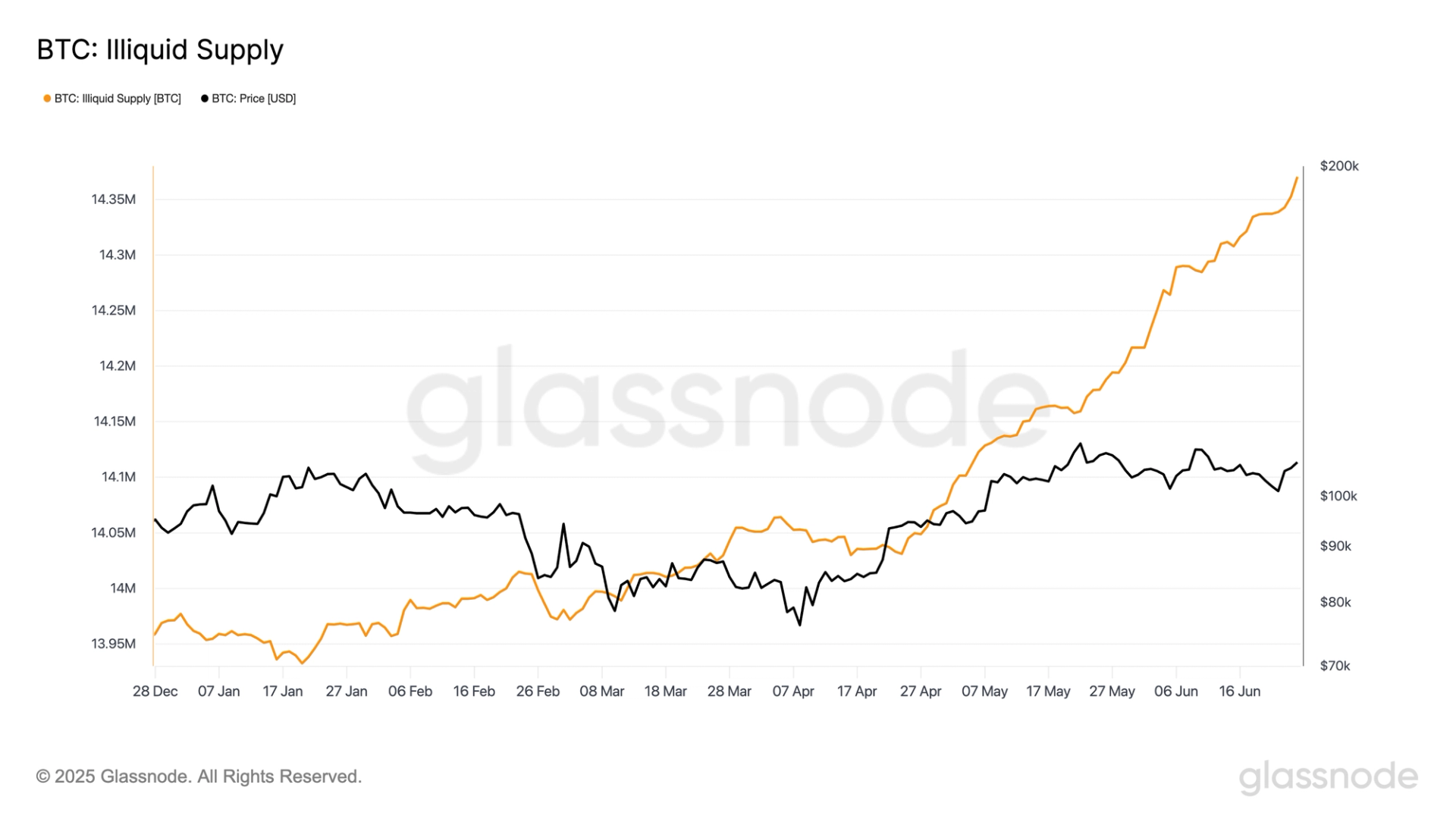

Illiquid the offer increased to 14.37 million BTC, according to Glassnode data from 13.9 million BTC at the beginning of 2025.

Given that the current circulating offer of bitcoins costs approximately 19.8 million, it means that more than 72 percent of all mined BTCs are now classified as unfamiliar.

Illiquid Supply concerns part of the BTC held by entities with minimal expenditure behavior, such as long -term investors and cold wallets holders. These coins are effectively excluded from the market and reduce the available amount for trading.

Since more investors decide to store bitcoins than to trade, the liquid part of the offer is shrinking and tightening the availability of the market.

This trend is significant because the growing illicit offer often reflects the growing trust of investors and long -term beliefs. It also creates the potential for shock on the supply side, where growing demand meets a limited supply, historically associated with bull prices.

The ongoing increase in bitcoins’ illicacy supports the narration of bitcoins as a storage of value. If this trajectory was true, it could exert pressure on the price, especially in connection with increased market interest and mining reduction.

This underlines the analysis of liquidity as a key indicator of sentiment on the market and future price action.