Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

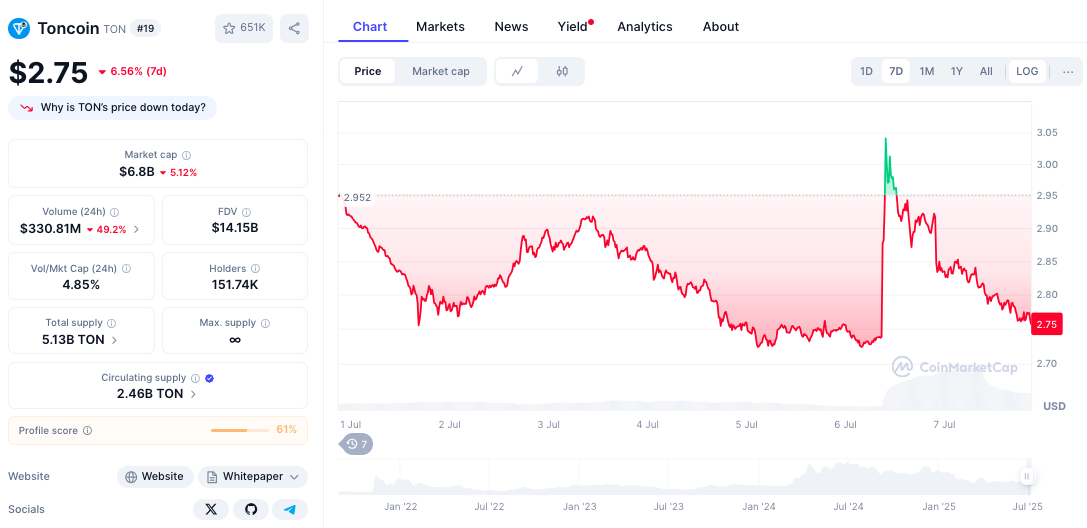

Processed AI CHATGPT 42 Live indicators, revealing Bear analysis when toncoin plunged 2.36% on 2.771 $ After the refusal of the Golden Visa claims the government of the UAE, which He exposed a crisis of credibility of the TON Foundation.

TONE He is currently traded under all the main EMAS, while the volume decreases 48.25% on $ 332.73 million How the Fallout scandal speeds up an institutional departure.

Strong sales pressure occurs when the price drops below 20 -day Ema (2.866 $), 50 -day Ema (2.981 $), 100 -day Ema (3,179 $) a 200 -day Ema (3,701 $), with misleading marketing claims that cause regulatory control. The market hat will collapse $ 6.84 billion, down 4.67%with critical support on 2,70-2,75 $ Zone determining views of survival.

The following analysis synthesizes the Chatgpt 42 Real -time technical indicators, development related to the gold scandal of visa, regulatory consequences and damage to credibility for assessment TON 90 -day Trajectory in the middle of the crisis of responsibility for the leaders and destroying the ecosystem reputation.

Current Toncoin price 2.771 $ reflects on 2.36% Daily drop from its opening price $ 2.838, which determine the disturbing business scope between 2.856 $ (high) and 2.751 $ (low).

This 0.105 $ Intraday Spread shows accelerating volatility because scandalous fallout intensifies institutional sales pressure.

Rsi and 42.02 The territory is proceeded without reaching extreme levels, indicating balanced momentum despite significant basic damage. This location suggests that TON remains prone to further decline, as the credibility crisis deepens and regulatory control increases.

MACD indicators appear on the sign with the MacD line on 0.001 Trading near zero, indicating rapidly deteriorating dynamics.

Negative histogram on -0,067 It denotes significant bearish acceleration requiring careful monitoring for complete division scenarios.

The false claims of the TON Foundation on the UAE Gold Visa for TON Stakers represent a disastrous failure of credibility that revealed major management problems.

Notification of CEO Max Crown to Ton moving would ensure the UAE Golden visa induced by an immediate government denial and regulatory investigation.

The UAE authorities have publicly rejected the claims and explained that TON lacks proper licensing and visa programs that require traditional investments, not speculation of cryptocurrency.

Communities leaders, including hipo finance, convicted misleading communications as “unacceptable” and demanded responsibility in the management.

The scandal reveals an incompetent DUE diligence or intentional market manipulation, which permanently undermines the institutional credibility of Ton.

The Vara, ADGM and SCA regulators have confirmed that betting is a regulated activity that requires proper licensing that the TON foundation lacks.

This regulatory clarity exposes a ton of potential coercive measures and operational restrictions on key markets in the Middle East.

Although Ton Foundation has explained that the Digital Residency initiative is an independent project Without official support of the UAE government.

Ton’s 2025 Power has shown a catastrophic deterioration after a strong closure of January $ 4,83.

Subsequent correction for February $ 3,33a short torch recovery on $ 4.11and continued to decline until June 2.91 $ To determine the Swterint formulas.

The current price event represents a and 43% a decline from January maximum, even if it keeps 609% profits from 2021 Lows provides a long -term perspective.

The Golden Visa scandal deteriorates the existing technical weaknesses that have been determined in the months of institutional pressure.

Immediate support appears on today’s low surroundings 2.751 $reinforced by a zone of critical support on 2,700 $ -2,750 $.

This confluence is the most important technical level for determining the ability to recover from the crisis of credibility and prevent complete collapse.

The main support zones are expanding to 2.600 $ -2.650 $, representing the historical level of accumulation, followed by a strong support to 2.400 $ -2,500 $ corresponding to previous minimals of the cycle.

These levels provide a potential foundation during extended correction scenarios if institutional trust is stabilized.

Resistance begins immediately at 20 -day Ema 2.866 $representing an impressive obstacle for any recovery attempts.

A more significant cluster of resistance lies between 50 -day Ema (2.981 $) a 100 -day Ema (3,179 $), creating a demanding overhead offer that reflects basic damage.

Ton keeps and 6.84 billion USD Market capitalization of decreasing 24 hours Volume of trading $ 330.81 millionrepresentative 49.2% decrease.

The volume cap ratio to the market 4.85% It denotes an institutional withdrawal rather than in an accumulation opportunity.

The dramatic decrease in the volume from previous levels confirms institutional positioning is shifted from the tonne during the scandalous fallout and verifies the technical analysis that indicates the ongoing weakness.

Current prices represent a 66% Discount on all higher maxima achieved in 2024;; However, comparisons with recent maximum shows a 43% decline from January 2025 peaks.

The community sentiment reveals a deep division among the participants of the ecosystem, some of which publicly condemn misleading marketing practices of the TON Foundation.

Critichissitissishesystem Finance, indicating the golden visa, claims that “unacceptable” shows fractures of the inner community that exceeds typical concerns about price volatility.

Social media analysis reveals approximately 60% negative sentiment with a focus on responsibility for managing things than on technical analysis, which is a basic shift from typical cryptocurrency discourse.

The scandal has usually unified competing community votes in the required transparency and responsibility of management.

The erosion of the developers’ trust will manifest itself through reduced ecosystem involvement and partnership announcements because the scandal creates uncertainty about the strategic direction of the TON Foundation and the ability to adhere to the regulations.

Successful management changes and transparent management reforms could lead to recovery $ 3,20-3,50representing 15-26% upside down.

This scenario requires the immediate responsibility of the CEO, improving compliance with the regulations and the restoration of community confidence through demonstrable changes in public affairs.

Technical objectives include 2.98 $, $ 3,18and $ 3.50 Based on the regenerative formulas of EMA and the level of historical resistance.

The technical capabilities of the ecosystem could attract a renewed institutional interest if driving problems are solved in a comprehensive way.

Continuing denial of the line and regulatory control could lead to tunne 2,40-2,60 $representing 6-13% disadvantage.

This scenario assumes persistent management problems and failure to comply with fundamental credibility during the summer consolidation periods.

Support for 2,70-2,75 $ would probably fail during the prolonged crisis, with the volume remaining at the end of 200-300 million daily.

This action reflects permanent damage to the reputation requiring an extended recovery period.

Serious regulatory measures or complete failure management could cause repair towards 2.00-2.30 $representing and 17-28% disadvantage.

This scenario would require additional regulatory enforcement or continuing failure to manage things against the current scandal.

Strong technical foundation and ecosystem utility limit of extreme scenario disadvantages, with great support on 2.40-2.50 $ Providing critical long -term trend support for potential future recovery under new leadership.

Ton’s current positioning reflects the convergence of public management failures, regulatory control and acceleration of technical collapse.

The 42-Signal The analysis reveals a cryptocurrency placed at a critical intersection between the recovery of responsibility and a complete collapse of credibility.

The Golden Visa scandal reveals fundamental management problems that require immediate improvement for management and transparency, while technical disorders under all EMA confirm the erosion of institutional trust.

The decrease in volume confirms the withdrawal of professional investors during the credibility crisis.

Current consolidation around 2.77 $ with critical support on 2,70-2,75 $ It creates a decision point for prospects for the survival of Ton.

Contribution Analysis of 42-signal tons of chatgpta flags critical collapse of $ 2.70 after the scandal of Sae Golden Visa scandal He appeared for the first time Cryptonews.