Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

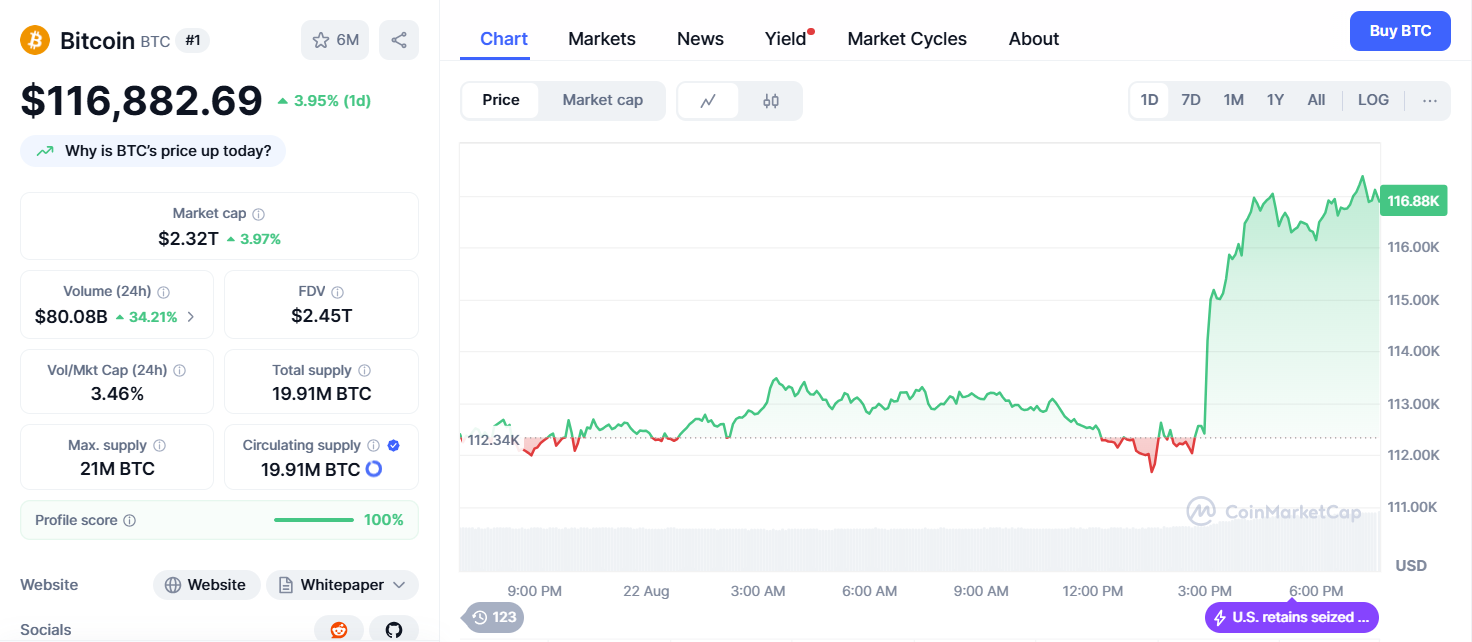

Chatgpt Bitcoin Analysis reveals a dramatic recovery 116 859 $ After a sharp assembly of 112 320 $ After the chair of Fedu Jerome Powell has indicated in September a reduction in rates even though they face $ 1.17 billion In ETF units and institutional sales pressure throughout the week.

At the same time bitcoin maintains the bull structure above all the main EMA, including 20 -day (113 982 $), 50 -day (115 333 $), 100 -day (116 164 $) a 200 -day (115 943 $) Support levels, placement for potential escape towards $ 120,000 Resistance in spite of the signal weakening the driving force.

Bitcoin shows a healthy RSI on 62.75 with MacD there is a bull left on 328.20 but a negative histogram on -903,78, denoting exhaustion of momentum, albeit mild 10,83k The BTC volume proposes institutional participation during the Powell Regeneration Rally.

Analysis of Chatgpt Bitcoins synthesizes 25 Real -time technical indicators to assess the BTC trajectory in the middle of changes in the federal reserve policy and pressure on institutional distribution in navigation by altcoin outperformation and market rotation dynamics.

Current price of bitcoins 116,859,35 $ reflects the dramatic intraday recovery despite a -4.04% Daily drop from the initial price 112 320,01the introduction of volatile business range between 116 988,00 $ (high) and 111 684.79 $ (low).

This 4.5% Intraday demonstrates the extreme volatility after Powell’s comments and causes a sentiment of risk.

Rsi on 62.75 It maintains a healthy positioning of a neutral colored without an indirect condition and provides balanced momentum for potential continuation.

Moving averages reveal exceptional bull positioning with Bitcoin trading primarily the main EMA: 20 -day on 113 982 $ (+2.5%), 50 -day on 115 333 $ (+1.3%), 100 -day on 116 164 $ (+0.6%) a 200 -day on 115 943 $ (+0.8%).

MacD shows a strong bull structure on 328.20, high above zero, with a signal line on -575.59but about a negative histogram on -903,78 It proposes a significant deterioration of momentum.

The volume analysis shows a slight activity on 10,83k BTC, indicating a constitutional institutional participation during volatility controlled by the Fed.

ATR maintains extremely high values on 113,152,27It suggests massive volatility potential for continuing significant movements in both directions based on feature -length development.

The Bitcoins revival is followed by Fed chairman Jerome Powell’s Jackson Hole Comments, which indicates September rates, creating a sentiment to the risk that overshadowed the weekly institutional sales pressure.

Dovish Pivot represents a basic catalyst because “markets respond to a hint of speed reduction” with the potential for reinforced movements after real implementation.

A wider context reveals institutional distribution challenges with bitcoin ETF $ 1.17 billion In the jerseys, while the main holders, including Blackrock and other institutions, systematically reduce positions.

Despite this sales pressure, Powell’s signals create a renewed institutional interest in risk assets.

Outperformance altcoins shows the dynamics of the rotation of the market with Ethereum is recovering above 4,800 $ and BNB reaching new historical maximum.

The 2025 Trajectory shows resistance from February 84 373 $ to the current $ 116k levels that represent 38% recognition.

The current location maintains proximity to Maxim July-August despite institutional sale.

Bitcoin keeps the dominant placement with $ 2.32 trillion market hat (+3.31%) Despite institutional distribution challenges.

Growth of the market ceiling is accompanied by an increased volume to 80.01 billion USD (+34.12%), indicating active institutional relocation.

The 3.46% The CAP volume ratio proposes increased business activities supporting price stability during policy volatility.

Circulating van 19.9 million BTC represents 94.8% from the maximum 21 million The offer, with the lack of supporting long -term value despite the short -term distribution phases.

Dominance on the market 61.40% shows a slight weakness due to altcoins during the phases of institutional rotation, while -6,39% distance from August 14 HIGH-TIME HIGH OF 124 457 $ It demonstrates the proximity of recent peaks despite the sale of pressure.

Current prices maintain extraordinary 239 486.002% profits from 2010 Minika in trading in historical maximums, verification of the trajectory of institutional adoption of bitcoins despite temporary distribution pressures from ETF drainage and institutional profit activities.

LunarCrush data reveals excellent social performance with bitcoin altrank to #1 During the development of the federal reserve policy.

Galaxy scores 90 reflects a strong sentiment as participants reduce the consequences of the level of asset assets.

The wiring metrics show a substantial activity with 5 million total obligations (-500k) While it mentions an increase 500k (+100k), demonstrating increased attention during the events of the political catalyst.

Social dominance 43.06% maintains exceptional visibility while sentiment registers in robust 80% Positive despite institutional distribution.

Recent social issues focus on Powell’s Dovish Pivot, with community discussions emphasizing “false disorders confirmed” and “inverse head and shoulders” of technical formulas.

A remarkable analytical comment includes predictions $ 175k Objectives and comparison with cycles of reducing historical speeds, controls the evaluation of bitcoins.

Prominent traders also identify double DNA formations and potential for movements above $ 127k before q3 ends.

Bitcoins analysis reveals that bitcoins benefit from the shift of the federal reserve policy despite the institutional division of headwinds.

The recovery of EMA after Powell’s comments shows the ongoing influence of monetary policy on the placement of bitcoins as a risky asset.

Immediate support appears on 20 -day Ema around 113 982 $followed by a strong support of Confluence to 50 -day (115 333 $) a 100 -day (116 164 $) It’s not.

The layered EMA support structure provides significant protection of the disadvantage during the volatility -based volatility phases.

Resistance starts at today’s high 116 988 $followed by psychological $ 120,000–$ 122k levels.

MACD volume and signals suggest that institutional positioning continues despite the surface distribution, while extreme ATR values indicate the potential for significant movements corresponding to the federal reserve policy implementation and institutional rotation dynamics.

Successful implementation of rates in September combined with continuing Policy Dovish Fed could Bitcoin aiming to $ 125,000–$ 130,000representing 7–11% upside down from the current levels.

This scenario requires permanent institutional trust and verification of subsequent policy.

The ongoing institutional profit reception could lead to consolidation between $ 112K–$ 120,000Allows you to complete the distribution, while the monetary policy provides basic support for the location of the asset of risks.

Break down $ 113k EMA support could cause sale towards $ 108,000–$ 110K levels that represent 7–10% disadvantage.

The recovery would depend on the acceleration of the federal reserve policy and the completion of the institutional distribution.

The analysis of Chatgpt bitcoins shows that bitcoins are located for potential escape based on politics despite institutional distribution pressures.

The combination of the Fed Dovish Pivot with technical support, above all, suggests that the influence of monetary policy prevails over short -term pressure sale.

Another price goal: $ 125,000 -130 000 $ within 90 days

Immediate trajectory requires holding above $ 113k EMA support to verify the strength of the catalyst of policy compared to distribution pressure.

Hence the implementation of the reduction in September could move bitcoins toward $ 125,000 psychological resistance, with permanent pigeon policy that heads to $ 130,000+ Level of escape.

However, inability $ 113k would signal extended consolidation towards $ 108,000–$ 110K Series, creating an opportunity to accumulate before another political wave of bitcoins towards new historical maximums $ 125,000 Because cash conditions are increasingly supporting.

Contribution Analysis of the Chatgpta Flag Bitcoins $ 116,000, but will Powell’s reduction of rates really evoke optimism? – Here’s what the data says He appeared for the first time Cryptonews.