Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

China was once the undisputed center of Bitcoin mining. Known for its cheap energy and access to leading hardware manufacturers, all of this has positioned China as a leader in global Bitcoin mining.

However, that changed when mining was banned by the Chinese government in 2021. In late September 2021, the People’s Bank of China (PBOC) further banned all cryptocurrency transactions. The PBOC cited the role of cryptocurrencies in facilitating financial crime as well as posing a growing risk to China’s financial system.

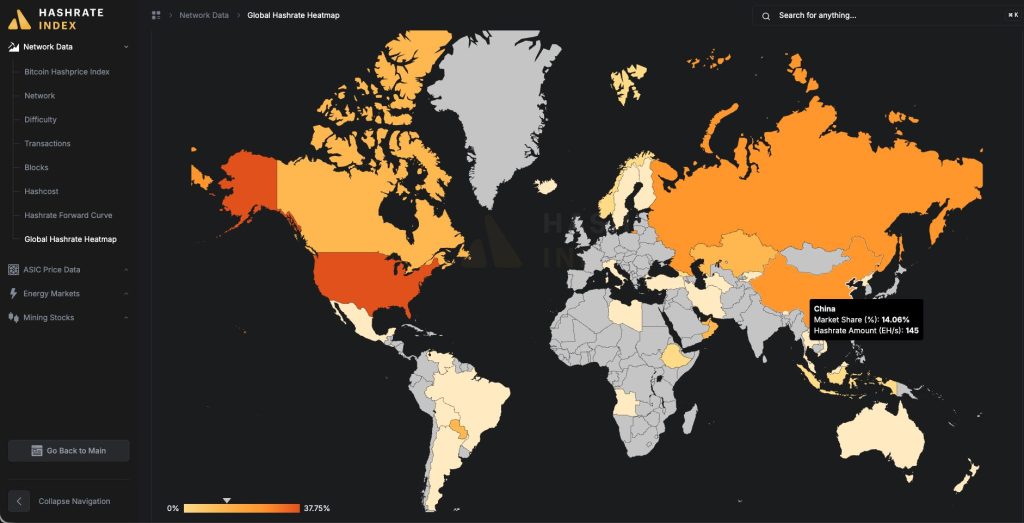

Fast forward to today – despite the government’s great efforts to shut down all cryptocurrency miners, many have found ways to continue operating. As per Q4 2025 update Luxor global hashrate mapChina currently accounts for 14.05% of Bitcoin’s total computing power, or roughly 145 exahashes per second (EH/s). That’s up slightly from 13.8% in Q3.

Kaan Farahani, a researcher at Luxor, told Cryptonews that Luxor’s Global Hashrate Map estimates the geographic distribution of Bitcoin mining around the world.

“The map provides weighted hashrate concentration across regions by incorporating mining pool data, ASIC trade flows and firmware adoption trends,” Farahani said.

Based on recent data China is the world’s third largest contributor to Bitcoin miningjust behind the US and Russia.

Luxor’s findings do not indicate where the hashrate resides specifically. According to Mining weeklymultiple sources throughout the ASIC supply chain have pointed to Xinjiang as one possible target. The region’s relative isolation and abundant energy resources have made it a longtime center for bitcoin mining ahead of China’s 2021 ban.

While China’s continuation of Bitcoin mining may not come as a complete shock, it does illustrate the dark, underground nature of the mining industry.

Kent Halliburton, CEO and co-founder of bitcoin mining platform Sazmining, told Cryptonews that he is not surprised that mining is still ongoing in China.

“That’s one of the beauties of bitcoin mining. It’s a cypherpunk way to generate bitcoins, which means as long as you have electricity and hardware, you can generate bitcoins for yourself. It’s hard to stop mining on the outskirts of the city, which is why I believe the hashrate we’re seeing in China is still there,” Halliburton said.

Other regions where bitcoin mining is considered illegal are also showing signs of growth. For example, Farahani noted that the Luxor hashrate map provides a glimpse of Iran, estimating that around 8 EH/s hashrate works in region from Q4 2025. This represents 0.75% of the global market share.

Another good example of this, according to Halliburton, is Iran Bitcoin mining was going on, but it was largely illegal. Iran initially banned Bitcoin mining in May 2021 for four months. The second ban in the region took place in December 2021. Before that, Iranian Bitcoin mining was estimated to be between 4% and 8% of the global BTC network.

“Basically, any country with strict capital outflow controls is likely to restrict or try to ban bitcoin mining,” Halliburton said. “But if you have power, you can generate bitcoin if you have the right hardware to use it. That means if you’re trying to stop the flow of capital from leaving your country, you have a way to do it with bitcoin mining.”

In addition to mining, recent findings from Bitcoin solutions maker Auradine found that more than 95% of Bitcoin ASIC mining rigs are made by Chinese firms such as Bitmain, MicroBT and Canaan. Auradine’s report says Chinese manufacturing of the device poses a major threat to US national security and critical infrastructure.

Sanjay Gupta, Chief Strategy Officer at Auradine, told Cryptonews that China’s mining infrastructure operations are worrisome for a number of reasons. For example, he mentioned that there are more than a million Chinese Bitcoin mining machines with foreign firmware connected to the US power grid.

“This poses a potential serious cyber security risk to the power grid in various states,” Gupta said. “If there is software embedded in these Chinese miners that is triggered by a coordinated cyber attack that causes a large number of miners to rapidly overload or underperform at the same time, it could cause a catastrophic failure of the US power grid.”

Gupta added that the highly concentrated supply of BTC mining hardware poses a major risk of a potential 51% takeover of the Bitcoin protocol in a hostile geopolitical situation. This has recently become an even greater threat tariffs imposed on China by President Trump, which could rise to as much as 155% in the coming weeks..

“This could have a dramatic impact on the value of BTC and a ripple effect on financial markets,” Gupta noted.

It is clear that Bitcoin mining and production continues in China despite the bans. So what does this mean for miners based in regions where BTC mining is considered legal?

According to Farahani, Luxor is not aware of challenges or threats based on Chinese mining operations.

On the other hand, Gupta believes that Chinese firms supplying mining equipment will create complexities for other regions.

“To combat this, we need to enable strong US Bitcoin mining suppliers who can drive continuous innovation and performance for mining operations,” he said.

Gupta added that in the future, bitcoin miners should have technology that enables energy demand response with the ability to quickly increase or decrease energy consumption based on the needs of a state or region’s power grid.

Meanwhile, the architecture and legacy of mining in China will likely continue to emerge above the global web. In the ever-changing world of cryptocurrencies, China hasn’t disappeared – it’s simply operating on the fringes.