Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

CME overtaken the binance as the largest bitcoin exchange in the world with an open interest while the decentralized Hyperliquid platform reached a record $ 5 billion Daily trading volume, according to the comprehensive company Coinglass H1 2025 Derivative Report.

The open interest of CME Bitcoin Futures has reached 158 300 BTC ($ 16.5 billion) Until June 1, overcoming binance 118 700 BTC ($ 12.3 billion) For the first time in the history of crypto derivatives.

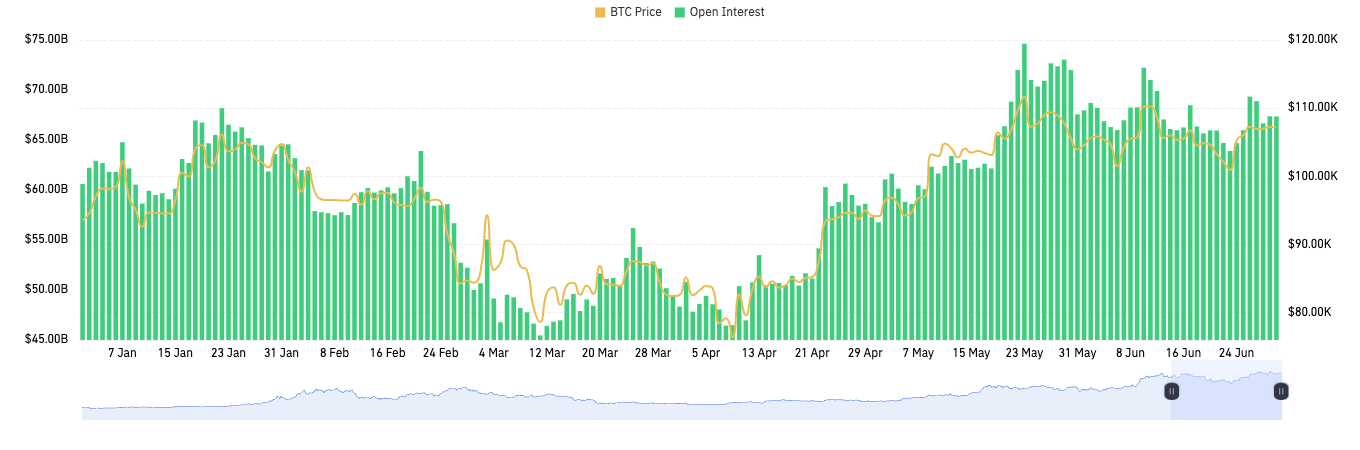

The landmark comes when BTC derivatives open interest climbed $ 60 billion Over $ 70 billion During the first half of 2025, driven a massive influx of ETF and institutional demand.

The total volume of trading in cryptocurrency derivatives maintained a slight momentum in ascending way throughout H1 2025, while binance continued to dominate the total derivatives and almost reached $ 200 billion at peak hours.

However, the market structure was consolidated around leading exchanges, including OKX, Bitget and Bitget and Gate, with the main platforms capturing most of the market share through Matthew Effect.

Hyperliquid appeared as a standout artist in decentralized derivatives and processed the average daily volume over 3 billion dollars with peaks overlapping $ 17 billion.

The platform now commands More than 80% of the market share While it captures 10.54% of Binance’s market, 9.76% in April.

The rise of regulated exchanges means a significant shift in business samples associated with cryptocurrency derivatives.

The dominance of CME in Bitcoin Futures is open to an open interest stems from the increasing institutional participation through compatible channels, while ETF serves as the main sources of incremental demand together with traditional institutional allocators.

Bitcoin’s dominance on the market has been strengthened throughout the H1 2025 and reached 65%by the end of Q2, the highest level since 2021.

Spot ETF ASSEMPT has exceeded $ 140 billion under administration, which created permanent demand for securing tools on regulated platforms.

Ethereum and altcoins have experienced a significant weakness during this period. Eth In April, more than 60% of its $ 3,700 in the early year of up to $ 1,400, with the ETH/BTC ratio dropped from 0.036 to 0.017, which is 50% of the collapse.

The main altcoins, including SolanIt also fell by more than 60% of their peaks, despite the short early annual gathering.

The Coinglass (CDRI) derivative (CDRI) derivatives index remained at a slight level throughout the H1 and reached 58 within June 1, indicating the conditions of ‘slight risk/volatility neutral’.

Several liquidation events helped flush the excessive lever effect, with 3 February noticed $ 2.23 billion in forced liquidations within one 24 -hour period.

The financing rates remained mostly positive all the time, remaining above the base level of 0.01% and indicating the persistent bull sentiment.

However, three remarkable episodes of negative financing in February, April and June coincided with the sharp corrections of the market and served as reliable indicators of the inflexive point of sentiment.

Hyperliquid explosive growth placed the platform as a leading power in trading in decentralized derivatives.

The average daily volume consistently exceeded $ 3 billion, while the growth of the monthly monthly exceeds the entire dex sector.

The platform has achieved subscriber finality and support of more than 100,000 orders per second through its proprietary engine corresponding to the native chain.

The decentralized stock exchange ranks sixth among all DEX with a daily volume of more than $ 420 million and at the same time captures $ 6.84% of global eternal flows.

The annual volume of trading has reached $ 1.571 trillion, an increase of 843% of $ 26.3 billion recorded twelve months ago.

Generating income exceeded $ 56 million a month, resulting in a cumulative revenue of over $ 310 million.

The platform reinvests 97% of the protocol fees to the redemption of the Hype tokens, leading to a redemption of $ 910 million during the six -month period.

The total value of the locked reached $ 1.75 billion, which ranked eighth among all the blockchains.

In particular, institutional acceptance accelerated Nasdaq-Blisted Lion Group announcing plans to hold $ 600 million with hype hype as its primary treasury asset.

The token reached a new peak to $ 44.86, outperforming its previous December maximum 35.51, while standing on a potential maximum of $ 50.

In addition, market depth analysis revealed the continuing dominance of Binance in trading with bitcoins with a unilateral depth of $ 8 million and 32% of the market share.

However, the space of derivatives is increasingly fragmented between regulated institutional sites such as CME, and leading decentralized platforms such as hyperliquid, both serving different segments of investors.

Contribution CME beats binance in futures BTC while hyperliquid hits $ 5b in volume: Coinglass H1 Report He appeared for the first time Cryptonews.