Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The long-debated US crypto market structure law is regaining bipartisan momentum, with Coinbase CEO Brian Armstrong expressing optimism that lawmakers could finalize landmark legislation before Thanksgiving.

Speaking in a CNBC interview with Emily Wilkins, Armstrong said recent meetings with both Democratic and Republican lawmakers had been “very productive,” describing the level of cooperation as a rare and encouraging sign.

“We had great meetings today with Democrats and Republicans,” he said. “There is strong bipartisan support to pass this market legislation. It’s important to America and the 15 million Americans involved in cryptocurrencies.”

The comment comes as Armstrong said it a day earlier “eager” to work on crypto market structure legislation as key Senate Democrats are scheduled to meet with top digital asset officials on Wednesday.

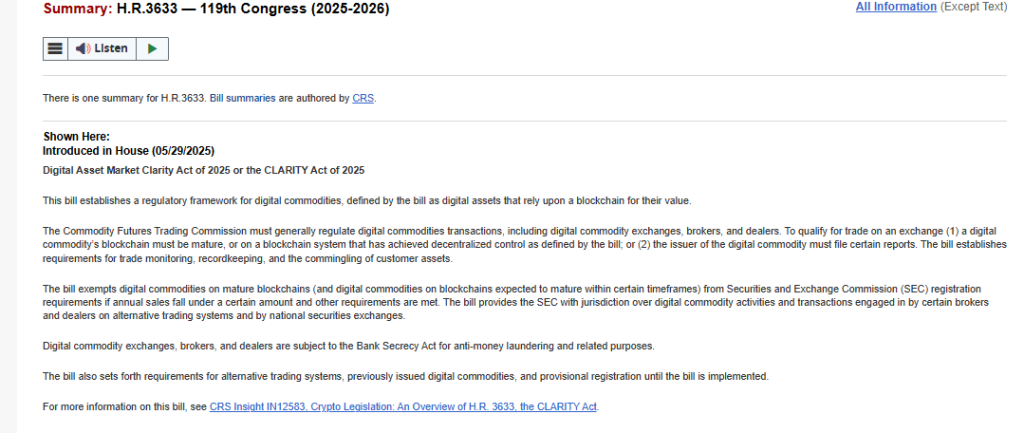

Armstrong’s remarks reflect a growing sense of momentum around the Digital Asset Market Clarity Act, also known as the The Law of CLARITYwho passed the House of Representatives in July with strong bipartisan support in a 294–137 vote.

According to Armstrong, roughly 90% of the bill’s issues have already been resolved, with the remaining details expected to be ironed out once lawmakers meet to finalize the text.

“There’s a lot of collaboration going on,” he said. “The last 10% of the problems will be solved once everyone is in the room together.”

A bill now making its way through the Senate seeks to end years of uncertainty in U.S. cryptocurrency regulation by making a clear distinction between securities and commodities in the digital asset market.

Especially under designed digital assets built on sufficiently decentralized networks would fall under the supervision of the Commodity Futures Trading Commission (CFTC), while more centralized or early tokens would be classified as securities regulated by the Securities and Exchange Commission (SEC).

The bill also outlines clear rules for decentralized finance (DeFi), secondary market trading and institutional custody, areas that have long lacked consistent federal guidance.

“This is a critical moment for the crypto industry in the US,” Armstrong said. “It will provide clarity, foster innovation and ensure the US remains a leader in the global digital economy.”

The comments come as a wave of industry executives, including Armstrong, Kraken co-CEO David Ripley, Uniswap Labs founder Hayden Adams and Chainlink Labs’ Sergey Nazarov, met with lawmakers on Capitol Hill earlier this week.

The meetings, which included the likes of Senate Banking Committee Chairman Tim Scott (R-SC) and New York Senators Chuck Schumer and Kirsten Gillibrand, lasted nearly three hours and focused on advancing market structure legislation.

Participants described discussions as more substantive and at a higher level than previous industrial commitments.

Nazarov noted that “multiple senior senators were speaking at once”, showing a shift in tone among policymakers who “are aware of the economic value of the industry and need to address it properly”.

The meetings included separate sessions with Democratic and Republican lawmakers. Democrats raised questions on DeFi Illegal Funding and Oversightwhile Republicans reiterated support for passing the bill.

Senate Banking Committee spokesman Jeff Naft called the meetings productive, and participants reaffirmed their bipartisan commitment to moving forward.

The CLARITY Act follows the earlier approval of the GENIUS Act, a bill aimed at stablecoins President Donald Trump signed the law in Julywhich laid the groundwork for broader regulation of digital assets.

Together, the two bills form the centerpiece of Congress’s ongoing efforts to create a coherent national framework for cryptocurrencies.

Sen. Cynthia Lummis (R-WY), a key sponsor of the market structure initiative, also expressed confidence that Congress will pass the bill this year.

Speaking at the SALT Wyoming Blockchain Symposium in August, Lummis she said she expects the legislation to make it to the president’s desk “before the end of the year – hopefully before Thanksgiving.”

Senate Banking Chairman Tim Scott, who had previously set a target of 30 September for the completion of the bill, expressed similar optimism. “We’ve been working on the markup since June,” Scott’s spokesman said, noting the thousands of pages of stakeholder feedback that had already been reviewed.

Scott believes the Senate “shouldn’t be far behind” after the House’s decisive action earlier this summer.

However, progress in the Senate was not without obstacles. Internal contradictions within both parties and ongoing government shutdown they delayed the labeling process.

Senator John Kennedy (R-LA) expressed skepticism, saying he didn’t believe the committee was ready to move forwardciting unresolved questions about what authority the crypto industry might gain under the new framework.

Meanwhile, a group of twelve Democrats in the Senate, led by Senators Gillibrand, Booker and Warner, they called on Republicans to adopt a fully bipartisan design process.

In a joint statement last month, they described digital assets as a $4 trillion global market that requires “mutual understanding” and equal participation by both parties.

Despite the friction, industry optimism remains high. Armstrong described the two sides’ recent meetings as a “turning point,” while SEC Chairman Paul Atkins urged lawmakers to speed up the processemphasizing the need for joint rulemaking between the SEC and the CFTC.

However, there is still uncertainty about the timetable for the bill. There are only about 20% punters on the decentralized prediction market Polymarket believe the CLARITY Act will be signed into law by the end of 2025, down sharply from 87% in mid-July.