Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

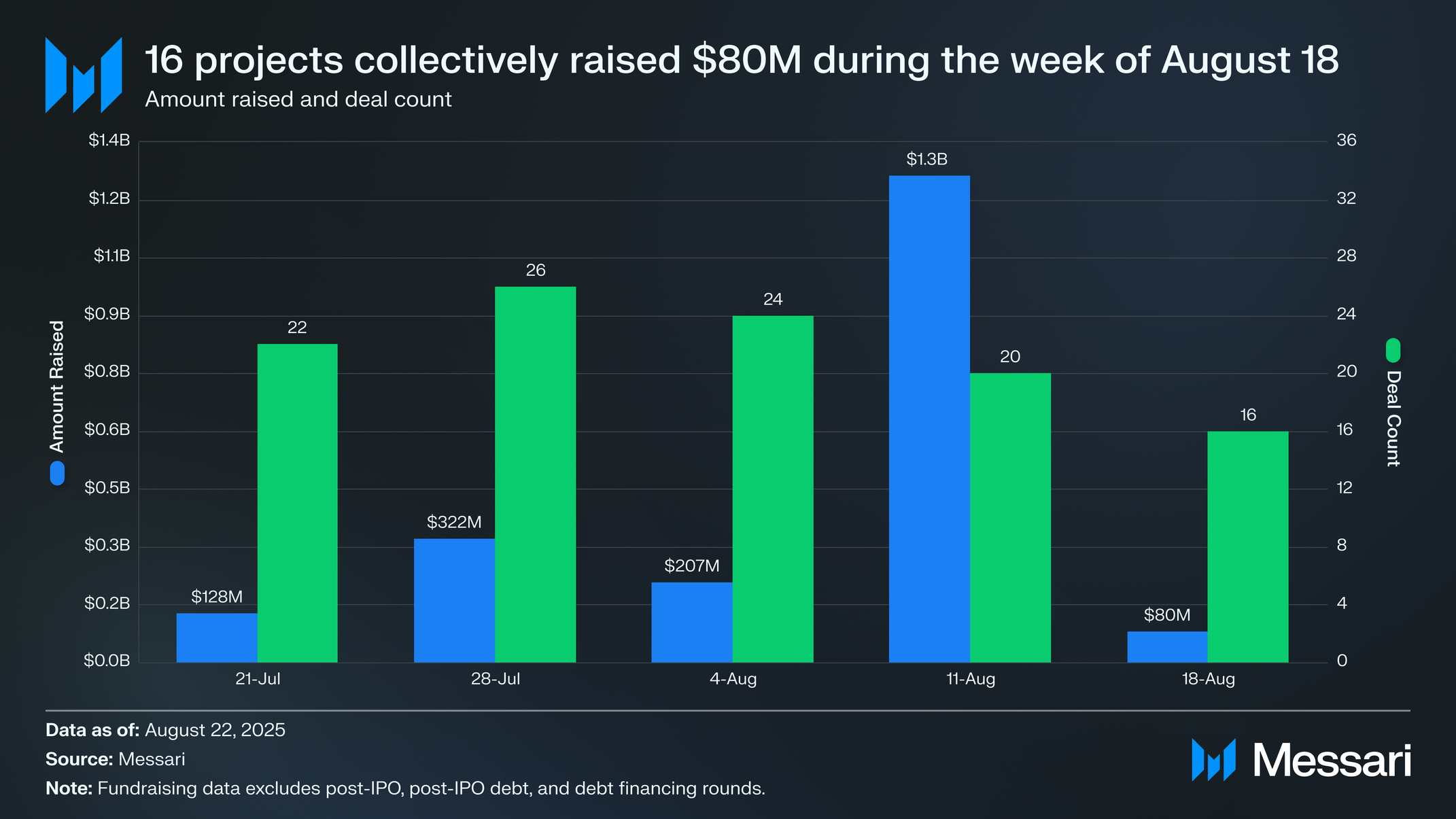

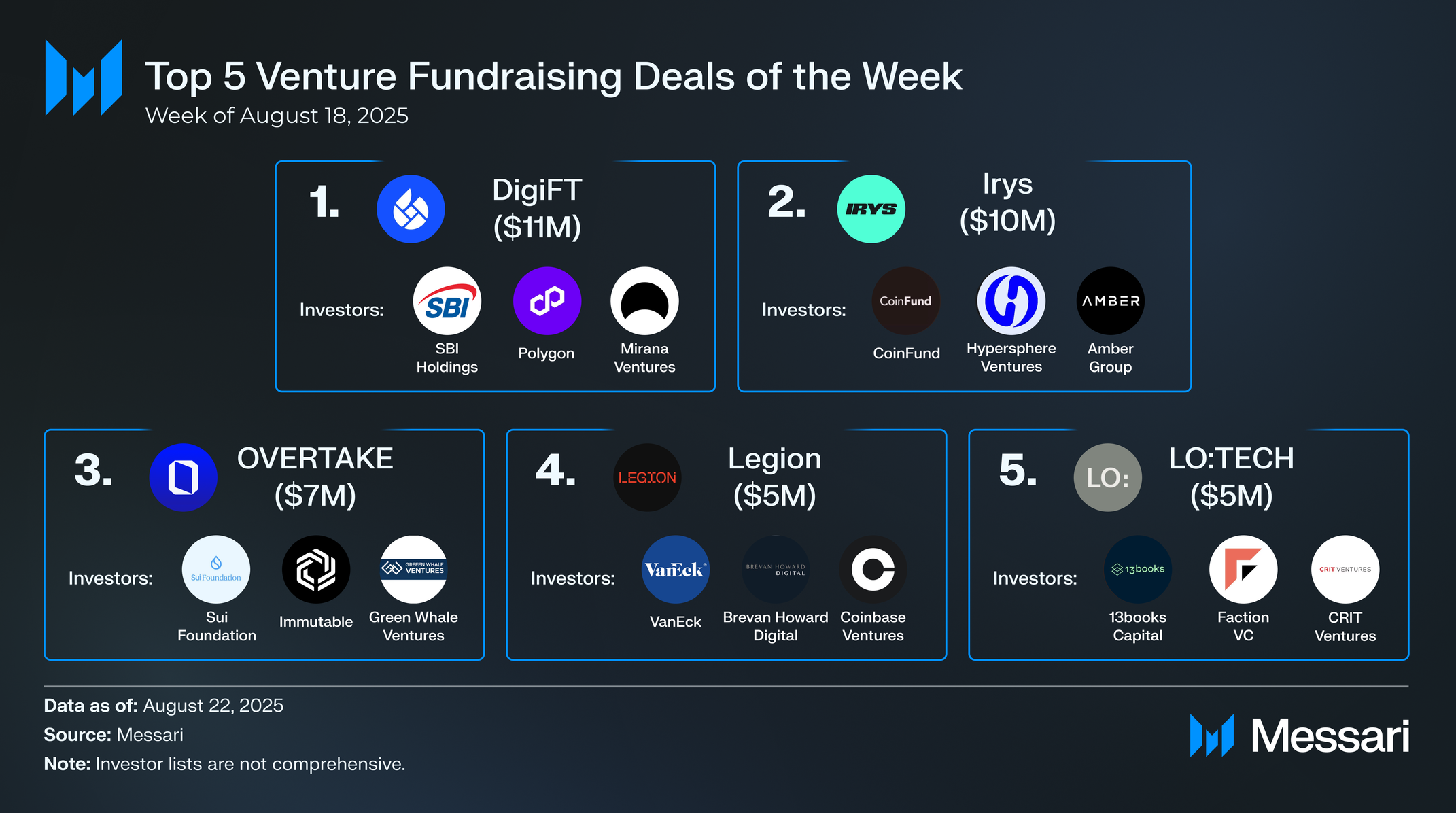

16 projects have raised $ 80 million this week, led by Digift ($ 11 million) and Irys ($ 10 million), while LM funding America and AMDAX has expanded its Bitcoin Treasury strategies with fresh allocations. Kraken bought Capitalise.ai, Valantis acquired the stakehipes and Kerberus bought Pocket Universe. On the investor side, Jon Charbonneau compared the investments in the basis on speculation aimed at flow, Regan Bozman warned the founders of the starting of the unproven L1S, and David Sverdlov and Aiden Slavin explained the misconceptions about Blockchain’s privacy. Here is the breakup of this week’s best offers and insights.

16 projects have collectively raised $ 80 million this week. Here are the eight that stood out:

In recent months, digital assets have accelerated, and corporate and structured vehicles are increasingly accumulated by tokens on scale. Here are notable examples from last week:

Kraken acquired property and technology Capitalization.aiPlatform for automation of trading without a code founded in 2015, in order to strengthen Kraken pro. Capitalization.ai enables Customers for research, design and automation strategies in DIOns, cryptocurrencies, FX and derivatives using natural language intake. In a phase overturning to Kraken Pro it will start later this year, giving Traders the possibility of automation strategies of cross -assets directly on the platform. Capitalize.ai co-founders and key team members will join Kraken to improve technology within the Pro Business Unit.

Cleaning acquired StancedhipeProtocol behind tinselliquid token (lst) for Hyperlikida ecosystem. Acquisition united Development under the valtis, who will monitor Sthype -ov transition to Corewriter and expand integration, liquidity and yield capabilities. Schype will be upgraded in modular LST with synchronous liquidity over Hyperevm and Hyperkorallowing deeper define interactions with safety maintenance. Community Code, Schype -ov Recommendable Integration System, will also be expanded.

Kerberus acquired Pocket spaceExtension of browsers that protect users from malicious web3 transactions in 11 chains, with features such as the detection of rugs and covering transactions up to $ 20,000. The acquisition combines protective measures at the Pocket Universe transaction level with Kerberus Sentinel3 Real -time fraud detection, protection by and a 30,000 -dollar coverage guarantee. Pocket Universe will continue to operate with its existing user experience, at the same time integrating the Sentinel3 technology, expanding protection to all EVM chains and Solan, and introducing mobile and desktopic security products. The founders of the pocket universe will deviate as Kerberus adds Cryptocurrency Run Neuner As a strategic advisor to help scan adoption.

David Sverdlov | Aiden Slavin (A16z Crypto)

It’s a wrapper for this week’s Crypto Venture Weekly. Thanks for adjusting to you and see you next week!

Launched ButcherOur comprehensive supervisory board for funds allows you to move in 18.700 crypto ventures roundsover 1,100 M & a offersand access profiles for 16,900 investors.

Let us know what you loved in the report, which may be missing or sharing any other feedback Fulfilling this short form. All the answers are subject to our Privacy rules and Service conditions.

The author (s) has made all the content independently and does not necessarily reflect the opinions of the author Messari, Inc., can maintain the cryptocurrency of the currency appointed in this report. This report is intended for information purposes only. Not intended to serve as an investment advice. Before making any investment decisions, you should implement your own research and consult with independent financial, tax or legal advisor. Nothing contained in this report is a recommendation or proposal, directly or indirectly, to buy, sell, bring or retain any investment, loan, goods or security or take any investment strategy or trading regarding any investment, loan, goods, security or any publisher. This report should not be interpreted as an offer to sell or collect an offer to buy any security or goods. Messari does not guarantee the sequence, accuracy, integrity or time of any information listed in this report. Please see ours Service conditions For more information.

No part of this report can be copied, photocopied, multiplied in any form in any way or (b) redistributed without prior written consent Messari®.