What to know:

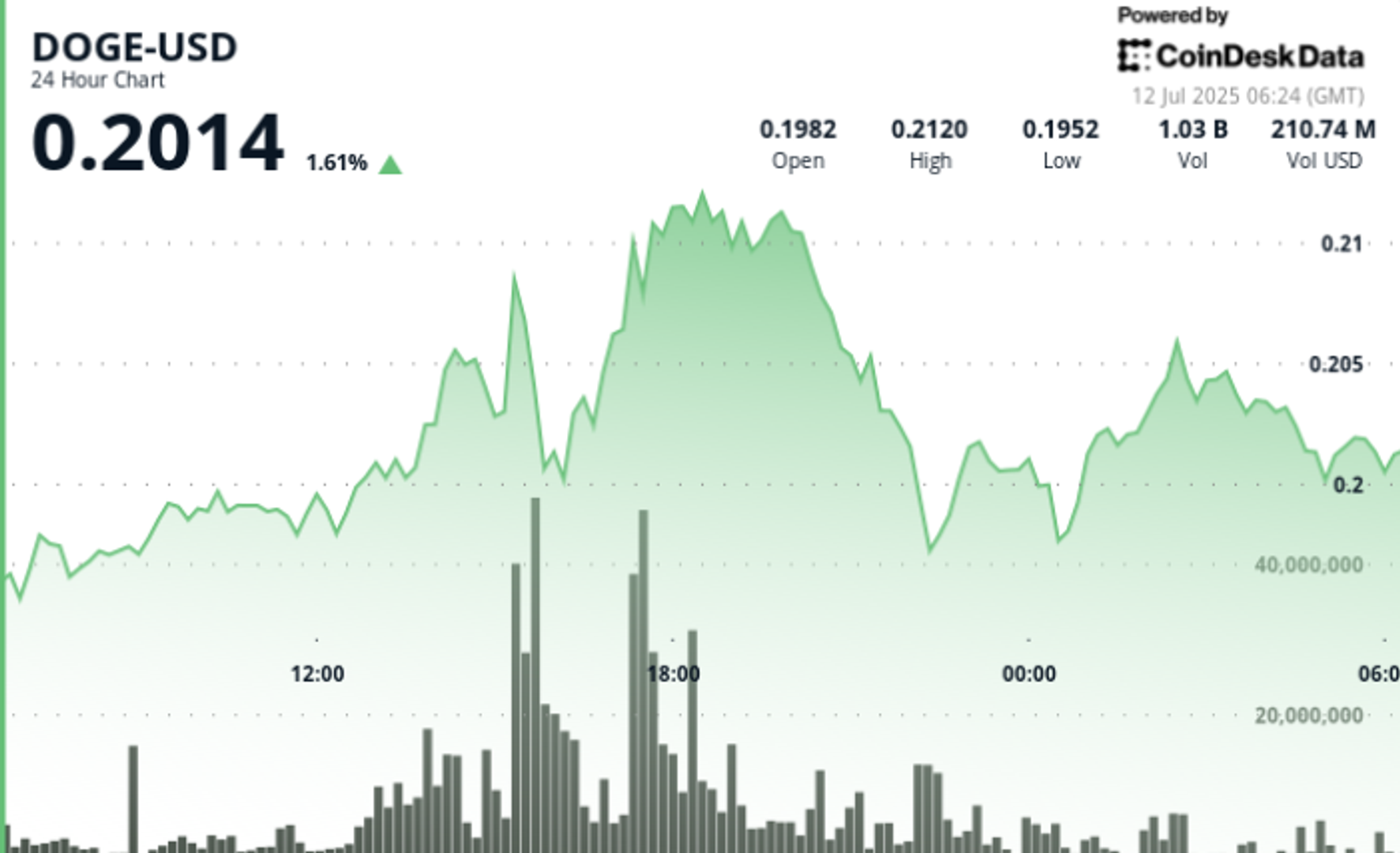

- DOGE advanced 8.6% of $ 0.198 to $ 0.213 between 11 July 06:00 and 12 July 05:00 before closing to $ 0.202 – a complete renewal of its intraday profits.

- The volumes of trading occurred around 1.1b during the session 13: 00–15: 00 and determined the resistance between 0.208 – 0.213 USD.

- Support held at $ 0.200-0.201 via the late session, while the price action stabilizes around $ 0.202.

- Analysts have marked the refusal at $ 0.211 (20:00) as evidence of systematic profit by larger holders.

News background: BTC Record, Risk-on Flows Drive Meme Coin Rally

During the session, Bitcoin touched the historically highest $ 118,000 because the cryptom markets benefited from the increase in institutional inflows-faded to 50 B this week.

The evasion of geopolitical tension, improvement of business relations and Dovish signals from central banks increased risk assets across the board. Dogecoin, usually a high beta game during crypto-collection, has grown in response next to altcoins.

Summary

- Range: 0.198 $ → 0.213 $ → 0.202 $ | Total fluctuations: 8.6%

- Breakout zone: 0.200 – 0.208 $ erased on a strong volume

- Resistance: 0.208 – 0.213 $, with a turn from $ 0.211

- Support: Tested and held multiple times 0.200 – 0.201 $

- Last hour (04: 55–05: 54): The price increased from $ 0.200 → $ 0.202 (+0.5%)

- Volume peak: 1.1b between 13: 00–15: 00; 19 m during 05: 00–05: 10 late increase

Technical analysis

- Momentum of the middle session broke over key zones of resistance but could not keep over $ 0.213

- Order reversal near High session suggests strategic exits of institutions

- Last hourly recovery shows that $ 0.200 remains psychologically significant

- Making cooling; Expected consolidation of nearby terms in a band of 0.200-0.204 $

What do traders watch

- Can Doga regenerate and hold over 0.208 – 0.210 $ to repetition of maximum?

- A schedule below 0.198 – 0.200 $ would signal the trend of exhaustion

- Consolidation over $ 0.202 would support the Bull’s Setup Settings to the next week

- Wider BTC and macro risk sentiment will continue to dictate altcoin flows

With you

DOGE watched wider crypto markets with pure intraday escape – but its rejection to $ 0.213 and sharp pullback emphasizes the fragile nature of coins of coins during high volatility.

Institutional streams remain, but traders should monitor the volume confirmation before chasing upside down. $ 0.200 is now a line in the sand.

Responsibility: part of this article was created with the help of AI tools and reviewed our editorial team to ensure the accuracy and observance of our standards. See Coindesk Full AI for more information.

Source link