Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

ZEC’s bull run may have just run out of steam, with its latest decline forming a double top, obscuring bullish Zcash price predictions.

The altcoin it made its second local high at $300, marking the start of a potential double bottom that could take it back to pre-bullish lows.

Still, the private coin story remains strong. Almost 2 million ZEC were shielded in the last month, bringing the total shielded circulation supply to 30%.

This underscores strong adoption beyond short-term speculative trading. Unlike swing trading, investors choose to protect and hold and stabilize price movements.

Social sentiment shares a common belief: privacy is more than just a passing trend, but one of the core values of cryptocurrencies.

Zcash has found new meaning in this institutional-driven market cycle: Institutional use cases need rails that offer privacy but are compliant with selective disclosure.

Support from the world’s largest digital asset manager further underscores demand with the launch of the Grayscale Zcash Trust, which allows TradFi markets regulated access to ZEC.

With a second stand around $300, strong psychological resistance, Zcash appears to have formed a double top.

If this classic reversal pattern were to fully materialize, it could trigger a 50% drop back to the altcoin’s October low near $120, erasing much of the bull market’s gains.

However, the momentum indicators indicate strength rather than exhaustion. The RSI continues its uptrend while the MACD histogram is flattening, both signs of increasing buying pressure.

A broader bullish flag structure may still be in play, with the current retesting of its upper limit as support key for the continuation of the bull run.

If confirmed, the breakout of the flag targets a 125% rally to a new price discovery, with an eye on $500. The recent pullback could simply be a wave of weak hands ahead of Zcash’s next major leg higher.

Short-term catalysts like a potential US interest rate cut next week could give the Zcash price the fuel it needs to continue its rally.

In markets where bullish momentum can turn into a correction so quickly, traders need every advantage they can get – especially those who catch plays late in the run.

Snorter ($SNORT) is fast becoming a popular tool for investors looking to make the most of its high-potential plays.

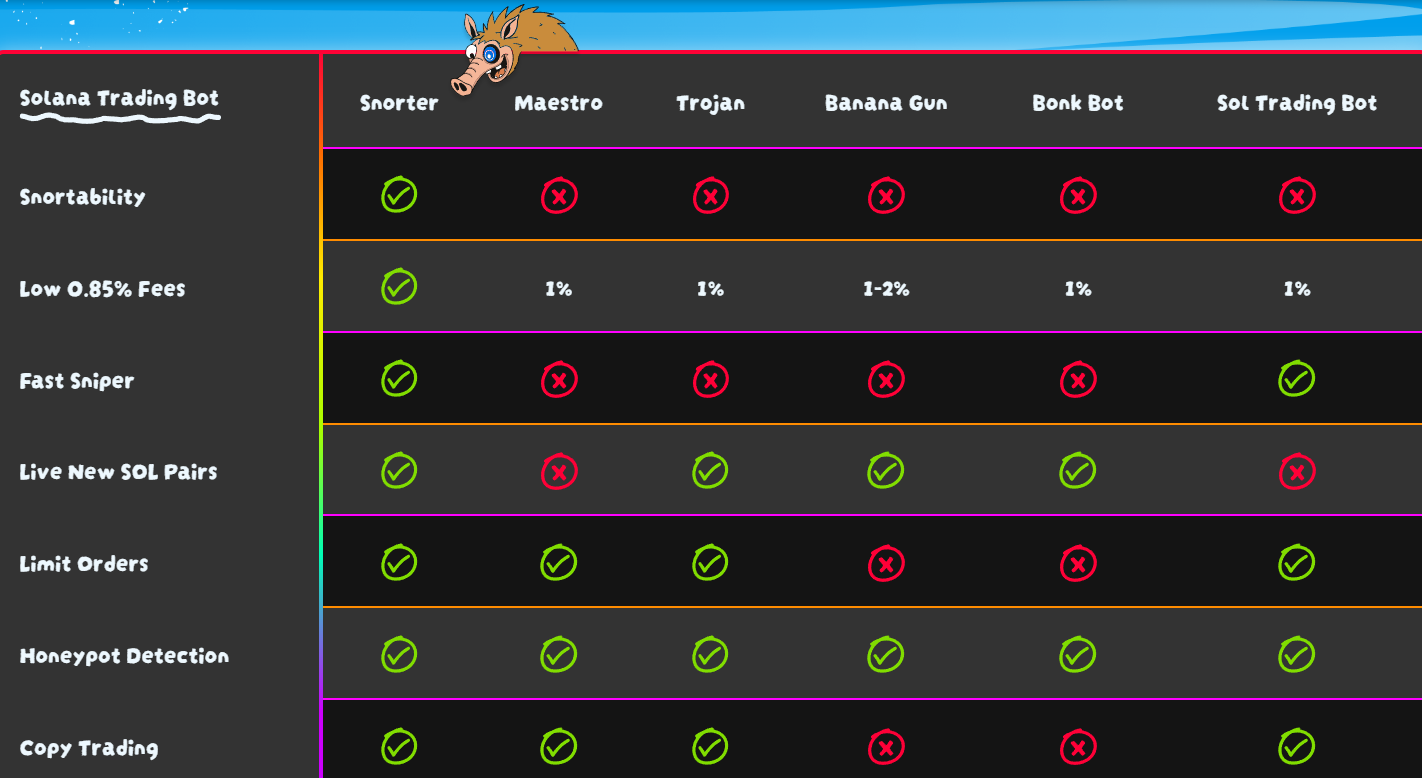

Snorter Bot equips users with a complete set of competitive trading tools: limit-order sniping for exact input, MEV resistant exchanges which block the leading players, copy trading which follows proven winners and protection against carpet pulling filter out scams before they happen.

Just as crucially, it helps traders get out right and lock in profits before the momentum fades instead.

This is not your average robot. It is built for chaos and bull market opportunities. And with a macro story that puts capital back into meme coins, Snorter’s the timing couldn’t be more perfect.

Pre-sales are nearing $5.5 million entering their final week, with momentum continuing to accelerate.

Early adopters of $SNORT are preparing for the next Solana rally – with sharper entries, cleaner exits and smarter trades.

Visit the official Snorter website here