Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Ethereum (ETH) could be set to a great return against Bitcoin (BTC), according to new data from the analytical company Cryptoquant.

The combination of historical formulas, increasing investors’ demand and declining sales pressure suggests that ETH could enter a fresh cycle overcoming – which many in the crypto community call the beginning of the “alt season”.

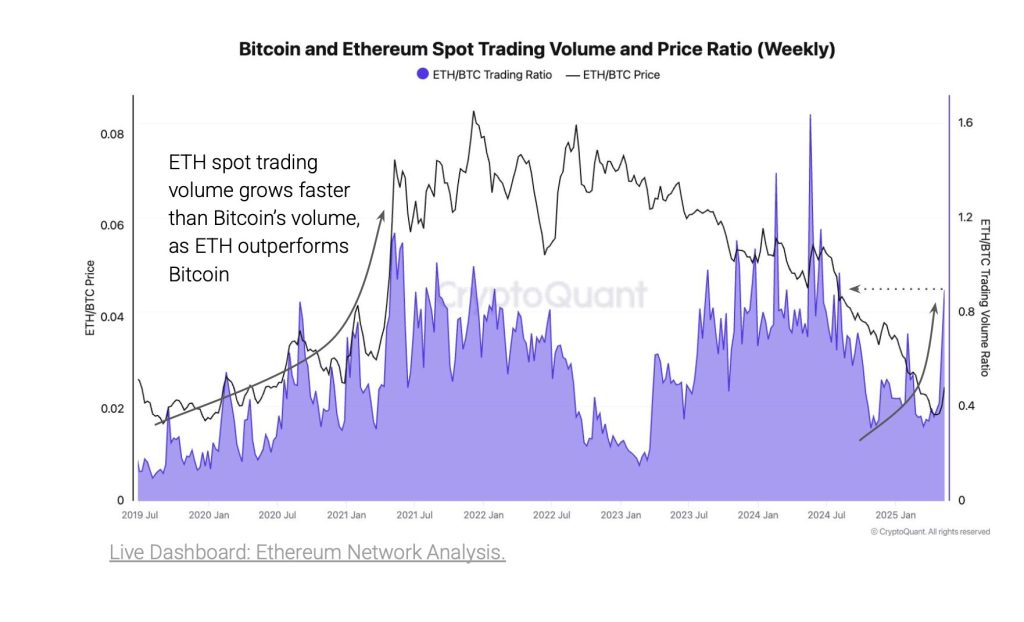

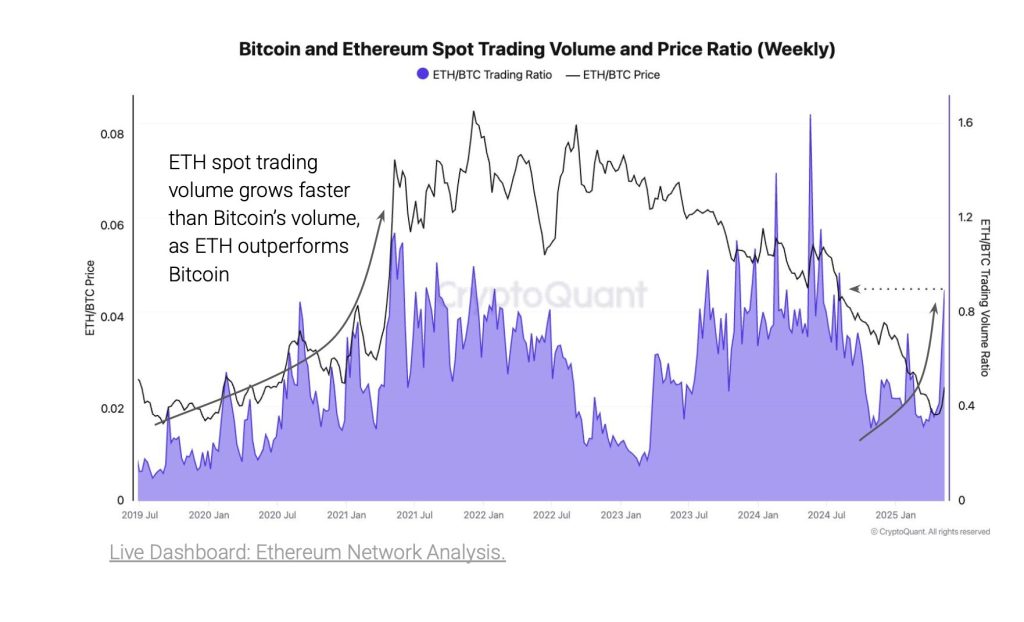

ETH/BTC price ratio, key indicator EthereumPerformance in relation to Bitcoin in the last week has increased by 38% after it recently hit its lowest level since January 2020, Cryptoquant news.

Historically, this level has marked the bottom for ETH and preceded the large altcoin assembly. According to Cryptoquant, Ethereum has actually just joined the extreme underestimation zones due to Bitcoin based on the ETH/BTC MVRV metric – the first such instance since 2019.

Similar conditions in 2017, 2018 and 2019 followed a strong average overturning in favor of ETH.

The recent recovery in ETH seems to be supported by a shift in market behavior. Traders and investors increase ETH exposure at a rapid pace.

The ratio of ETH-to-BTC trading has appeared to 0.89, which has been the highest since August 2024. This metric reflects a similar trend observed between 2019 and 2021, when ETH exceeded the bitcoins by four factor.

Institutional flows also show in favor of Ethereum. Kryptoquant notes a sharp increase in the ratio of ETF Holdings ratio in relation to BTC since the end of April.

This means that fund administrators allocate more Ethereum, perhaps in anticipation of favorable market dynamics, such as recent scaling enhancements or views of Makro gentle ETH.

According to Cryptoquant, the data Exchange Inflow reveals another Bull indicator for ETH. Since 2020, the ETH/BTC exchange ratio has fallen to the lowest level, indicating that fewer ETH holders send coins for sale for sale. On the other hand, Bitcoin seems to face relatively higher sales pressure.

Cryptoquant data is painted by a picture of growing demand ETH in the middle of reduced sales pressure and relative underestimation. If historical formulas apply, the Ethereum may be on the brink of re -dominance of bitcoins and potentially lead the wider altcoin market to the new growth phase.

Contribution Ethereum flashes extreme underestimation – cryptoquant eyes 38% ETH/BTC rally early He appeared for the first time Cryptonews.