Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Ethereum is back in the center of attention – not for the price but for activity. Ethereum daily active addresses hit 841 100, the highest since 2022. This meter monitors how many unique addresses are connected to ETH gears every day and is considered to be proxy for users’ connection.

Spike is a significant departure from consolidation of the 600,000 range we have seen in recent months. Although it is good for the user’s interest, it is not distinguished between purchasing and selling. Historically, these spikes precede volatility in address activity, and this is no exception – the price of Ethereum has been steadily withdrawn after an increase in activity.

What does this mean? Increased transactions often mean that traders move themselves, especially in front of the main market events or key technical settings.

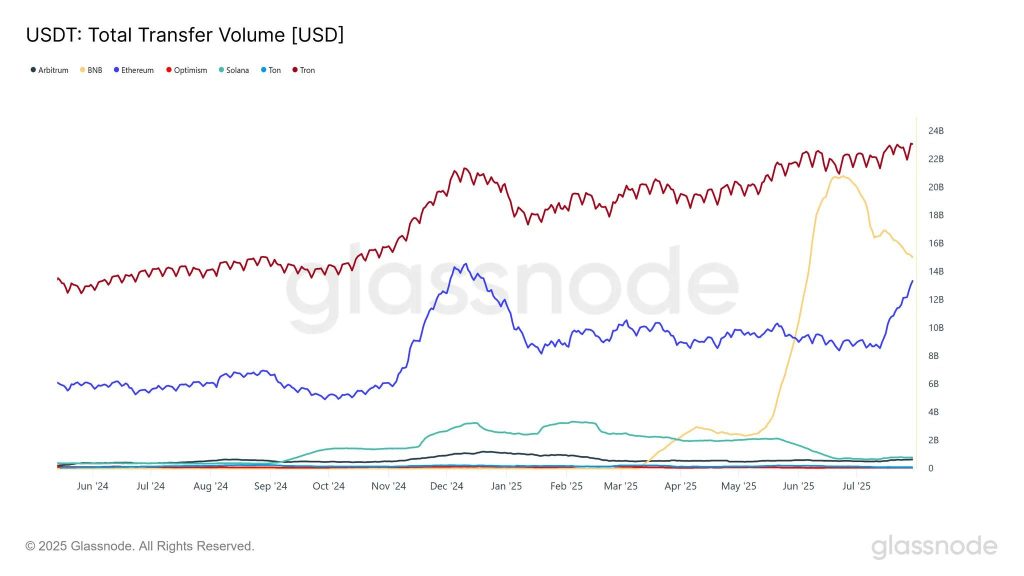

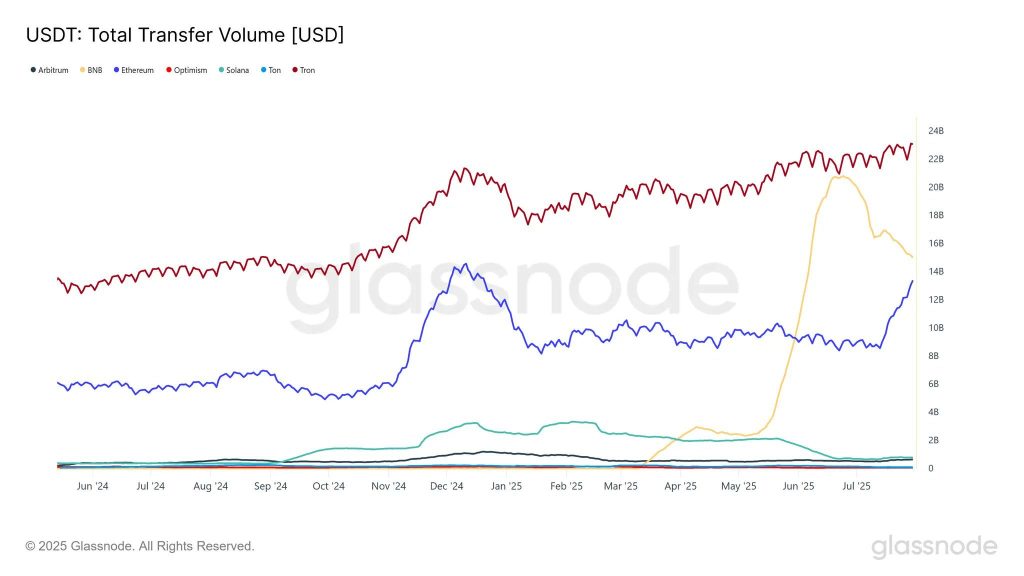

Glassnode reports that the 30 -day volume of the sliding diameter transmission USDT has grown up $ 52.9 billion, recovery from a market decline in 2022. However, Ethereum’s share in the USDT transaction volume decreased.

Currently:

This decrease in the dominance of stable-coins settlement could mean, while the Ethereum network activity is higher, transaction preference is shifting to lower fees for using stablecoin-especially volatile gas prices.

In terms of price action, Prediction Ethereum Price looks weaker. ETH broke below $ 3,548 and could not stick to the growing trend line that has been in place since mid -July. Bear absorbing pattern, followed by three large red candles (such as three black crows), confirms the division.

Key signals:

The level of support track:

If ETH repeats $ 3,548 and will be rejected (eg shooting star), short to $ 3,548 with stopping over $ 3,600 and targets at $ 3,428 or lower. More aggressive should be shortened to $ 3,428 with targets to $ 331 and $ 3,235. It is necessary to return above $ 3,651 and the trend line to turn over the bull’s bias.

Bitcoin Hyper ($ Hyper)The first BTC-national layer 2-powered Virtual Machine Solana (SVM) has received more than $ 6.2 million in its public pre-platform, with $ 6,278,761 from $ 21,644,097. The token is awarded $ 0.0115, with another price level expects to be announced soon.

Bitcoin Hyper, designed to combine the security of bitcoins with the velocity of the Solana, allows fast, cheap intelligent contracts, DAPPS and MEME coins, all with a trouble -free BTC bridging. The project is audited by Consult and created for scalability, trust and simplicity.

The Golden Cross Meme attraction and real usefulness caused Bitcoin Hyper a candidate for layer 2.

Contribution Ethereum pricing: Daily active addresses at a two-year peak-this means for ETH? He appeared for the first time Cryptonews.