Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The latest Ethereum retreat, a 13% decline in the recent maximum, denotes its first weekly loss in more than a month and violates a stable uptrend that has seen ETH testing for more weeks. A correction that briefly reached a price below $ 3,400 caused a debate: is it a pause from escape or the beginning of a deeper decline?

A fascinating anti -counter appeared: the whale purchased $ 300 million ETHThis suggests that they believe that this decline is temporary.

The Arkham Intelligence chain data shows that a massive purchase occurred when prices dropped-strategy “buy a dip” from a highly convicted entity. This, because the wider market turns from macro pressures: strong US dollar and weak data on payouts without a farm that caused a sentiment with a risk.

This divergence between the price action and the behavior of the whale suggests a potential conversion. While many traders leave fear, aggressive accumulation indicates moderate to long -term outlook for recovery. It also comes because Ethereum is an institutional asset linked to the upcoming ETF and upgrades of the on-line.

Prediction Ethereum Price It changes the bull because ETH is trying to recover from $ 374 – the lowest since the beginning of July. The price is testing 0.236 FIB at $ 3,491, which was a level that was support and resistance earlier.

A net break over it could lead to $ 3,564 (38.2%FIB) and $ 3,623 (50%), with a final recovery to $ 3,681 (61.8%), which is also 50 SMA periods for $ 3,711.

Momentum is still weak. The 4 -hour RSI is 39, just below 50 neutral zone. Without bullfighting or volume confirmation, the price can stop when resistance.

A reversed candle (bull -absorbing) above $ 3,564 would increase to recover. But refusal for $ 3,491 or $ 3,564 would be bearish and could be pulled back to $ 374 or even $ 3,67.

If ETH breaks over $ 3,564 With volume and bull candlesticks, traders can focus $ 3,681 and $ 3,765. This is fibonacci and historical resistance, setting high probability.

Business level:

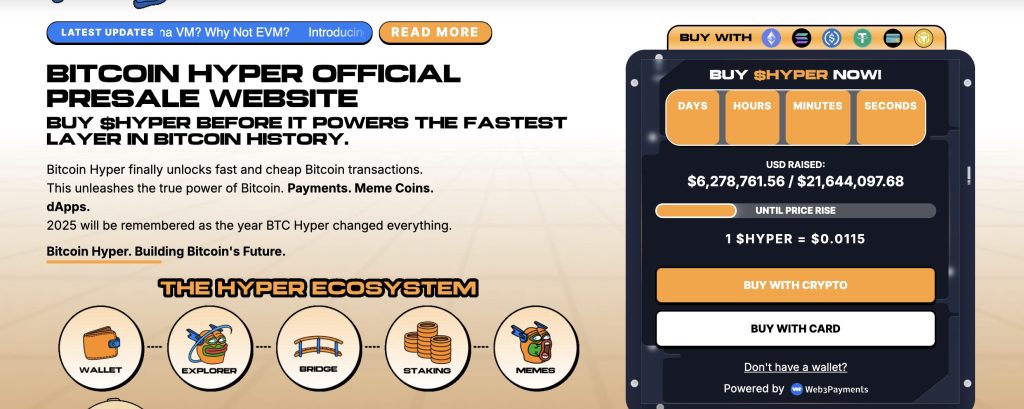

Bitcoin Hyper ($ Hyper)The first BTC-national layer 2-powered Virtual Machine Solana (SVM) has received more than $ 6.2 million in its public pre-platform, with $ 6,278,761 from $ 21,644,097. The token is awarded $ 0.0115, with another price level expects to be announced soon.

Bitcoin Hyper, designed to combine the security of bitcoins with the velocity of the Solana, allows fast, cheap intelligent contracts, DAPPS and MEME coins, all with a trouble -free BTC bridging. The project is audited by Consult and created for scalability, trust and simplicity.

The Golden Cross Meme attraction and real usefulness caused Bitcoin Hyper a candidate for layer 2.

Contribution Ethereum prices prediction: post-rally 13% decrease-is ETH for deeper correction or new maxima? He appeared for the first time Cryptonews.