Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

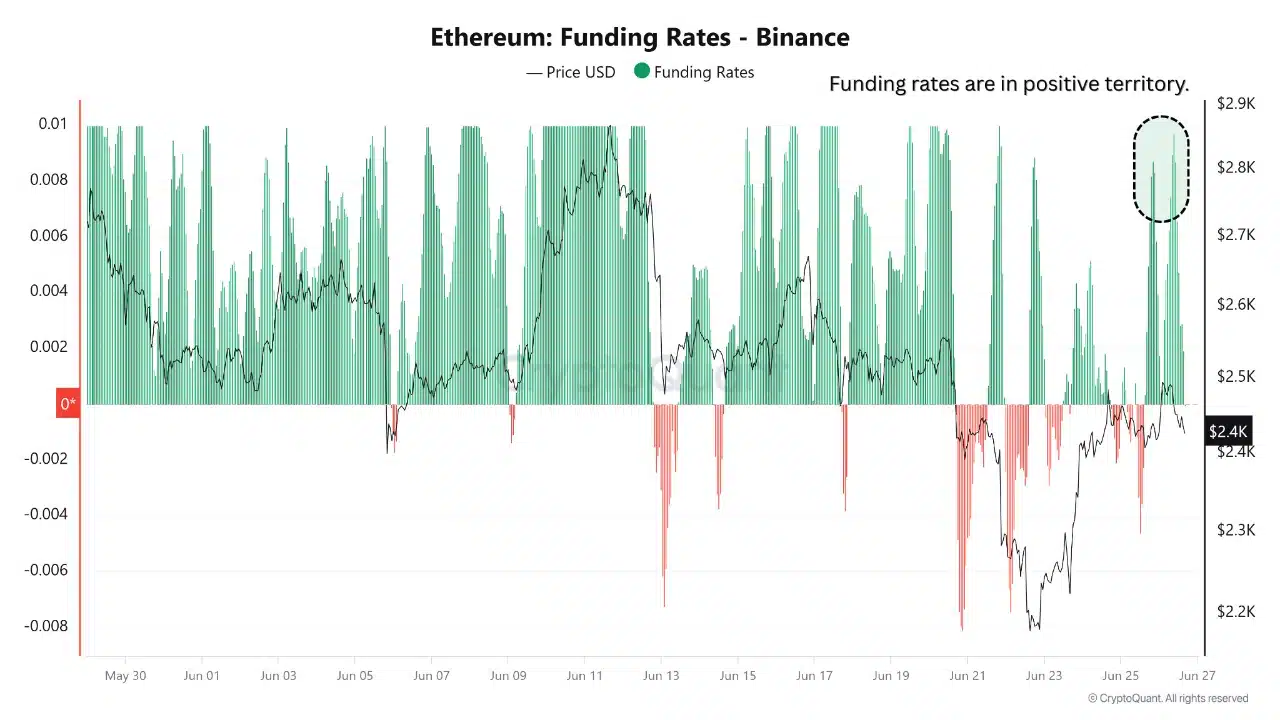

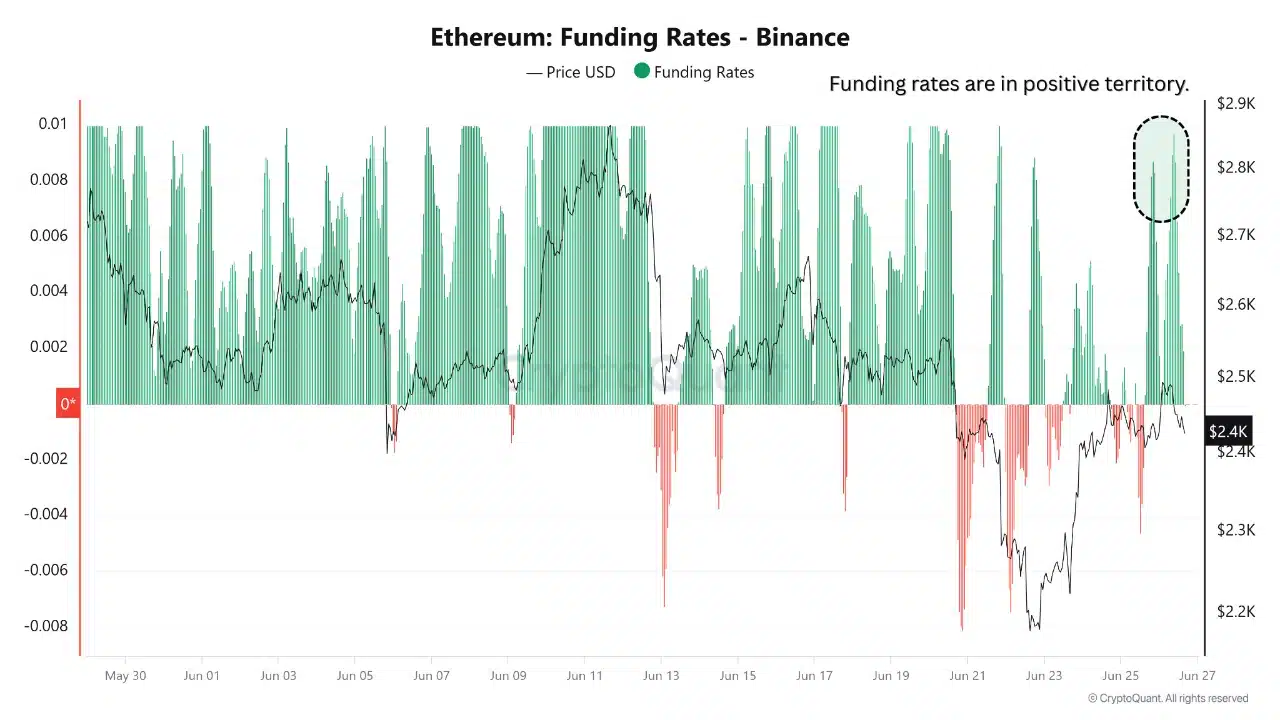

Ethereum [ETH] He published a strong reflection on the latest sessions, which gained a level of $ 2,400, because the rates of financing derivatives on binance have changed positive.

This shift He revealed the influx of long positions because the traders bet on the next up.

Over the past three days, however, more than 177,000 ETH has flowed into Binance, indicating possible profits of large holders. This increased the short -term risk despite the structurally bullishness.

While Sentiment overturned in favor of buyers, the growing influx on the stock exchange indicates caution, as the market participants have re -evaluated the term ascending potential.

Source: Cryptoquant

ETH continued trading within a growing channel when it bounced off the lower trend line near $ 2,195 and consolidation over $ 2,400 at the time of the press.

RSI remained neutral at the age of 47, suggesting that the asset had room for movement in both directions without being reached or sold.

This channel structure historically supported the bull patterns of continuation. However, the buyer must prevent this zone to avoid slipping back below $ 2,200.

Therefore, the ongoing price stability in this extent could serve as a springboard if the wider sentiment remained intact.

The Ethereum activity in the chain showed a weakening divergence between price and daily active addresses. At the time of the press, Divergence Daa, which previously increased positively, began to retreat.

This meant that the growth of addresses did not keep the pace with a price action, which weakened basic support for ongoing recovery.

While ETH maintained levels above $ 2,400, fading divergence can reduce permanent bull momentum.

Ethereum therefore needs renewed network participation to avoid stagnation and strengthen the recent price.

Source: Single

Despite the bull’s technical structure, the daily transaction Ethereum has sharply decreased to 337k – steep decline compared to recent averages.

This decline in activity indicates a potential disconnection between price action and the actual use of the network.

Therefore, even if traders are involved in lever purchase, the activity of users on the chain seems to weaken. If this continues, the lack of transaction demand could undermine the price rally.

As a result, the next step Ethereum can depend strongly on whether users’ engagement has been quickly reflected.

Source: Single

Signals CVD Spot TAKER showed that Ethereum is experiencing dominant pressure on the purchase side at the time of printing. This reflected the ongoing trust among market participants who carried out more buyers of markets than the seller.

Such behavior usually copes with short -term bull trends and strengthens current price levels.

However, due to the conflict decrease in the volume of derivatives and metrics on the chain, this dominance must buy to prevent conversion.

For the time being, the bulls remain under control, but the momentum requires that the support is based on a wide range.

Source: Cryptoquant

The Ethereum revival above $ 2,400 shows technical and derivative market power, but fading of metrics on the chain and the growing exchange influx creates caution.

If the demand persists and network activity recovers, ETH can continue its ascending trajectory. However, if we do not lie growth and the volume of transaction, price momentum could stop below $ 2,500.