Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

While Crypto has already turned its own cash markets (Defense) and his own art scene (Nfts), another boundary is the way we connect online. This chapter is called Socialfi – an abbreviation for “social finances”. Simply put, the concept means that every follow -up, as or a repost can make a small payment. It gives people a conversation to a reduction in the value they create rather than to have the Web2 platforms capture everything.

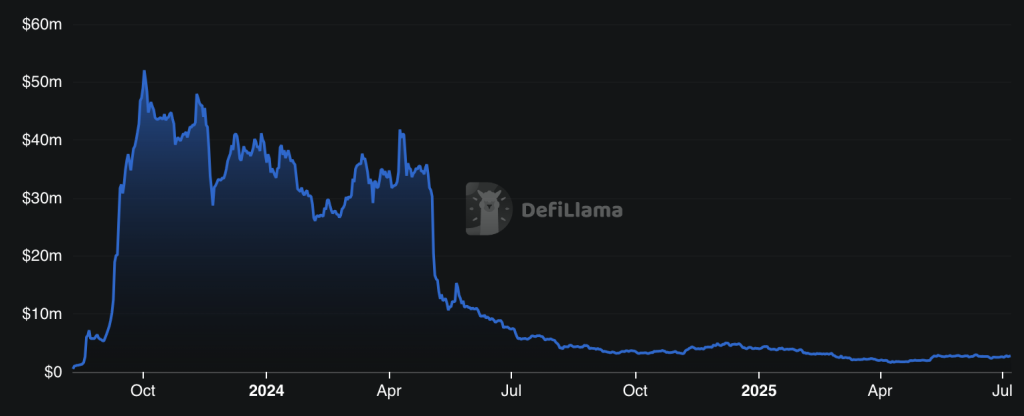

In fact, there is no brand new mechanism because it finally hit the mainstream in August 2023, when the application called “Friend.Tech” allows users to “buy shares” of their friends. For two intoxicating weeks it changed social chatting into a business floor: more than 100,000 people have accumulatedand deposits on the intelligent contract piled $ 50 million. A year later, however, less than $ 3.4 million the remnants.

The case felt familiar – euphoria, vertical graphs, then silence that follows and Burst Bubble.

Today, the second wave of projects is trying to prove that socialfi can be more than a rapid overturning. So they solve real problems and bring real value or just restart the machine for the hype? Let’s see where the evidence shows.

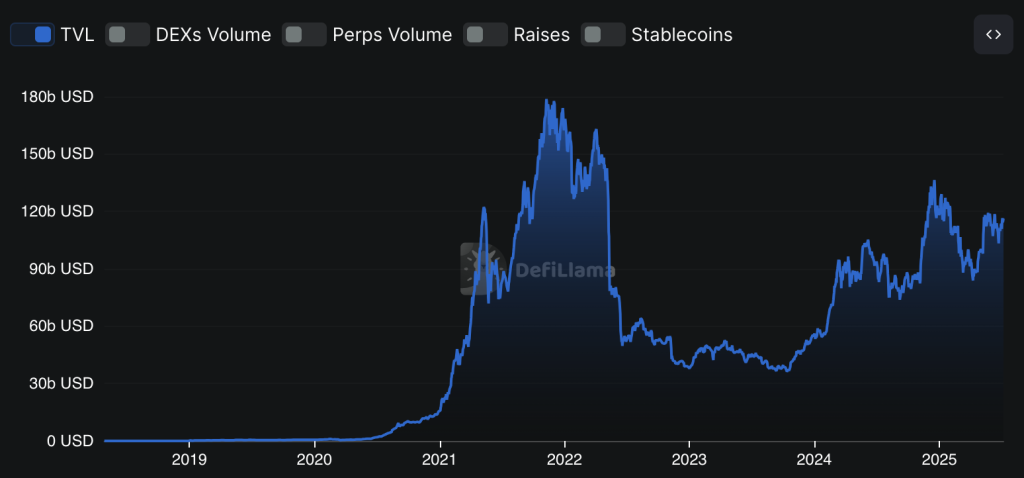

If you scan the market, you may find that the “socialfi” tokens have a value $ 1 billion today. Place this next to the total market limit of $ 3.07 trillion and about $ 104 billion, which are now locked in defi protocols, and the niche begins to look slight. On such a relatively small market, one week of enthusiasm or hesitation can double the chart (or reduce it in half) before most people even notice.

What are the reasons for this whip? The crypto is known to be prone to what is called market reflexivity. It is a loop where rising prices support the belief that faith attracts more buyers and the cycle will intensify – until it eventually breaks. It shows how rising prices can change from the real basics to maintain the story alive.

As an example, take the previously mentioned “Friend.Tech” application. In August 2023, literally every social connection changed to the “key” and the gluing curve behind these keys that were timely applications felt like free money. Thereafter, six -digit registrations and eight -seater bearings were then poured almost overnight.

But the curve proved to be a double sword. The moment when the growth stopped, the keys dropped, the liquidity exhausted, and most of the capital slipped away quietly. Why? Because the boom was driven by a reflective bet that someone else would pay more, and the floor dropped out as soon as the narrative burst.

Takeaway is simple: Sociali needs something more resistant than reflexive price loops if it hopes to grow its phase only for trading. Good news? Some teams create Socialfi models where the price is not the main product.

Although Defi’s activity immersed in Q1 2025, in the “Social” category saw 2.8 million daily unique wallets -O 10% quarter. It is still a niche, but suggests that some users are not just chasing rewards. This is a signal worth paying attention to. Socialfi can now set a different path that is not sent about yield, tokens or Airdrops. And several projects quietly show that this is possible.

Some platforms experiment with paid access. Instead of offering rewards, they charge users a small annual fee for a contribution. The aim is to make spam expensive and keep the lights without starting the token. In this way, it turns the usual script and asks users to pay for a cleaner and more stable net instead of hanging rewards. So far, this approach has gained a certain land, but there is one big question: will people still apply when most social applications are free?

Others focus on portability. In these models, every post is followed as NFT, allowing creators to take their audience across applications. It is an attempt to create an identity owned by a user rather than a locking-conviction. However, the fees for attributing the wallet and the gas fees still create friction, and although they may have a decent user base, the experience has not yet interpreted from the cryptal circles.

The third category avoids tokenization completely – at least for now. These projects are completely delayed, running on non -transferable point systems and skipping the introduction of a liquid asset. This can suppress the hype, but also avoids reflexive cycles that have derailed previous “social” experiments. Whether this patience pays off (or just delaying harsh decisions) is still in the air.

This means that the Token-Light models are not without compromises, including slower growth, limited liquidity and fundraising problems. All together, none of these models offer a definitive answer, but show one thing: Sociali can be explored without the default state.

The way I see it, in 2025, the socialfi does not let the tuning of the curves of gluing or distributing chips to get into the door. This scheme has already done its course. Now it depends on whether someone can build something that people use when there is nothing to manage.

So, my view is: if speculation is the only thing that has attracted attention, then the attention will not take long.

The projects we have explored did not solve the scale, but they showed one thing: use without speculation is possible. Therefore, another real breakthrough comes from the lowest drain protocol. One that offers free on board, spam resistance, portable identity, and people UX really want to stick.

Responding to the responsibility: Opinions and opinions expressed in this article are the author’s views and do not necessarily reflect the views of kryptonews.com. This article is only for information purposes and should not be interpreted as investment or financial advice.

Contribution How could socialfi on board millions – if she avoids her own bubble He appeared for the first time Cryptonews.