Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The native token hyperliquide, $ hype, is traded lower, although its parent platform records historical growth and Ethereum continues its sharp rally.

At the time of writing, Hype is 3.3% in the last 24 hours and 1.1% in the last seven days. Currently, the price is $ 45.13, about 8.5% below the historically highest $ 49.75, achieved at the beginning of this week.

The volume of trading remains increased and will hit over $ 570 million in the last 24 hours, a 13.4% increase compared to the day before.

Ethereum’s Explosive Rally It takes over the flow of capital through the crypto market. It is now traded for $ 3,609, ETH has risen by 43% over the last 30 days, and for the first time since February for the first time broke over $ 3,280, only 9.6% shy of the historically highest $ 4,891 specified in 2021.

Source: ETH Daily Chart \ Cryptonews

It seems that this sharp climb pulls liquidity from smaller altcoins, while the token $ Humbuk saw the disadvantage of a strong two -month rally, which was rising by 80%. Analysts on the chain report profit as a primary driver of a recent correction.

Technical indicators confirm the loss of momentum. The daily RSI token dropped from the peak 73 (overwhelmed) to 60.6, indicating that the buyer will cool down.

Despite the price drop of $ Humbus, the hyperliquid ecosystem is experiencing an unprecedented activity. On July 16, the platform recorded a new historical high day on a daily permanent volume of $ 18.99 billion, showing a massive merchant beer on a new platform.

The open interest also rose to a record $ 13.8 billion, with Ethereum leading fees. ETH represented a volume of $ 5.92 billion, exceeding Bitcoins to $ 5.11 billion, while open interest rates reached an ETH historical $ 2.84 billion, driven by bull traders who persecuted the rise to the current rally.

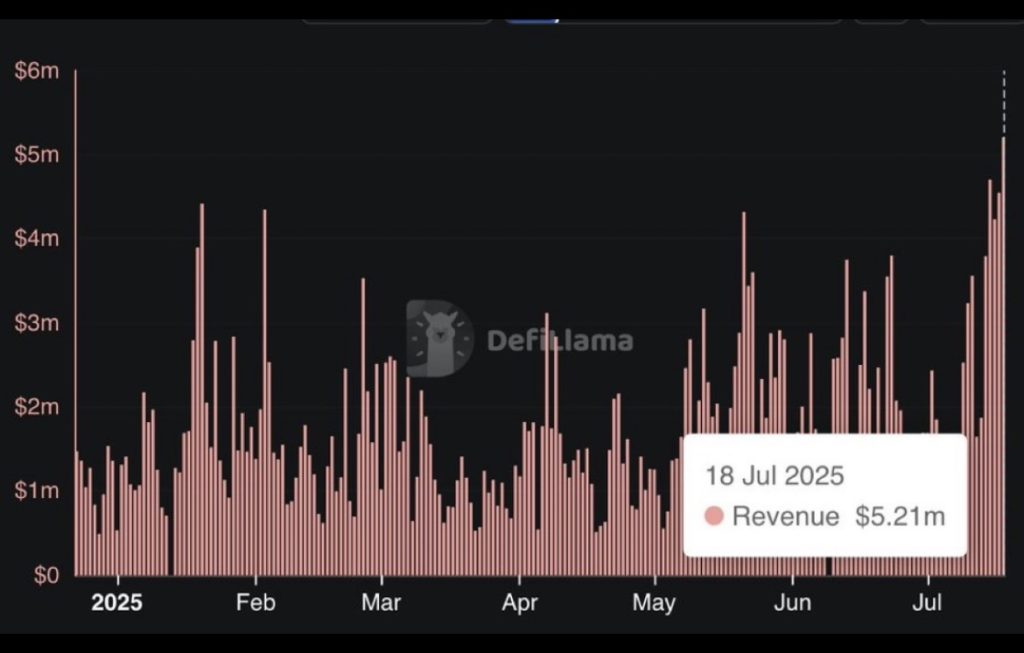

He added hyperliquid to the bulls for the platform and, according to Defillam, also published the highest revenue of daily income of $ 5.06 million.

Source: Procession

Over the past 30 days, hyperliquid has processed more than $ 243 billion in permanent volume. The volume of the Dex platform in the same period reached almost $ 10 billion. Annualized revenues are now around $ 828 million, while the same value is distributed to holders. Annualized fees a total of approximately $ 890 million, reflecting constant growth across the platform.

Institutional trust in the token contributes to dynamics. In early June, Holdings Tony G Convestment Holdings deployed $ 438,000 to $ Humbukbecome the first public company to add it to its cash register.

June 18. Nasdaq appeared Eyenovia became the first US publicly traded company to establish a reserve of the cash registerIncreasing $ 50 million through private placement to accumulate over $ 1 million $ Humbus tokens.

Recently also the biotechnology company Sonnet Biotherapeutics on the NASDAQ list announced plans You want to start the treasury of a digital asset built around the $ Hype token. The agreement includes a planned Ministry of Finance $ 12.6 million token, at the time of agreement at the time of an agreement worth $ 583 million, along with $ 305 million in cash for future purchases, thus increasing the total valuation to $ 888 million.

While the Ethereum strength attracted attention and liquidity from altcoins such as $ Humbuk, the hyperliquid platform itself is prosperous. The key question is whether $ hype can regain momentum in the middle of the dominance of Ethereum.

The price of the hype entered the phase of consolidation after a sharp rally, which reflects what analysts describe as a healthy break after steep profits powered partially momentum in the wider Ethereum ecosystem.

On Monday, $ Hype retreated from a key psychological resistance near $ 50. Despite the Pullback, the uptrend remains intact because the price still respects the lower limit of its ascending channel.

Source: TradingView

The asset has recently been reflected in support of around $ 38.80, and since then the formula has created a continuation, indicating that the possibility of fresh pressure higher if the resistance levels are cleaned.

Technical indicators remain widely supported. The 20 -day exponential gliding average (EMA) is $ 42.93, while a 50 -day simple gliding average (SMA) is located near $ 38.86.

Source: TradingView

Both averages still trend up and RSI remains close to the level of the overbug, usually a sign of strong purchasing interest. The decisive reflection from the $ 45.80 zone would confirm this level as support, which would increase the likelihood of another attempt to break through the $ 50 brand.

If bulls manage to move the price above this threshold, $ hype could target $ 60 at another level.

However, non -compliance over $ 45.55, Fibonacci support, may indicate a deeper repair towards $ 42.89. A permanent step below $ 38.80 would invalidate the bull’s budity and increase the risk of a wider renewal.

Source: Tradingview

The short-term price action on a 4-hour chart indicates a battle for control near 20, while RSI floats just above the neutral territory. This suggests that no party in the immediate period has gained a clear advantage.

Analysts follow the escape of the continuation pattern as a potential trigger for renewed upside down. On the other hand, just below the 50 -day SMA could lean short -term momentum in favor of bears and open the door to move towards $ 41.

Contribution $ Hype slips when Ethereum rises and hyperliquid hits $ 19b – can it bounce? He appeared for the first time Cryptonews.