Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

After all the arguments and mini disputes with Binance’s CZ, is HYPE the real winner here?

Not so long ago, Changpeng Zhao claimed that ASTER would overturn Hyperliquid. Since then, ASTER has fallen over 60%, while HYPE is still holding just below $40, which most see as a minor correction.

Hyperliquid Strategies Inc. recently filed an S-1 with the SEC to raise up to $1 billion through an offering of 160 million shares. A portion of these funds could be used to purchase HYPE tokens. Following the news, HYPE’s price jumped 11% in the past 24 hours, making it one of the biggest gainers in an otherwise sluggish market.

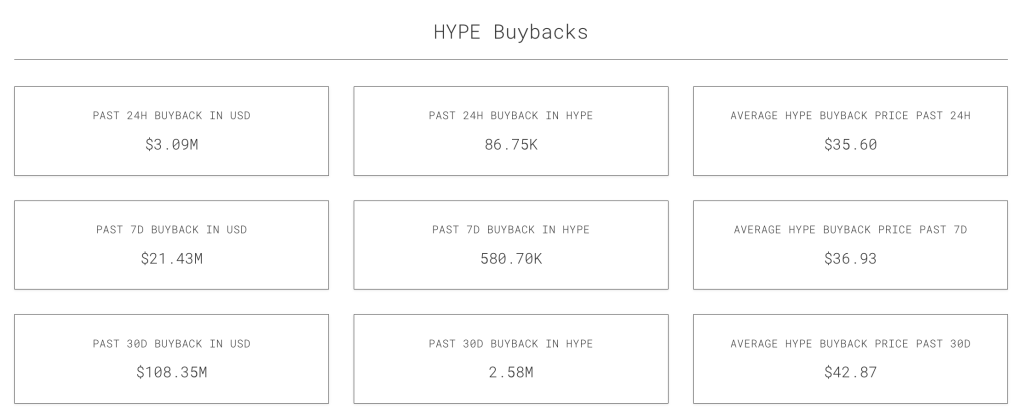

Most of this momentum comes from the HYPE buyback system and the project’s solid performance by the numbers. In the last 24 hours alone, Hyperliquid bought back over $3 million worth of tokens, and $21 million in the last week. These massive buybacks pushed the average price up to around $35.60.

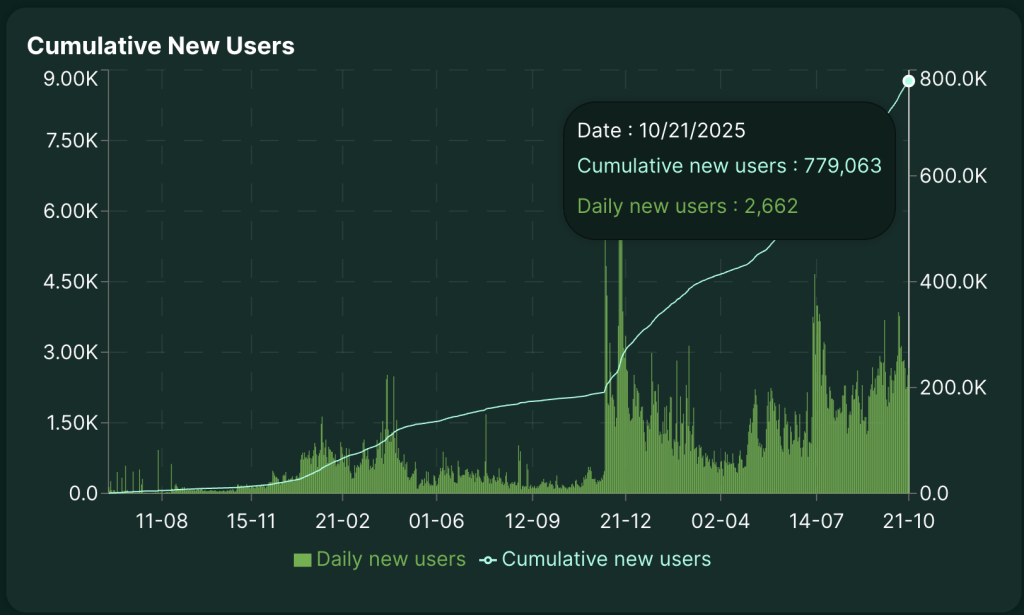

Hyperliquid statistics they go vertically. The latest update on October 21 showed that the total number of new users reached an all-time high of 779,063. Since the end of last year, the platform is currently averaging around 1,800 new users every day.

HYPE is one of the most prominent assets of this cycle and has proven to be one of the most used products in cryptocurrencies. The real question now is, can he sustain this momentum?

HYPE is trying to bounce back after the market crash and tap the 34-35 support zone. This green zone has been a solid area of demand several times before, and the small double bottom forming there suggests some early accumulation.

Right now, the price is testing short-term resistance around 40, which is in line with both a key psychological level and a structural pivot. If buyers flip this area into support, momentum could lead to a move towards 43.6 and possibly even 50.

The RSI is hovering around 61, indicating increasing bullish pressure. Still, if the price is rejected near 40 again, there may be a retest of the 35 zone before an actual breakout.

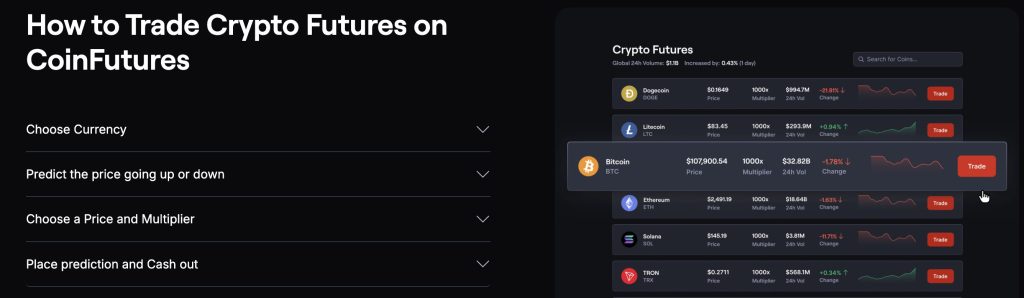

CoinFutures is a new crypto futures betting game from CoinPoker, one of the biggest names in crypto gambling. It allows you to bet on short-term price movements of top coins like BTC and ETH in a fast and competitive setting.

Instead of trading real crypto futures, you are essentially betting on simulated charts that reflect price action. You can go long or short, set take-profit or stop-loss levels and trade without worrying about contract dates or complex mechanics.

Since this is not a real futures exchange, there is no KYC and you can play completely anonymously. You can even use up to 1000x, much more than normal exchanges, and cash out at any time.

The platform is easy to use, CoinFutures has its own section inside CoinPoker. When you open it for the first time, you will see a simple tutorial on how everything works.

CoinPoker does not charge fiat or crypto deposit fees, although withdrawals come with small costs, such as 5 USDT per USDT withdrawal and 1 USDT per BTC. You can withdraw up to 25,000 USDT per day.

Overall, CoinFutures gives you the thrill of crypto trading with the speed and simplicity of a betting game, no stress, no KYC, just fast action.

Visit the official website here