Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The Innal Revenue Service (IRS) criminal division has been controlled for not having been properly documented and watching billions of dollars in confiscated cryptocurrency assets according to recently confiscated cryptocurrency assets message General Inspector of the Ministry of Finance for Tax Administration (TIGTA).

The survey of the guard dog, which was published this week, shows the main outages of how the IRS criminal investigation (IRS-C) processes digital assets seized in criminal cases.

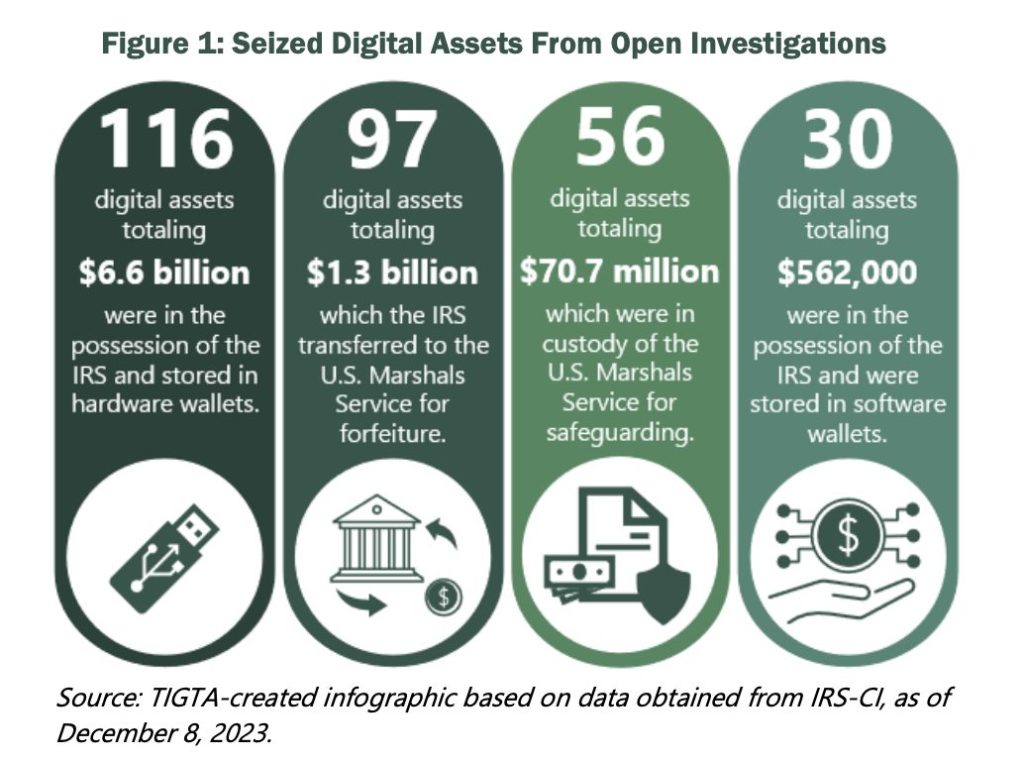

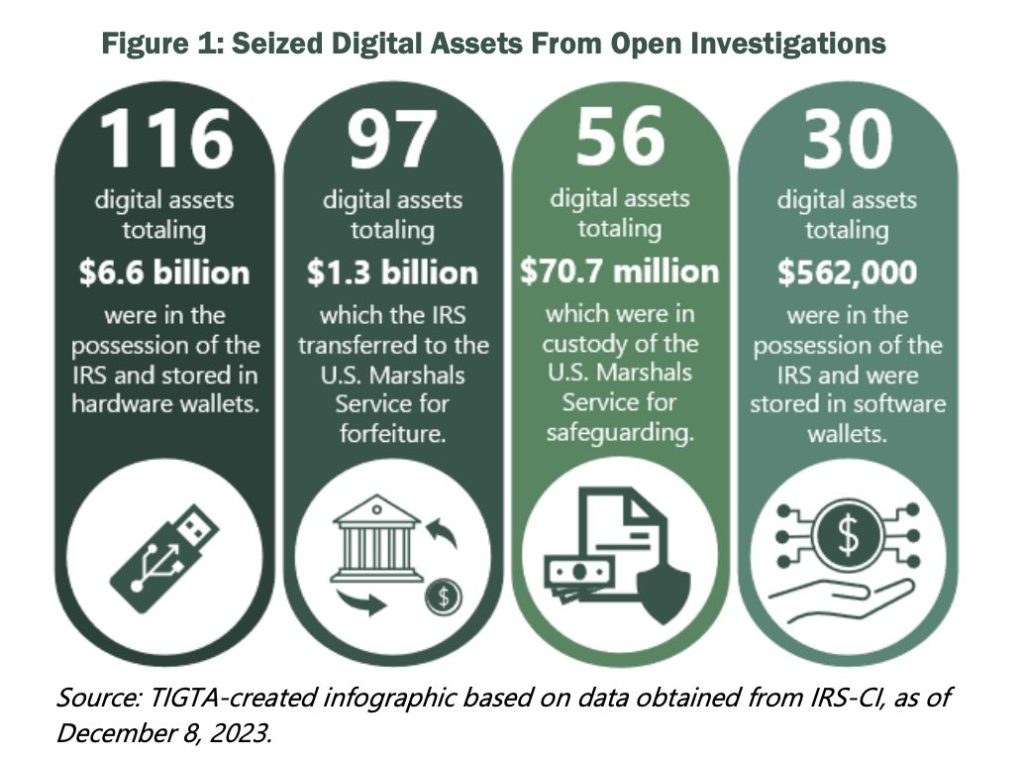

At the end of 2023, the agency was interested in approximately $ 8 million in digital assets linked to the opening of the investigation. Yet Tigta found that IRS-CC had not kept following its own procedures for documenting these seizures, with key data remaining missing or incorrect.

One main problem included the desired seizures. The purpose of these documents is to formally register digital assets to government wallets.

Tigta found that not all seizures had such remarks, and among those who did it, many of them lacked major details such as wallet addresses, transaction amounts or even a seizure date. In one case, the addresses of the wallet were mistakenly confused.

In addition to the gaps in the papers, the message marked more serious concern. Investigators found that three hardware wallets disappeared after the FBI was handed over.

In another case, IRS employees shred the phrase again for the government’s wallet, which risk a permanent loss of access. While the funds were eventually renewed, the report noted that such mistakes could lead to irreversible losses.

IRS-Ci was also criticized for the transfer and Litecoin asset to Bitcoin during a seizure. Failed to maintain the asset in its original form. Later, the agency updated its instructions to maintain a confiscated crypto in its native format. However, this change came only after Tigta raised concerns in May 2024.

Record disorders have expanded to the IRS system, known as Aftrak.

Approximately 43% of the confiscated crypto assets were shown in the wrong place. In addition, several items had a mismatch of the amount that could affect the valuation of assets. For example, one confiscated holding of bitcoins was underestimated by more than $ 9,000 for a simple decimal error.

Tigta issued six recommendations, urged the IRS-CC to improve inventory systems, clarified internal instructions, and promote the timeline for documentation. IRS agreed to five of them and partially accepted the sixth, quoting complications in the real world while maintaining types of assets during seizures.

Since crypto seizures are likely to grow, there is now pressure on the agency to improve their checks and prevent expensive incorrect steps.

Contribution IRS culpable over the records of crypto seizures – here’s what to know He appeared for the first time Cryptonews.