Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Institutional money has changed as crypto traded. Bitcoin and Ethereum are now responding to economic reports in a way that reflects traditional assets. CPI reports, inflation and interest rates move prices. This shift means that macroeconomic indicators are no longer optional for crypto traders. They are part of the main book.

This article explains how official inflation data, central bank rates and crypto-specific indicators such as Bitcoin dominance can help predict market trends. The analysis is based on MAKRO editions, crypto graphs and research from large shopping tables.

The aim is not to predict accurate movements, but to offer practical guides to understand how wider economic trends create crypto performance.

Inflation began to rise sharply at the beginning of 2022. Consumer price indexReported by the Office for Labor Statistics, reached nine percent year -on -year in June. Bitcoin dropped by six percent within three days of this issue. Investors moved from risk assets and expected stricter financial conditions.

This formula continued until 2023 and 2024. When CPI came to lower than the forecasts, bitcoins often reflected. For example, in November 2022, a month was 0.1 percent against a prognosis 0.3 percent. Bitcoin has gained Almost four percent in two days.

This repeated reaction suggests that bitcoins are now traded as technological shares. In the short term, it does not act as a hedge against inflation. Instead, the expectations of interest rates follow. If inflation values shift the federal reserve towards cuts, traders often turn to the crypto. If inflation jumps, traders leave quickly.

The CPI for May 2025 showed that price growth slows towards the target of the federal reserve system. If this trend continues, investors can again add risk. However, if energy or wage costs increase inflation over forecasts, expectations may move back to tightening.

Traders are likely to adjust positions in Bitcoins and Ethereum based on these editions. The CPI release now acts as a short -term price driver.

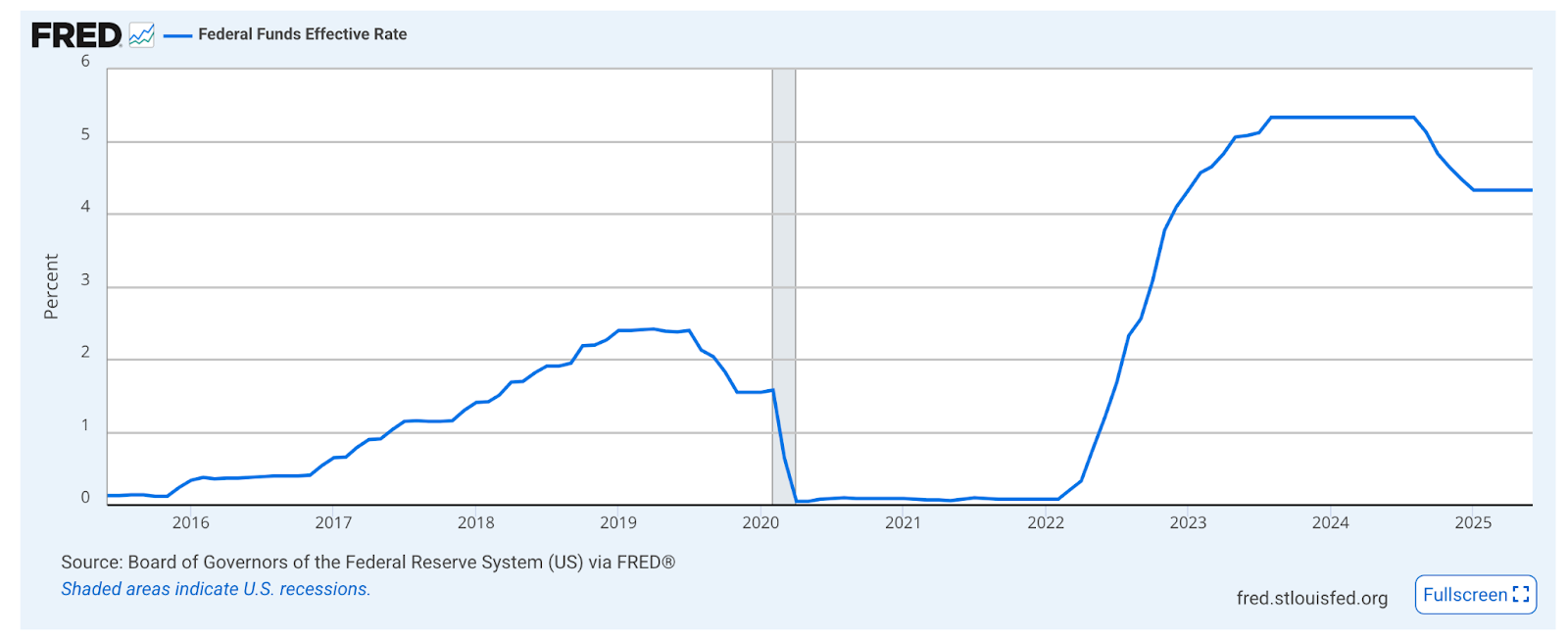

The federal reserve system began increase in interest rates In March 2022. This cycle lasted until mid 2023, with the target range reached 5.25 to 5.5 percent. Any increase indicated stricter liquidity. Ethereum often fell on the days following these notifications and reflected a decline in growth actions.

Ethereum Price 2022 (Source: CoinMarketcap)

The sensitivity of Ethereum to the evaluation decision has become clear at several key moments. After an increase in 75 basis points from June 2022 ETH, it dropped by more than eight percent to 48 hours. The same pattern was repeated in September. On the other hand, when the Fed stopped in July 2023, ETH bounced almost five percent over the next three trading sessions.

However, one exception came in March 2023. Silicon Valley Bank’s collapse launched panic on financial markets. The Fed raised rates by 25 basis points, but indicated that it could stop soon. This shift helped ETH recover when it climbed from below $ 1,400 to more than $ 1,800 within three weeks.

These events show the link Ethereum to Monetary policy. Rating increase the conditions and push ETH down. Pauses or symptoms of release often lead to sharp rebounds. Ethereum trades as a representative for the risk of taste in the liquidity market.

Bitcoin dominance It monitors the percentage of the total market value of the crypto that is held in bitcoins. When dominance rises, it often reflects retreat to safety. During the tightening period, investors reduce the exhibition to smaller tokens and move capital to bitcoins. This behavior reflects wider risk patterns.

US interest rate 2015–2025 (Federal Reserve Bank)

From the end of 2021 to 2022, the dominance of bitcoins has climbed from less than 40 percent to almost 48 percent. This step came during sharp inflationary tips and many Fed rates increase when the market withdrew back from speculative assets. The dominance again increased in the middle of 2023, just before the Fed indicated a break and dropped shortly thereafter.

This pattern supports the well -known cycle. Bitcoins lead in the early stages of risk. Once stabilized, capital turns into Ethereum and then to altcoins with a lower market value. Dominance drops often refer to the beginning of these rotations. The index can act as a sign of changing sentiment on the market.

Bitcoin dominance reflects how crypto investors respond to wider economic shifts. It can act as a barometer – it moves up when uncertainty grows and decreases when conditions prefer a higher risk.

In the past year, institutional research has an increasingly tied macro indicators with digital asset performance.

In the October 2024 report, Crypto.com The research said “economic growth may generally indicate a more favorable environment for cryptocurrencies, but the impact will vary depending on other market conditions.” They noted that “growing correlations between traditional markets and cryptocurrencies mean that the performance in the stock market can potentially provide valuable knowledge of potential trends”.

Looking forward for another 90 days includes several macro events that could affect the crypt direction. July CPI data is due on August 12, while the consensus predicts a year -on -year increase of 2.8 percent. Another FOMC meeting is September 17th, where markets currently prices by 25 basis points. The Nonfarm Payroll Group (payable 6 September) and revision Q2 GDP (29th August) also excel in volatility.

This data offers key decision points. Lower CPI prints could strengthen the expectations of feeding and push capital into risky assets. On the other hand, these expectations can reduce stronger than the expected payroll. Flow -related flows and cryptomitative reactions are likely to depend on these allusions, which strengthens the case that macro indicators now control a wider crypto narration.

Macroeconomic indicators now play a measurable role in shaping the market crypto direction. Inflation data, Central bank policyAnd internal metrics, such as Bitcoin dominance, have shown clear relationships with past pricing changes in both bitcoins and eThereum. These characters, when they are aligned, can offer a grounded framework to interpret future movements.

While no model captures every round, CPI’s release, FOMC decision and market reaction allows more informed positioning. Macro data does not replace crypto-red analysis, but adds a wider context that is increasingly harder to ignore. Maintaining the economic calendar in the perspective can prove to be useful as any technical chart.

Contribution Makro meets the crypto: predict prices with CPI, Fed Rates and BTC dominance He appeared for the first time Cryptonews.