Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

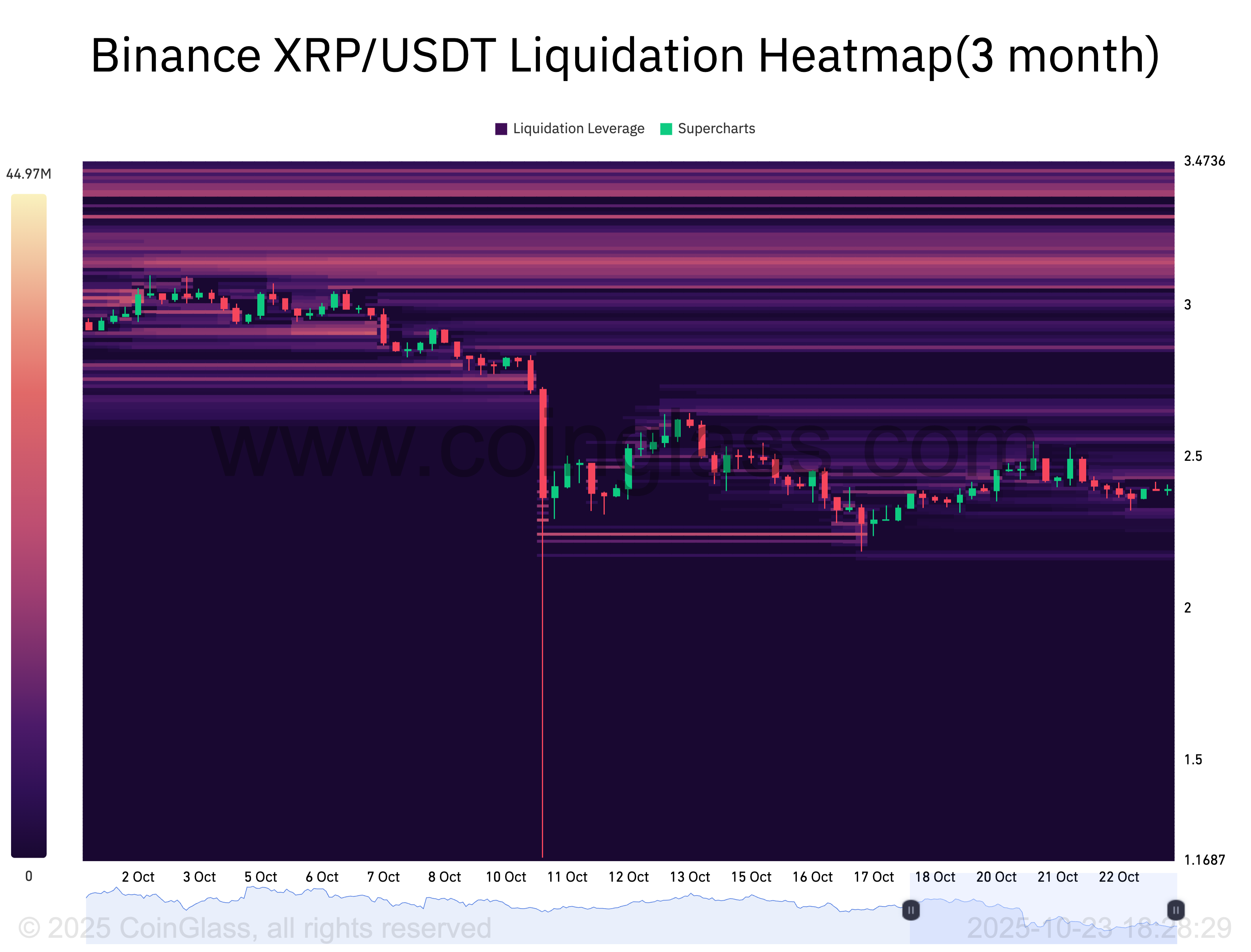

XRP trading around $2.40 shows an uneven setup: for the bears to reach their maximum pain point, the price would have to rise almost 30% to $3.08, while the bulls would only need to drop 10% to reach their own pain point at $2.31, as shown in CoinGlass.

This means that the bear side is taking on much more risk. If XRP price it will hit $3, putting pressure on current positions and may also lead to $15.45 million worth of liquidations where the cash-strapped will have to buy back into the rising market.

But on the other hand, if you are a bull, you only have to deal with a little risk because your maximum pain milestone is so close to the current point. That means you don’t need as much capital or as much conviction to defend it.

After falling to $2.20 in October, XRP has stabilized, sitting in a tight $2.30-$2.50 range. Sellers have not been able to push below this lower limit and every time XRP bounces back to $2.50, putting pressure on shorts as they know the $3.08 level is close in percentage terms. Meanwhile, bulls are doing well as their downside risk is kept in check.

With the shorts needing a 30% rise to avoid the worst and the longs only needing a 10% drop to get theirs, it looks like things are going to be volatile. The market doesn’t need news to ignite it; the maximum pain mechanic has already set the scene.