Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

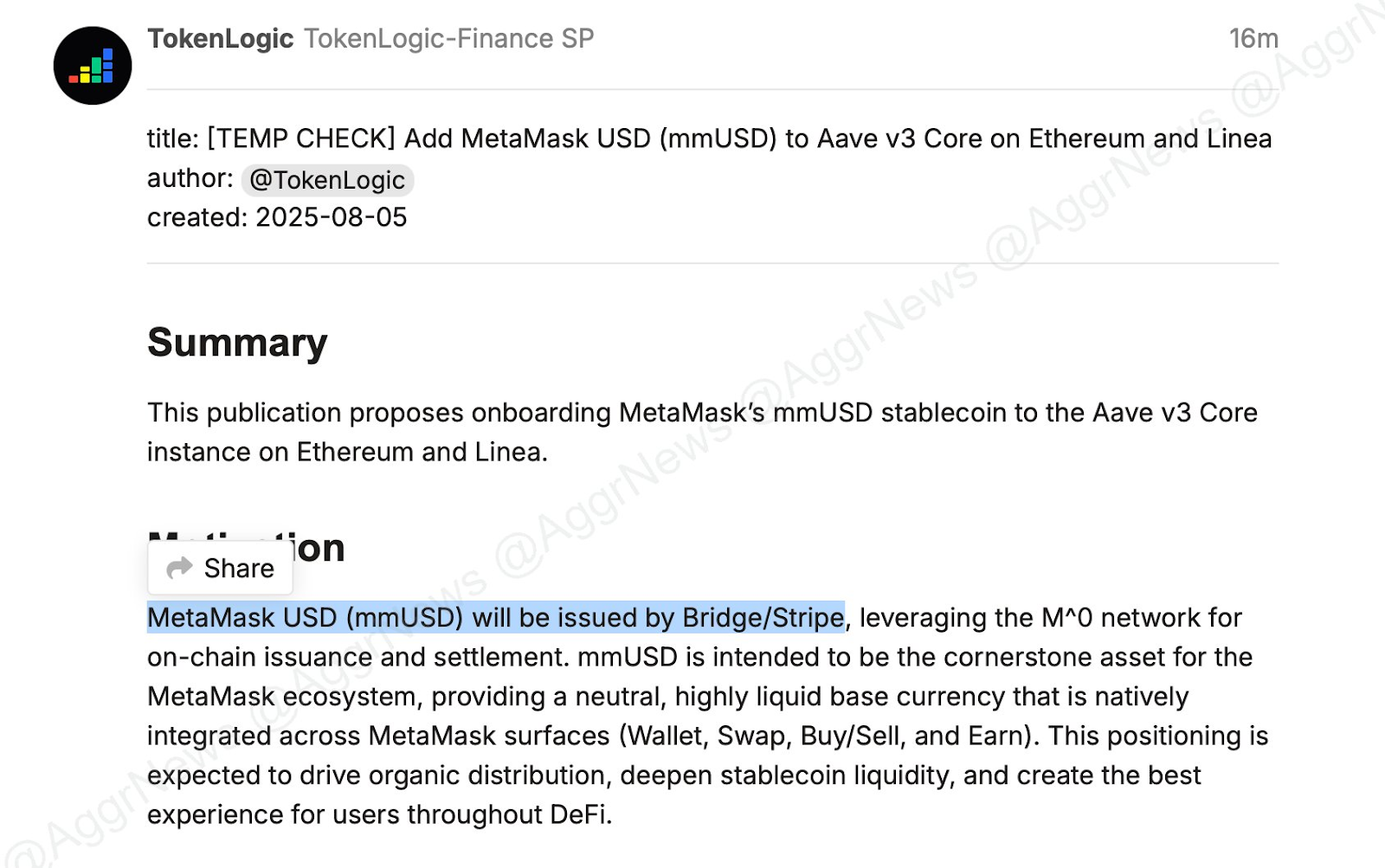

The proposal of administration, which circulates in the Metamask community, reveals plans to launch a “metamask USD” (MMUSD) through a partnership with Stripe payment infrastructure and potentially creates a direct competitor for established stablecoins such as USDC and USDT.

The proposal It denotes building mmusd in the M⁰ network for decentralized publishing and settlement, while stripe serves as a issuing partner to ensure regulatory clarity and credible Fiat support.

Metamask serves 30 million Monthly active users around the world through one of the most used non -odial wallets in Web3.

The proposed mmusd would function as a basic currency in the ecosystem of Metamask, while integrating with defi protocols such as Aave for loans, loans and revenues.

Stablecoin initiative monitors the recent metamask Launching card In collaboration with Baanx and MasterCard, allowing users to spend crypto directly from self -confident wallets without giving up ban on banks or exchanges.

Neither Metamask nor Stripe officially confirmed the development and left key details about reserve models and adherence to non -Adressed regulations. In fact, the initial administration and administration of public affairs were.

The proposal is in line with the industrial stable rush after the passage of the Genius Act, which introduced the federal regulatory framework for the release of stablecoin.

Legislation has raised the interest of the main corporations, including Western Union, interactive brokers, and all examiners of Stablecoin for modernization of payments.

Stablecoin sector quickly expanded to market capitalization to more than $ 250 billion, with Ripple CEO Brad Garlinghouse projects growth at 1-2 trillion $ Over the next few years.

Genius an act, Signed by President Trump in JulyIt distinguishes stablecoins as payment tools rather than investment products in creating clear regulatory instructions.

Western Union CEO Devin McGranahan announced pilot programs in South America and Africa Modernize operations of global remittance through stablecoins.

The company perceives stablecoins as an opportunity to streamline cross -border transfers and improve currency conversion into markets with insufficient operating, where average global remittings fees of 6.6%.

Founder of interactive brokers Thomas Peterffy also confirmed that the company is examining the Stablecoin start optionspotentially allowing real -time financing for brokerage accounts.

The market value of $ 110 billion serves nearly 3.9 million customers and already supports trading crypt through partnership with paxos and zero hash.

Last release for their testing beta beta Digital wallet with multiple currencies supporting both Fiat and Stablecoinswith a live commitment scheduled for September.

Finech, based in Seattle, added Stablecoin payouts via Bridge, an infrastructure provider owned by the lane, integrating the USDC into internal treasury operations.

All these adoptings of the company come as the Governor of the Federal Reserve Christopher Waller recognized The importance of stablecoins, with 99% of the market capitalization of stablecoin is associated with the US dollar.

The Federation believed that “stablecoins could keep the dollar world reserve” by being more affordable around the world.

Coinbase and PayPal continue to offer Stablecoin yield programs Despite the provisions of the Act on Brilliant Laws, it explicitly prohibits interest payments from Stablecoin issuers.

Both companies claim that the limitations do not apply because they act as intermediaries rather than direct issuers of the Stablecoins they reward.

Coinbase CEO Brian Armstrong said, “We are not an issuer”, while defending 4.1% of APY of the company’s Holdings company.

Although Coinbase jointly developed the USDC with a circle, in 2023 it ceased to be formal issuing obligations, the circle now served as the only issuer without offering direct return.

PayPal offers 3.7% annual revenues of Pyusd Holdings through PayPal and Venmo platforms.

While Pyusd bears the name PayPal, the technical edition of the third -party paxos allows PayPal to require exemption from the limitation of brilliant laws.

Formerly, Senator Elizabeth Warren warned This private launch on the Stablecoin market could create invasion and systemic risks of privacy and predict companies would “lose rescue when they inevitably throw away”.

Despite criticism, global corporation, including Amazon, Walmart, Jd.com and AlipayContinue to investigate the integration of stablecoin.

Stablecoin’s competitive space has intensified with approximately 20 million addresses now a transaction with Stablecoins on public blockchains.

The proposed Metamask entry would use its massive user base and the Infrastructure of Stripe Regulations to claim its market share.

Contribution Metamask plans to launch USD Stablecoin with Stripe Partnership, Administration’s proposal reveals He appeared for the first time Cryptonews.