Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

With me:

Moo deng (MOODEng) has touched 0.32 $ since the beginning of May before retrieving, by more than 600%.

From May 1 to May 14, the price of MOO deng jumped by 645.3%and climbed from 0.042 to $ 0.31. The token reached the peak of May 13 for $ 0.32, although it still trades almost 53% below the historically maximum maximum of $ 0.68, reached 15 November 2024.

Wider Meme coin market He also picked up. Over the past two weeks, tokens like dogwifhat (WIF), floki (floki) and PUDGY PENGUIN (PENGU) have returned. Bonk (Bonk) is also back in the center of attention, partly because of the restored interest in his launchpad. Some already draw a comparison between Bon’s ecosystem and pump. Fast rise.

The MEME coin activity increases that traders are moving into more risky assets, far from Bitcoins (BTC) and altcoins with great capitalization. This shift is usually linked to wider optimism on the market. One such trigger recently came, when the United States and China agreed to a temporary three -month trade ceasefire. By agreement Trump tariffs would be reduced from 145% to 30% in the US and from 125% to 10% in China.

In the case of Moo Deng, the key driving force was his recent rally announcement about the list of binance Alpha. May 11. The platform confirmed that the list of Moodeng, along with Goatseus Maximus (goat), coins meme with ties to AI stories.

The news helped move the price sharply higher and attracted a new interest. According to Holderscan, 165 new wallets bought about 25% of the total MOODEng offer in a few days. Many of them began to accumulate tokens before publishing Binance and seem to have benefited most of the move.

Since then, the price of Moo Deng has pulled back to approximately $ 0.20, which raised the question of what would come next.

Some traders expect another disadvantage. One widely shared prediction indicates a decrease in towards $ 0.118, which after a week of profits cope with a wider weakness on the market.

Others are more optimistic. Some believe that Moo deng could get back its previous historically high high high high almost $ 0.60.

In the short term, however, several market observers expect the price to approach $ 0.10.

Since the beginning of last week part Meme coin market They began to move again and triggered a new wave of tokens. This momentum has pointed out renewed attention – and risk. As usual, the number of fraud may also increase during these spikes, so caution is recommended.

The wider crypto market is currently undergoing repair. Yet Bitcoin still holds above $ 100,000 and strengthens its dominance.

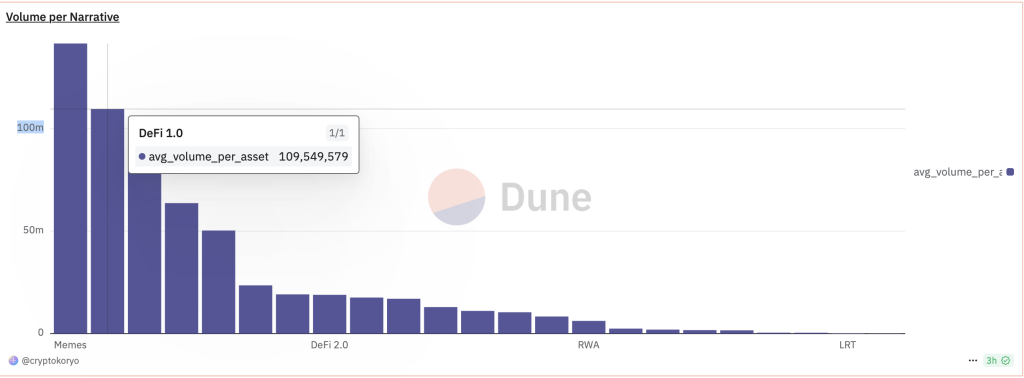

According to DuneMeme Coins currently lead all categories in volume trading and reach $ 141.5 million. Tokens from the defi sector 1.0 follow $ 109.5 million.

Part of this activity is associated with the rise of a new story around the coins “Internet Capital Markets” (ICM). These chips are often announced publicly before the start of basic projects. Theoretically, this approach helps to attract capital in time and speeds up development.

One example is the triggering coin to believe (launchcoin). According to Geckoterminal recently ranked fifth in the volume of trading between all Decentralized Finance (Defi)just behind Official Trump (Trump).

The recent revival of Meme Coin, led tokens like Moo Deng, suggests that the market appetite for risk remains strong, at least in the short term. While some traders are placed on the next, others remain cautious and point to wider market correction and speculative nature of many of these assets.

Contribution Moo deng in May 645%, but traders expect a decline He appeared for the first time Cryptonews.