Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

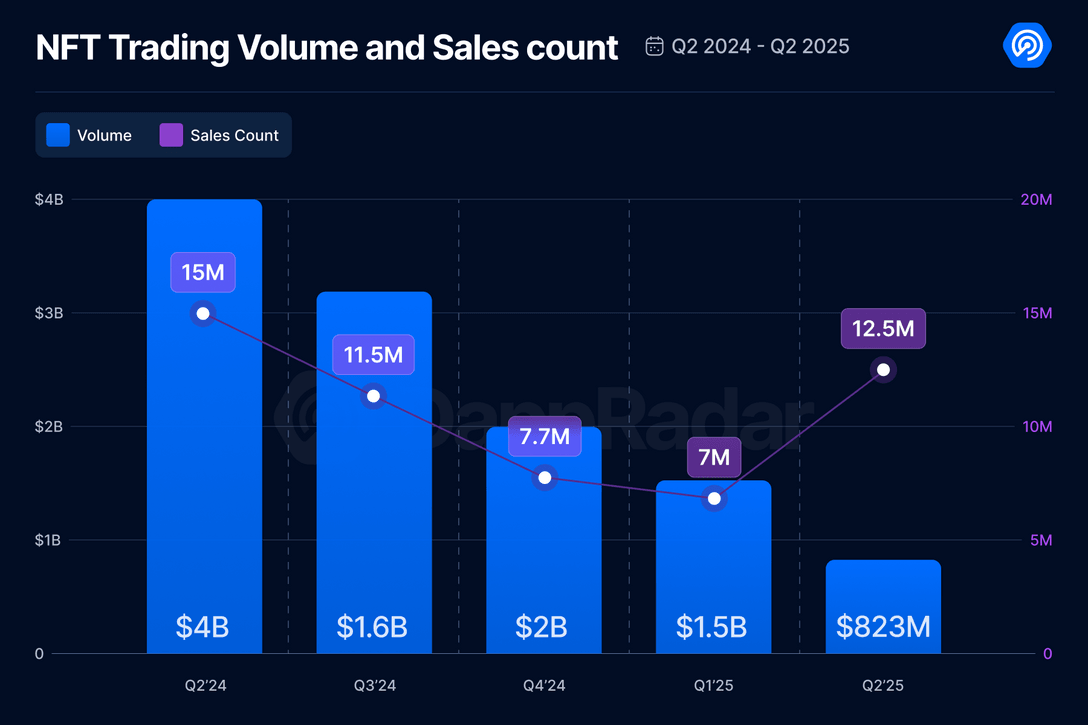

Nft Trading volumes fell after the fifth consecutive quarter and, according to Q2 2025 out of 2,2025 in fourth place out of $ 4 billion during the previous year, according to the previous year, according to Dappadar data.

A sharp decline is the weakest performance, as the NFT market reached its peak in 2022, when the annual trading volume reached over $ 50 billion.

Despite the declining trading trade, NFT sales in this quarter actually increased by 78%, indicating that prices have fallen significantly while interest is left.

The NFTS profile image has seen a significant decline, with a 72% decrease in the volume of trade volume, while the real world assets increased to second place and published a 29% increase in volume.

The number of monthly NFT traders has increased by 20% to 668,598, indicating that users are returning to space with different motivations than in previous cycles.

Domain NFT has experienced growth -powered blockchain activity tonWhere telegram users buy anonymous domains based on numbers connected to accounts without SIM cards.

The NFTS game dominated quarterly charts for the first time in the years when Guild of Guardians secured two positions in the top five collections and overcame projects with blue chips such as Cryptopunks and the bored apes of Yacht Club.

In the art category, the KO 51% was reduced, but a 400% increase in sales, allowing more accessible art NFT for a wider audience.

During the decline, it closes several main platforms.

For example interrupted its NFT market 8. April after a Security violations $ 1.46 billion North Korean hackers.

The stock exchange quoted efforts to “streamline tenders” and at the same time directed users to alternative platforms, including Opensea, Blur and Magic Eden.

The last time, Solsniper announced the closure of its 3.5 -year market Solan NFT 13th June automatically discarded NFT and return the balances of menus.

The platform explained that it would continue to function as a company and at the same time closed all NFT -related products to focus on telegram business robots and MEMECoin tools.

Similarly, LG Electronics has closed its LG Art Lab NFT platform after three years of operationTermination of integration that allowed users to buy, sell and display NFT directly on smart TVs.

The closure follows the similar exits Kraken’s NFT market and Nike’s RTFKT Venture in December 2023.

VK, the largest Russian social media platform, also Turn off the mushroom VK NFT 15. April in the middle of assembly financial losses Out of $ 94.9 billion ($ 1.1 billion) in 2024.

In addition, X2Y2, formerly the fourth largest NFT platform according to volume, has stopped Operations 30th April have seen only $ 53.5 million trading in the last year.

However, in the middle of all these, Opensea maintained its leadership on the market despite a sharp decline in the volume of trading, increasing sales associated with the upcoming Airdrop $ AirDrop AirDrop.

Users actively trade cheaper collections for agricultural points for future rewards, after known AirDrop campaigns.

Especially, The NFT credit market collapsed from nearly $ 1 billion a month In January 2024 to just $ 50 million in May 2025, which represents a 97% decline.

The debtors dropped by 90%, while the creditors’ participation has fallen by 78%since the previous year, with the average loan size to reduce from $ 22,000 to $ 4,000.

Gondi overtook the Blurn Blurn protocol to lead this industry with 54.2% of the total outstanding volume.

Blend previously checked more than 96% of the market through AirDrop incentives and aggressive strategies turning, which did not survive the conditions of the bear market.

The preferences of the collateral have shifted significantly across the platforms.

Traditional platforms, such as NFTFI and Arcade, are dominated by penguins with more than $ 203 million in a loan since January, followed by Azuki and a bored ape.

GONDI users focus on Art NFT and 1/1 pieces, while cryptopuns lead active loans to $ 21 million.

The conquest of loans in May 2025 tightened to an average of 31 days, from 40 days in 2023, indicating a more cautious and tactical approach between debtors.

With all these decreases, it is clear that the sector is experiencing a basic shift from speculative hype on cases of use aimed at benefit between experienced collectors and users.

Contribution NFT Trading will drop the fifth consecutive quarter by $ 80% to $ 823 million, Dappradar reports He appeared for the first time Cryptonews.