Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Tokenized assets in the real world (Rwas) became one of the fastest growing categories in the crypto-on the other only for stablecoins, according to the complex “RWA in finance on the chain: H1 2025 market overview” from the modular blockchain Oracle Redstonein cooperation with Glove and RWA.XYZ.

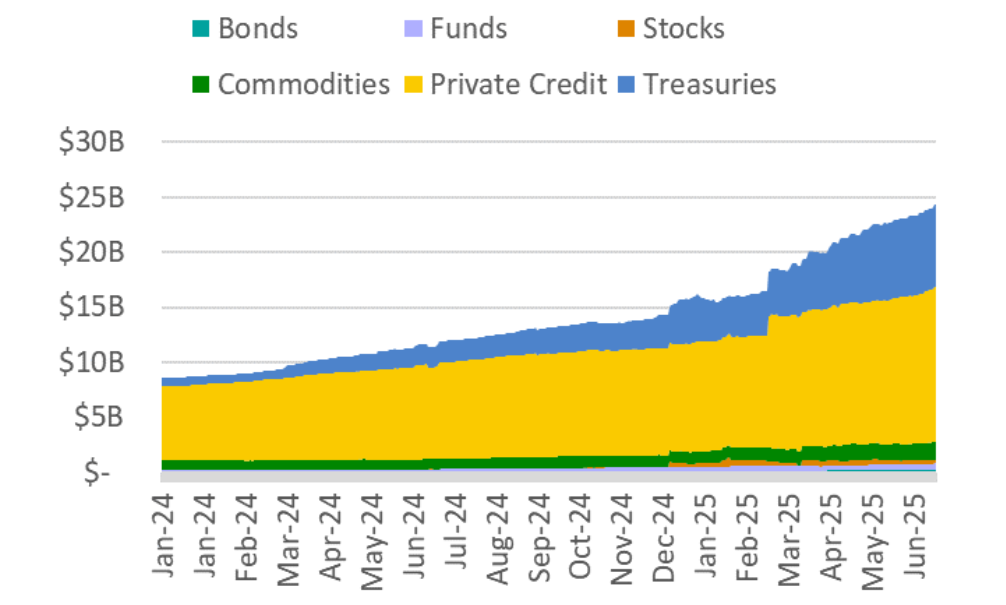

The Tokenized RWA The space moved from “Buzzword to a financial system with more billions of dollars,” the report says. Since January 2024, the total value of Onchain RWA (with the exception of Stablecoins) has almost tripled. Until December 2024 it reached $ 15.2 billion, which meant a year -on -year growth of 85%.

Until June 2025, this market has historically reached $ 24.31 billion.

This is an estimated $ 5 million – $ 10 billion in 2022. In the first half of 2025, the RWA market increased about 260% of $ 8.6 billion. It is assumed that it will continue to grow.

In addition, according to the report, several specific elements have led to this growth. These include higher interest rates that have increased demand for tokenized assets carrying revenues. In addition, the main issuers have brought institutional products to the market, while Defi platforms began to integrate tokenized assets into their collateral and liquidable frames.

In 2024-2025, “the tokenization of assets certainly moved from experimental pilots to modified institutional acceptance,” the report says.

Meanwhile in -mail CryptonewsThe team notes that the RWA tokenization market has shown “remarkable resistance”, despite the escalation of military tension between Israel and Iran, which starts in mid -June, while the US joined a few days later. The market increased within a 12 -day period of $ 464 million to achieve this ATH since June 25th.

“Permanent momentum in RWA capitalization suggests that institutional and retail investors continue to consider tokenized real world assets as a viable investment vehicle, although traditional markets are facing geopolitical instability,” the team says.

Private credit is the largest segment of RWA tokenization since June 2025, the report has found. More than $ 14 billion of the current RWA market or more than half is currently composed of a tokenized private loan. This shows “an institutional appetite for the credit markets on the blockchain.”

Tokenization reduces operating costs, increases availability and distribution and creates “potential for robust markets secondary liquidity”.

“As soon as he was limited to institutional tables and non -skilled vehicles with seven to ten years of locking, private credit was transformed by tokenization,” he says.

In addition, industrial projections indicate that 10% -30% of global assets could be tokenized by 2030–2034. It is “Location of RWAS bridging Aktiva Traditional Finance in the amount of $ 400+ USD trillion in blockchain – more than 130 times larger than the current market ceiling Crypto ~ 3 trillion dollars”.

In particular, this massive growth is not the result of hype or subtitles, reported in the report, but “hard financial logic”. Institutions are looking for higher returns and faster access to capital. Blockchain and tokenization give it.

The study also concluded that tokenized assets could soon intervene “critical quantity” on institutional and consumer markets, “not as a new class of assets, but as a basic upgrade on how existing capital markets work.”

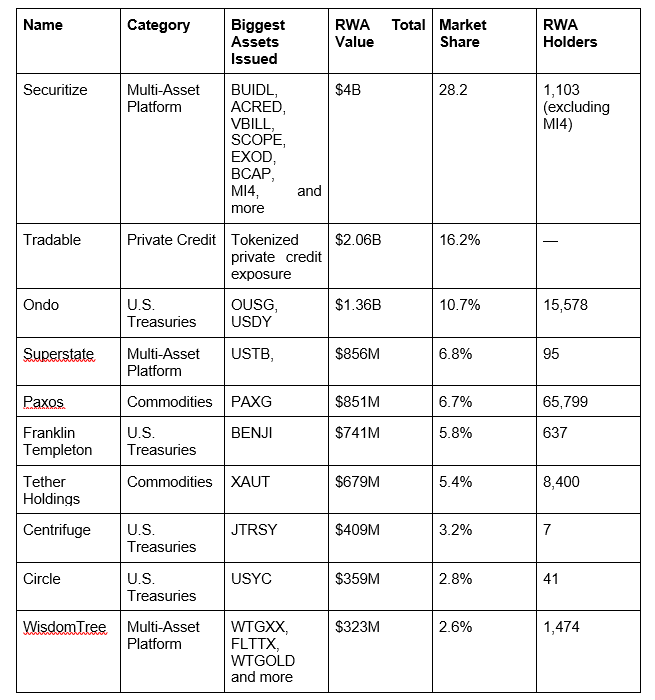

The institutional acceptance we now see is the result of years of infrastructure development. Financial institution as Black -shin, Jpmorgan, Franklin Templetonand Apollo Everyone moved “for experimenting”. Governments around the world are also beginning to recognize blockchain as “the basic infrastructure for the modernization of inheritance financial systems and the solution of basic macroeconomic challenges of decades”.

Therefore, the report concludes that “Catalyzed by a more friendly regulatory environment towards the tokenization is RWAS located for proliferation. […] From the Blackrock Fund Bidl Fund of $ 2.9 billion to Apollo’s pioneering private credit tokenization, we witness the early phases of what could be the largest capital migration in financial history. ”

Contribution Private credit units $ 24 billion tokenized RWA Boom – redstone report He appeared for the first time Cryptonews.