Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Solana (Sol) published a solid 4.3% profit this week, which dropped $ 126 after a fall to $ 126 just a few days ago. At the time of writing, he trades USD 147.12, hovering over the resistance of the triangle and improving technicians.

It seems that the sixth largest cryptocurrency according to the market ceiling is ready to test higher levels, supported by the newly created golden cross on the short -term chart and a growing appetite between binance traders for long exposure.

While the volume of daily trading is still cooling by 9.11% to $ 3.19 billion – structural momentum remains bull. The Bull’s absorption candle near the £ 144 escape area confirms the strong interest of the buyer and the technical settings are directed to the next up if the volume returns.

The key bull brands include:

The Current Price Structure It shows a clean triangular escape to a 2 -hour chart, with Sol rising above the converging zone of resistance.

This pattern, characterized by higher minimums and lower maximums, usually prevents strong movement. In the case of Solana Momentum, he favored upside down and the golden cross between 9 -day and 21 -day moving averages strengthens this outlook.

If the buyer keeps the price over $ 147.50, additional key levels lie at $ 150.54, $ 154.43 and potentially $ 158.81. Analysts believe that Sol could even reach $ 172.51 in the middle of the period, which would be a profit of 17.2% of the current levels if the involvement of investors rebounds.

Meanwhile, data from the Binance merchant reflect growing optimism with the growing number of long positions open to Sol. This promotes the case of the assembly controlled by the sentiment, provided that wider market conditions remain risks.

Although Prediction of Solana Award It remains bull, with testing Sol the upper zone of its escape zone, traders have two options depending on their risk tolerance:

Setup

An alternative item: Wait for a pullback on the $ 144.00 – $ 145.00 zone and buy for confirmation of support.

As long as the price remains above $ 140.28 and trends up, the path of Sol to $ 160 and remains intact. Traders should monitor decisive daily, close to $ 150 to verify further up to $ 172. This structure suggests that the bulls have the upper hand if the participation returns.

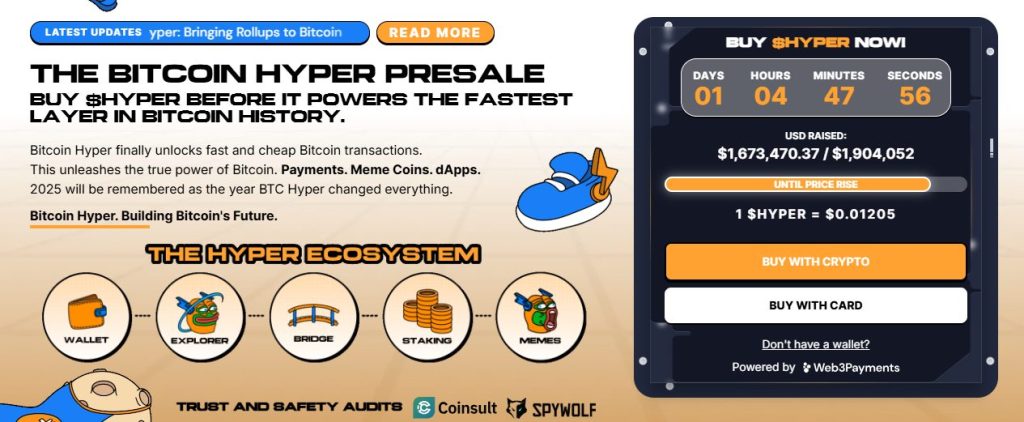

Bitcoin Hyper ($ Hyper) In his public advance, he broke the brand of $ 1 million and increased $ 1,673,470 from the target of $ 1,904,052 million. With just hours remaining before the price pops up to the next level, buyers can still lock $ 0.01205 per hyper.

Bitcoin’s 2 -driven 2 -powered SVM virtual machine (SVM) brings Bitcoin Hyper a fast, cheap intelligent contract to the BTC ecosystem. It combines the safety of bitcoins with the scalability of SVM, allows high-speed DAPPS, meme coins and payments-all with cheap gas charges and smooth BTC bridging.

Bitcoin Hyper, audited by Consult, is designed for speed, trust and scale. More than 91 million $ Hyper They are already set, with an estimate of 577% of APY rewards after startup. The token also strengthens gas charges, access to DAPP and management.

Pre -sale accepts crypto and cards and thanks web3payments, no wallet i

Contribution Solan prices prediction: this week by 4.3% – is Sol primed for $ 180? He appeared for the first time Cryptonews.