Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Solan [SOL] This week he registered a sharp reflection, broke out from a key level of resistance, and attracted strong participation across the board.

This powerful performance has gained considerable attention to traders and investors, which has led to a huge amount of SOL moved to the wallet addresses.

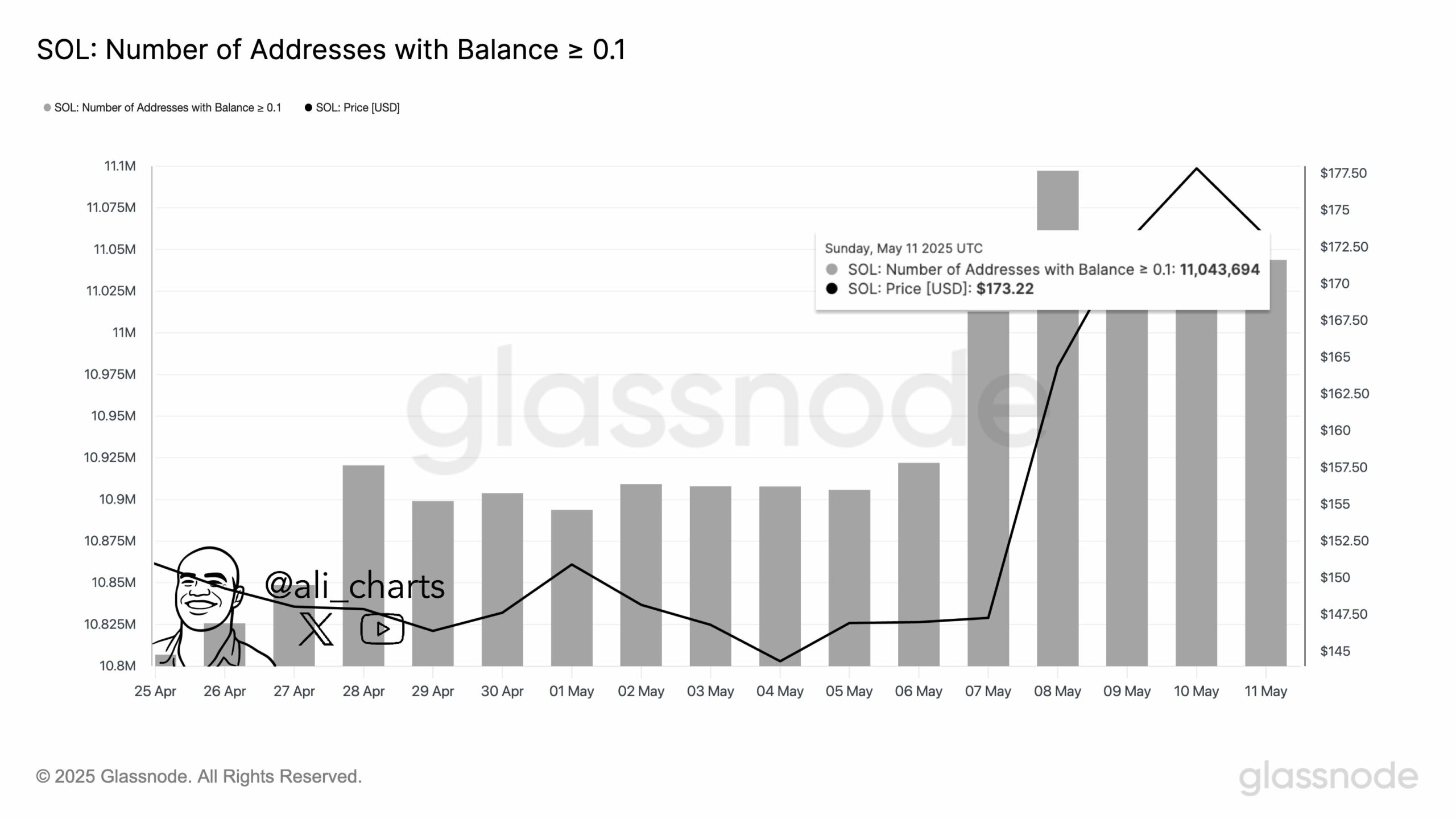

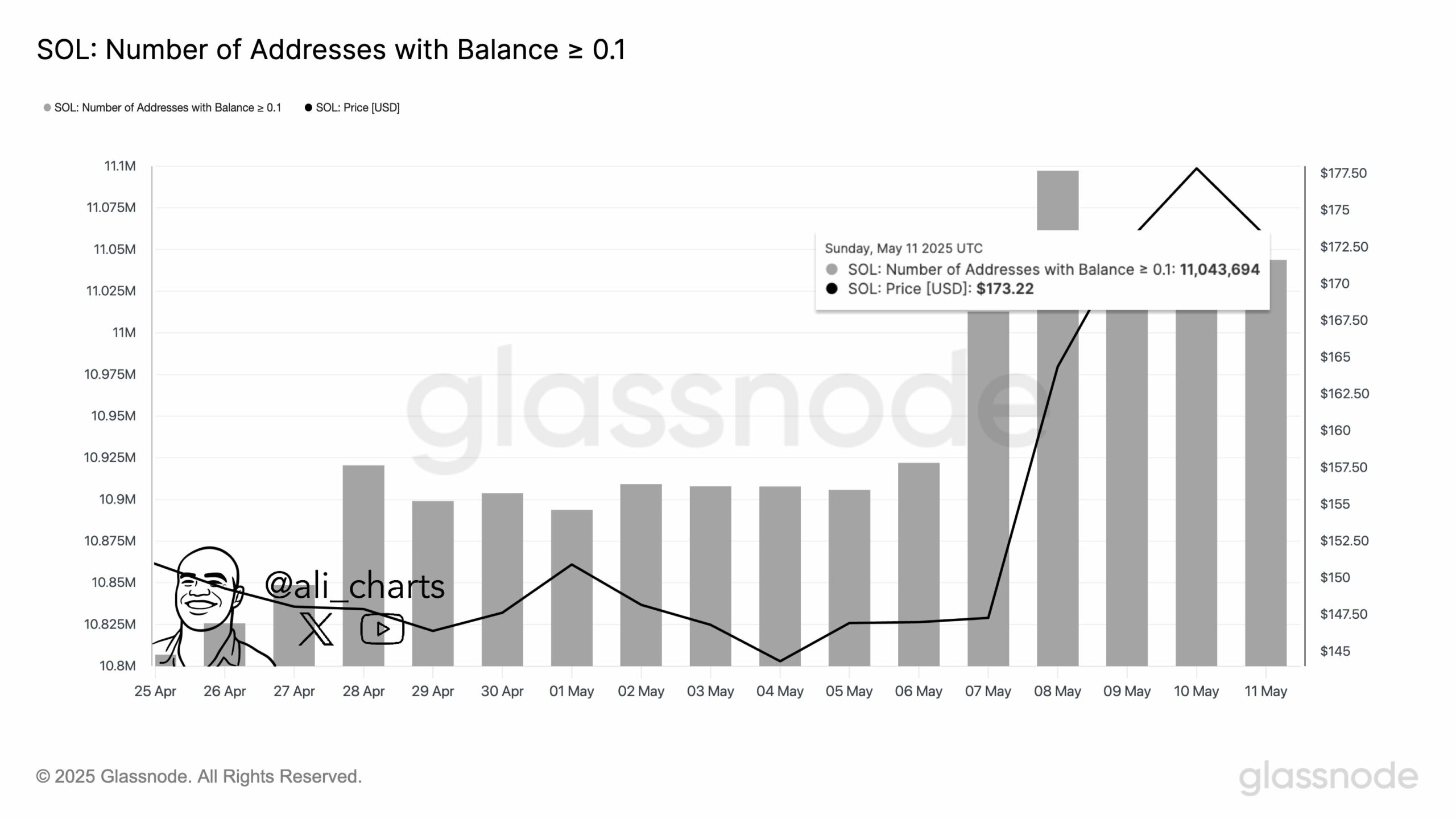

According to Glassnode, the number of addresses is share At least 0.1 Sol jumped to 11.04 million.

This reflected the growing interest and confidence of retail investors and long -term holders in the asset, which is in the long term bull.

Source: X (Formerly Twitter)

This increase in the number of wallets began when the price of SOL consolidated to a close range of over $ 150, after the extended descending trend line.

During the press, Sol traded nearly $ 180 and gained 3.5%in the last 24 hours.

In the same period, the participation of traders and investors increased, leading to a 11% increase in trading volume.

This jump in volume, along with the rising price, indicates a strong dynamics of asset and reflects current demand and interest on the market.

According to the technical analysis of Ambrpto, Sol seemed bulls and prepared for continuation of its upwards during the press.

According to Altcoin’s daily chart, he recently broke out from a key level of resistance to $ 180 after consolidation near this level on the last four business days.

Based on recent price events and historical patterns, the escape opened a 40% upward way, with Sol potentially reached a level of $ 270.

Solan’s bull’s work will only stick if the price of SOL remains above $ 179, otherwise it may fail.

At the time of printing, the solutions were the relative force index (RSI) 72, indicating that the asset is in an exaggerated area and can experience the repair before continuing the rally.

Given the current sentiment on the market, traders and investors strongly put on the bull side and seem to accumulate token, on data coinglass.

The inflow/draft data discovered that the stock exchanges have witnessed $ 13 million in the last 24 hours in the last 24 hours.

This outflow after escape suggests potential accumulation and can create a shopping pressure, leading to further upwards.

The SOL liquidation map revealed a heavy leverage, grouped around $ 171.8–186.5.

Interestingly, traders built $ 362.41 million in long positions near $ 171.8 and $ 222.77 million at short points near resistance.

This data shows that the bulls currently dominate Sol and believe that the price of the asset is It is unlikely that it would soon decrease below $ 171.8.