Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

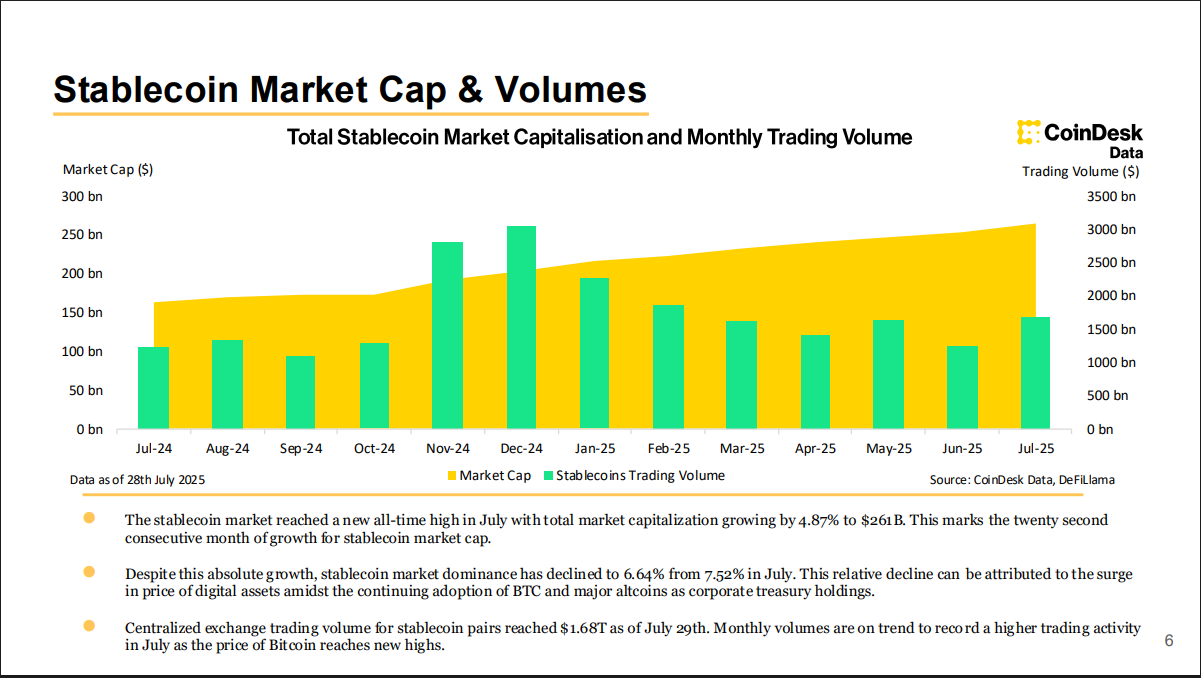

The Stablecoin sector It reached another milestone in July, with the total market capitalization reached a new historical maximum of $ 261 billion, which represents 4.87% of the monthly increase.

This success expands the unprecedented twenty -two consecutive months of growth in the Stablecoin market.

According to the latest Stablecoins message & cbdcs From Coindeska, the volume of trading with Stablecoin steam on centralized stock exchanges in July 1.60 t, which coincided with the wider rally of the digital assets driven by a sharp adoption of the company.

The report reveals that Tether (USDT) maintains its leading position of the sector, while market capitalization in July rising by 3.61% to 164b, which means the twentieth third consecutive monthly expansion.

Despite this growth of USDT’s dominance market, it has experienced a slight contraction in July and decreased from 62.5% to 61.8%.

Meanwhile, USD Coin (USDC) showed a strong performance with a 3.78% increase to $ 63.6 billion, while Ethena settled a remarkable growth of 43.5% to reach $ 7.60b in market capitalization.

The expansion of Ethena Use will prove to be particularly remarkable and, despite a significant decrease in ascending, APY from more than 20% to 9.79%.

A surprising finding from the report shows USDF Falcon Finance, which has seen the highest increase in market capitalization of the top 10 stablecoins, which increased by 121% to $ 1.07.

On the contrary, Blackrock’s BUIDL And FDUSD First Digital Labs experienced the steepest decline, fell by 15.9% and 8.54% to 2.40 B and 8.54 B.

The report ranks the top 10 stablecoins according to market capitalization as follows: Tether (USDT), USD coins (USDC), Ethena Usde, Sky Dollar, Dai, Blackrock USD (BUIDL), World Liberty Financial USD (USDD), Ethena USDTB, First USD and Falcon.

The Stablecoin ecosystem in the Tron network reached the new historically tallest high in July and climbed to $ 81.9 billion.

TRON now commands TRON for the first time since August 2024 50% of the total USDT offer across all Blockchain networks.

The consistent growth of the Stablecoin sector coincides with increased regulatory clarity. Most important, Genius Act became a law when President Trump signed legislation 18 July.

This pioneering framework lays down the first federal regulations for “payment stablecins”, which orders full support of 1: 1 on cash or liquid US state treasury and at the same time enforces monthly reserve data and requirements for audit.

This development accelerated adoption in the Stablecoin sector because builders, users and parties gain increased confidence in their usefulness and efficiency.

For example, in July, the combined market capitalization of non-USD stablecoins, including the tokens supported by the euro and rubles, exceeded $ 1 billion for the first time.

These trends have encouraged countries and traditional financial institutions to soften their attitudes towards the adoption of the crypto -stablecoin.

1st August announced Hong Kong license mode Plans to enable Stabnecoins with Pegged HKD and CNY Competition on the Asian Settlement Market, which is currently dominated by USD.

Just yesterday, the processor of payments published intentions Integrate the functionality of Stablecoin into its global payment network.

Stablecoin Wave of Adoption and Innovationd caused industry leaders such as Ripple General Director Brad Garlinghouse to reflect the growth of the explosive sector, design In the near future, the market could expand from the current $ 261 billion award to up to $ 2 trillion.

Garlinghouse spoke of “Squawk Box” CNBC “Squawk Box” and characterized potential expansion as “deep”, where as primary catalysts quoted institutional momentum and evolving regulatory frameworks.

JPMORGAN, however, has He expressed skepticism As far as the Stablecoins are concerned, it predicts a more modest growth to 500 B by 2028 and warn that trillion estimates are “too optimistic”.

The banking giant quoted limited acceptance of the mainstream and limited cases of use beyond the cryptocurrency trading as a significant obstacle to explosive growth.

Contribution Stablecoin Market cap rises 4.87% to $ 261 after 22 months of growth lane He appeared for the first time Cryptonews.