Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Cardano (ADA) is a Proof-of-Stake (PoS) Layer-1 blockchain launched in 2017. Cardano aims to provide security, scalability, and functionality to decentralized applications and systems building atop the network. In addition to its community of developers, node operators, and projects, Cardano is supported by entities like Input Output Hong Kong (IOHK), Cardano Foundation, Intersect, EMURGO, and others. These entities support the network’s development, adoption, and finances as Cardano is in the age of Voltaire (Governance), the final phase of its roadmap.

Cardano has taken a unique approach to development compared to other smart contract networks. The Ouroboros consensus mechanism allows for stake delegation, while the extended unspent transaction output (eUTXO) accounting model enables native token transfers and scalability.

With a dedicated community of users and developers, Cardano has demonstrated staying power. After the launch of smart contract support via the Alonzo hard fork in 2021, Cardano began to compete in more traditional crypto markets, such as DeFi and NFTs. For a full primer on Cardano, refer to our Initiation of Coverage report.

Website / X (Twitter) / Telegram

Research Contents

State of Cardano Q1 2025

ADA is the native currency of Cardano that is used as the primary medium of exchange when transacting on the network. ADA has three primary network-level use cases:

ADA is also used to elect and reward Delegated Representatives (DReps) who leverage staked ADA in governance. DReps’ influence can be evaluated based on how much ADA is delegated to them. Additionally, ADA is used to reward voters and fund projects in Project Catalyst.

ADA’s circulating token supply inflates until it reaches its maximum token supply of 45 billion. After each five-day epoch, 0.3% of ADA reserves (i.e., the ADA not in circulation) are distributed as SPO rewards. Inflation trends towards zero as the reserves deplete and the circulating supply approaches 45 billion.

Annualized real staking yield accounts for any value dilution due to inflation. In Q1, it was 0.7%, though this can vary by stake pool.

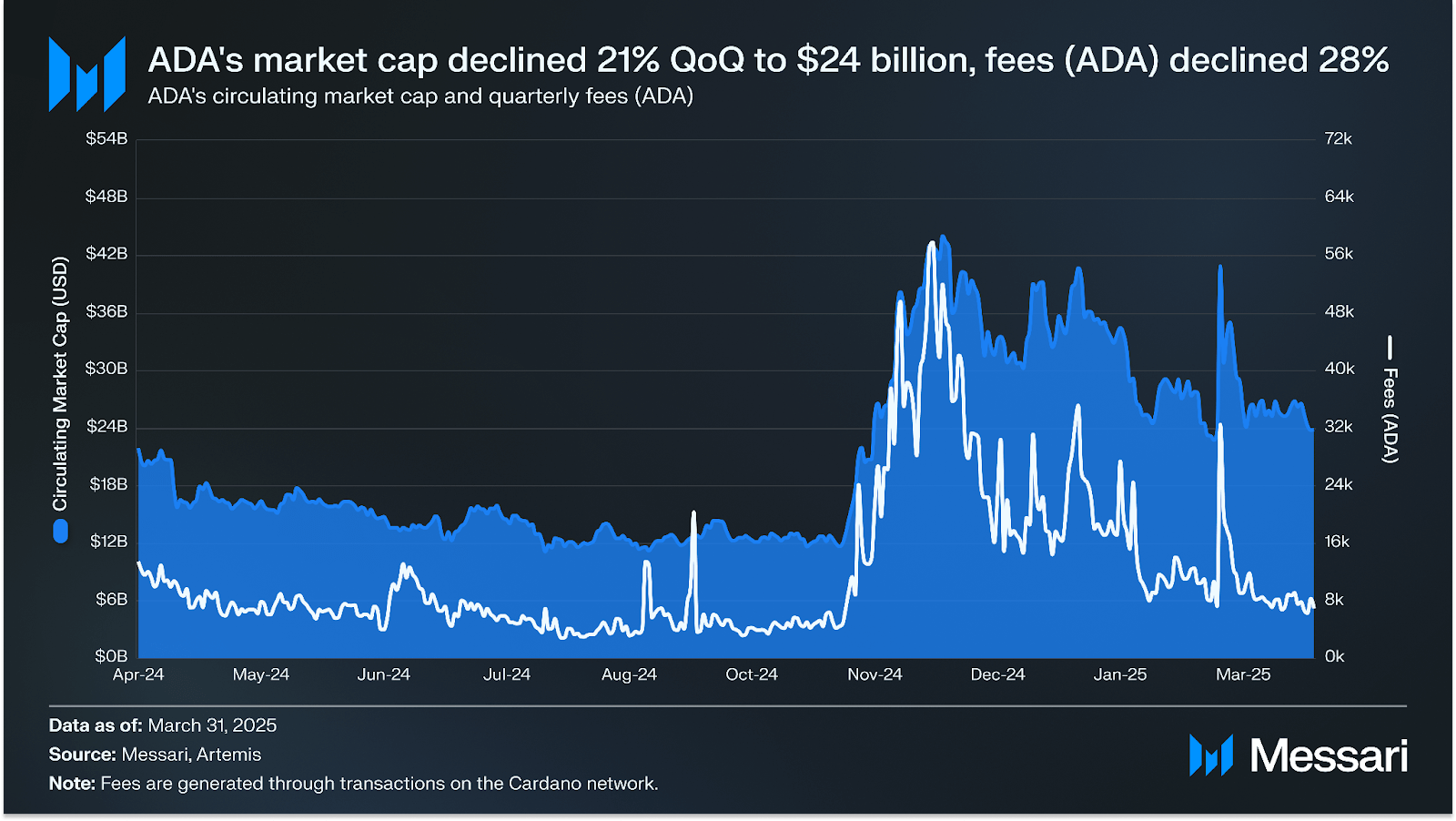

ADA’s price decreased 22% QoQ to $0.66 in Q1, while ADA’s market cap decreased 21% QoQ to $23.8 billion, with a slight discrepancy due to a 0.4% increase in circulating supply. ADA’s circulating market cap rank remained 9th at the end of Q1. The price and market cap decrease coincided with a 19% decline in the total crypto market cap in Q1.

Each transaction on Cardano is accompanied by a network transaction fee for processing transactions and paying storage costs. Fees are calculated by a minimum fee plus a variable fee based on transaction size. Fees (ADA) declined 28% QoQ to 1.4 million, and fees (USD) declined 32% QoQ to $1.2 million, driven by ADA’s price decline and a 28% decrease QoQ in average daily transactions.

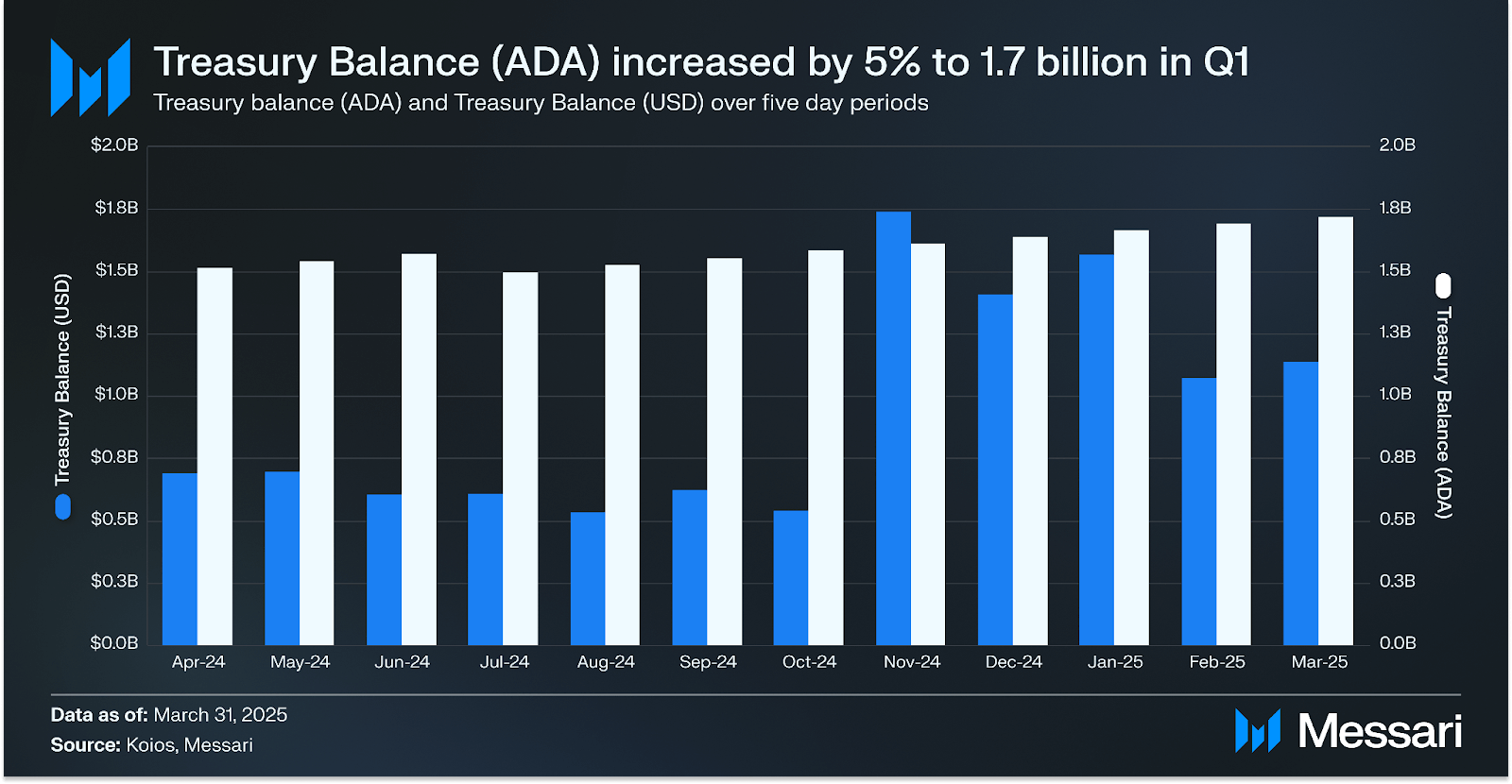

Cardano’s treasury balance (ADA) rose 5% QoQ to 1.7 billion ADA, while the treasury’s U.S. dollar value decreased 19% to $1.1 billion. The treasury provides funds to maintain and develop Cardano, with resources deployed through community governance as of the Plomin hard fork in Q4. Currently, 20% of Cardano’s transaction fees go to the treasury, which can be adjusted via governance.

Cardano’s average transaction fee (USD) rose 27% to $0.29, while the average transaction fee (ADA) rose 1% QoQ to 0.34. This divergence highlights the impact of ADA’s price volatility on network usage costs.

The total stake (ADA) and ADA’s staking rate (rewards earned from staking ADA) both declined by less than 1% QoQ. However, the total stake (USD) declined 22% QoQ to $14.4 billion, reflecting ADA’s price decrease..

Cardano’s average daily transactions decreased by 28% QoQ to 71,500, while daily active addresses decreased by 2%, which suggests users were less active in Q1. The ratio of transactions to active addresses decreased by 7% QoQ to 1.5. A decreasing ratio suggests activity is becoming concentrated across fewer users.

In April 2024, Cardano unveiled the Chang Upgrade, a two-phase network hard fork that would enable onchain governance and fulfill the core purpose of Cardano’s final roadmap phase (Voltaire). Voltaire takes the final steps toward Cardano’s self-sustainability via onchain voting, offchain mechanisms, and institutions like the member-based organization Intersect.

In December 2024, the Cardano community held a Constitutional Convention, gathering the Cardano community to shape the Cardano Constitution. On Feb. 13, 2025, the Interim Constitutional Council (ICC) unanimously voted “Yes” to support the Governance Action for the new constitution. On Feb. 24, 2025, the Cardano Constitution was officially enacted onchain, replacing the interim constitution. The new constitution established clear principles for decentralized governance (based on CIP-1694), clear roles and responsibilities for DREps and SPOs, the Constitutional Committee, and ethical guidelines for governance participants.

Elections for Intersect’s eight specialized committees (Steering, Budget, Civics, Growth and Marketing, Membership and Community, Open Source, Technical Steering, and Product) were underway in Q1 2025. These biannually elected committees support DReps and SPOs in decision-making for Cardano governance.

Following the ratification of the constitution, DReps, SPOs, and the Constitutional Committee now govern all areas of the network via an onchain voting and treasury system based on CIP-1694. This transfers responsibility from IOG, Cardano Foundation, and EMURGO, which have historically held all seven governance (genesis) keys. Governable actions include those related to the Constitutional Committee, parameter changes, constitution updates, hard fork initiation, protocol parameter changes, and treasury withdrawals.

Average daily Dapp transactions decreased by 2% QoQ to 10,600 in Q1. The top Dapps by volume in Q1 were DexHunter, Minswap, and WingRiders, with DEX activity driving the majority of application usage on Cardano.

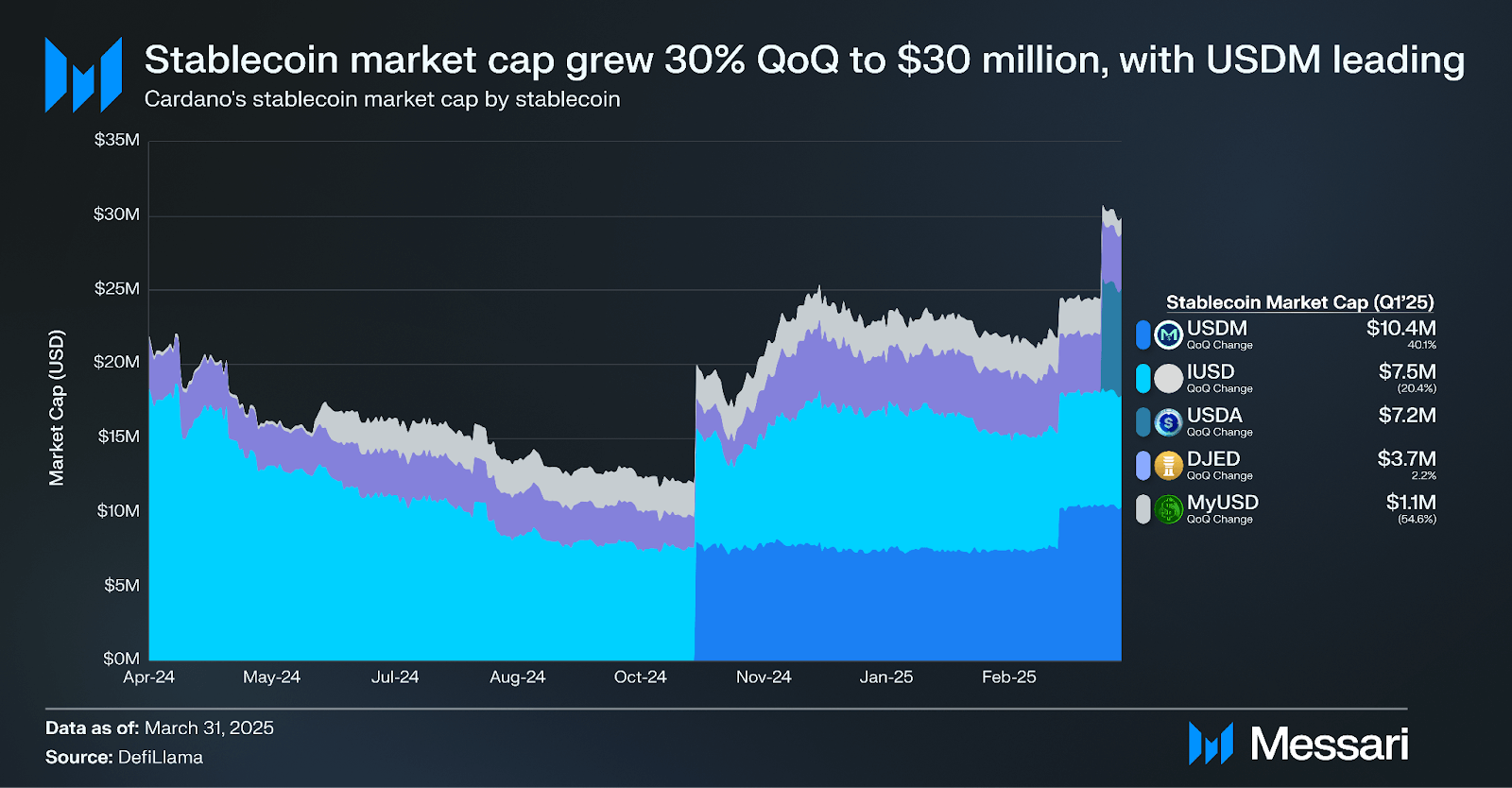

The average daily DEX volume on Cardano decreased by 5% QoQ to $5.8 million in Q1, while stablecoin supply increased 30% QoQ. This divergence suggests a shift in user behavior from active trading to stablecoin holding, aligning with broader risk-off sentiment observed across crypto markets in Q1.

DeFi TVL (USD) on Cardano decreased 29% QoQ to $319.3 million in Q1, compared to an industry-wide DeFi TVL decline of 26%. Notably, the DeFi diversity score (i.e., the number of protocols making up 90% of a network’s TVL) increased 13% to 9, demonstrating increased diversification despite the overall TVL reduction.

Despite Minswap’s TVL declining by 21% QoQ to $77.4 million, it surpassed Liqwid as the leading protocol by TVL. Liqwd’s TVL declined by 38% QoQ to $70.3 million. TVL also declined on other protocols like Indigo, Splash, Djed, and Aada, which is consistent with the broader TVL contraction.

In Q1, Cardano’s stablecoin market cap grew 30% to $30.1 million. Cardano’s first stablecoins (IUSD and DJED) were launched in November 2022 as fully overcollateralized stablecoins. In Q1, the market cap of iUSD decreased 20% to $7.5 million, whereas DJED increased 2% to $3.7 million. USDM grew 40% QoQ to $10.4 million, and USDA attracted $7.2 million in its first quarter, demonstrating a desire for new USD-backed stablecoin alternatives on Cardano.

Average daily NFT sales on Cardano declined 45% QoQ to 238 in Q1, while average daily NFT trading volume (ADA) decreased 53% to 54,200 ADA. This 45% sales decline was steeper than the industry average of 7%, indicating Cardano’s NFT ecosystem was particularly impacted by broader market conditions. jpg.store remained Cardano’s top NFT marketplace based on transaction volume, and was Cardano’s fifth most popular dapp in Q1.

In June, jpg.store launched NFT lending and borrowing, allowing NFT holders to borrow assets against its NFTs. In February, jpg.store launched Comet, the first Cardano-native trading app specifically built for mobile. The protocol was in a closed beta for most of Q1 and officially opened to the public on March 18.

Cardano’s development has historically followed a structured roadmap defined by distinct eras: Byron (Foundation), Shelley (Decentralization), Goguen (Smart Contracts), Basho (Scaling), and Voltaire (Decentralized Governance). Now that Cardano has completed the Voltaire phase, the network is entering a new era where its roadmap is driven by the community rather than a centralized team. In this model, development priorities and strategic decisions will be shaped collectively by community input. Intersect, a member-based organization contributing to Cardano’s continuity and development, will administer and provide continued support, ensuring that the roadmap reflects the collective vision and needs of the Cardano ecosystem.

Cardano’s new technical roadmap is anchored in three core pillars, each addressing critical aspects of the platform’s evolution:

Partner Chains is an all-encompassing term that can include technically sovereign sidechains or modular networks. These networks include Milkomeda C1 (which announced they were shutting down following the end of the quarter), Wanchain, Midnight, and World Mobile.

Launched in August 2024, the Alpha V1 Toolkit allows developers to bootstrap the security of Partner Chains by leveraging Cardano’s network of SPOs. The toolkit introduces a committee selection algorithm that integrates Cardano data to form trusted committees capable of producing a predetermined percentage of blocks, enhancing security by quickly growing validator sets.

Midnight, developed by Input Output Global (IOG), offers data protection and privacy capabilities using zero-knowledge proofs (ZK Proofs). It launched on testnet on Oct. 1, 2024, providing a sandbox environment for developers to use its capabilities. Midnight’s programming language, Compact, is based on TypeScript to enable Web2 developers to write onchain smart contracts easily. The project continues to grow via partnerships and hackathons. Charles Hoskinson confirmed on an X post in November 2024 that ADA holders would be eligible to receive a portion of the NIGHT token distribution. As of Q1 2025, Midnight remains in the testnet phase, with no announced date for the mainnet launch.

Project Catalyst is a decentralized fund where ADA tokenholders decide which proposals receive funding from Cardano’s treasury. Through 12 funding rounds, Project Catalyst has funded 2,161 proposals worth $152.5 million in ADA.

Voting for Fund12 concluded in July 2024, with 258 funded proposals for 46.5 million ADA. Funding was distributed across six categories, with the highest-funded proposals coming from the “Cardano Partners and Real World Integrations” category.

Proposal submission for Fund13 began at the tail end of Q3, and the round’s voting phase will conclude in December 2024. Fund 13 aims to distribute 50 million ADA toward six categories. In this fund, Cardano actively lowered the minimum ADA required for voting to just 25 ADA, a notable drop from the 450 ADA threshold set since Fund4. This enables more tokenholders to participate in the fund’s token allocation process. Proposers requested over 40 million ADA through submissions, but no funds were allocated in Q1. Project onboarding began in January, although there have been no additional updates on the fund.

Apart from the larger initiatives above, Cardano had several ecosystem updates:

Cardano’s performance in Q1 2025 reflected a network in transition against a challenging market backdrop. ADA’s market cap declined 21% QoQ to $23.8 billion as the token price fell 22% to $0.66, largely tracking the broader 19% decline in total crypto market cap. Network activity showed reduced engagement with quarterly fee revenue dropping 32% to $1.2 million while average daily transactions fell 28% to 71,500. Notably, despite price volatility, staking commitment remained stable with total staked ADA decreasing only 1% to 21.6 billion, underscoring continued long-term holder conviction. Ecosystem metrics revealed divergent trends, with DeFi TVL contracting 29% QoQ to $319.3 million (compared to a 17% industry average decline). In comparison, the stablecoin market cap expanded 30% to $30.1 million, driven by fiat-backed options like USDM and USDA.

The Plomin Upgrade, enacted via CIP-1694, empowered 1,220 DReps to drive trustless governance, marking a historic milestone. With Ouroboros Leios poised to reduce block production and finality to a few seconds, Midnight’s ZK-proof privacy features, and high-profile partnerships like SERPRO and the Grayscale ETF filing, Cardano is well-positioned to lead in scalable, privacy-focused DeFi, capturing institutional and global adoption.

Let us know what you loved about the report, what may be missing, or share any other feedback by filling out this short form. All responses are subject to our Privacy Policy and Terms of Service.

This report was commissioned by IOG. All content was produced independently by the author(s) and does not necessarily reflect the opinions of Messari, Inc. or the organization that requested the report. The commissioning organization may have input on the content of the report, but Messari maintains editorial control over the final report to retain data accuracy and objectivity. Author(s) may hold cryptocurrencies named in this report. This report is meant for informational purposes only. It is not meant to serve as investment advice. You should conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. Past performance of any asset is not indicative of future results. Please see our Terms of Service for more information.

No part of this report may be (a) copied, photocopied, duplicated in any form by any means or (b) redistributed without the prior written consent of Messari®.